3% and Chill

CPI stays at 3%, FED cut odds jump and Stocks rip to highs

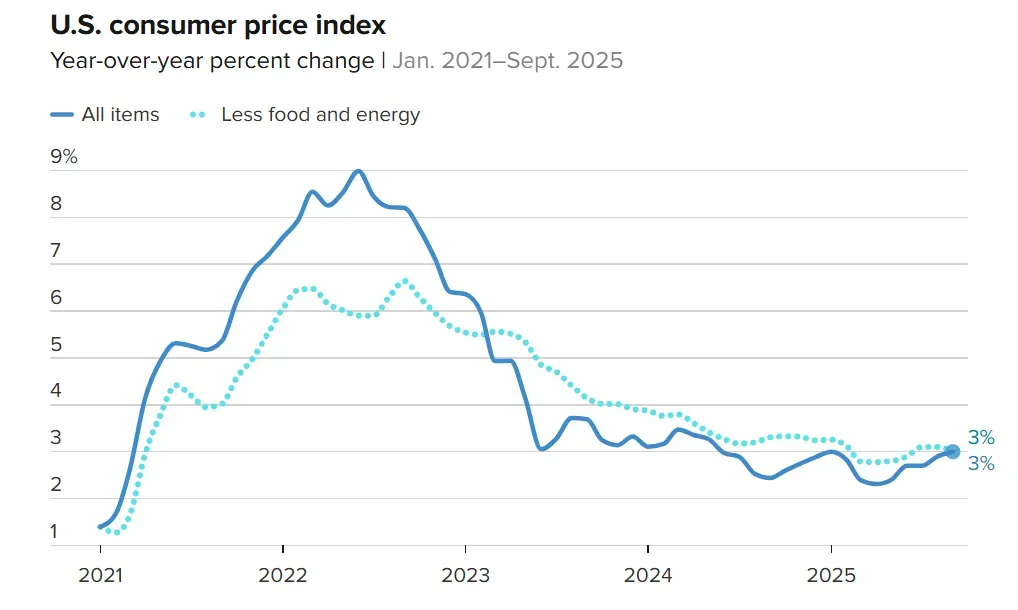

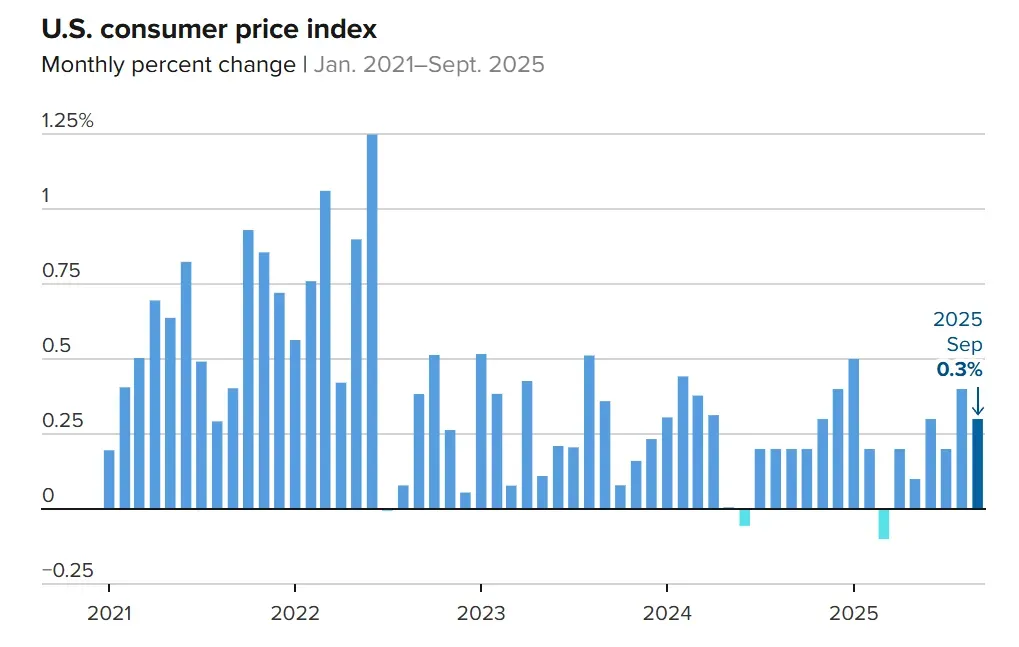

September’s inflation report came in at 3.0% year-over-year, slightly below expectations and just above August’s 2.9%.

It’s not a game-changer - but in the middle of a government shutdown that’s frozen most data releases, this CPI report became the signal markets were waiting for. It showed price growth is cooling without collapsing, giving the Federal Reserve cover to cut rates next week.

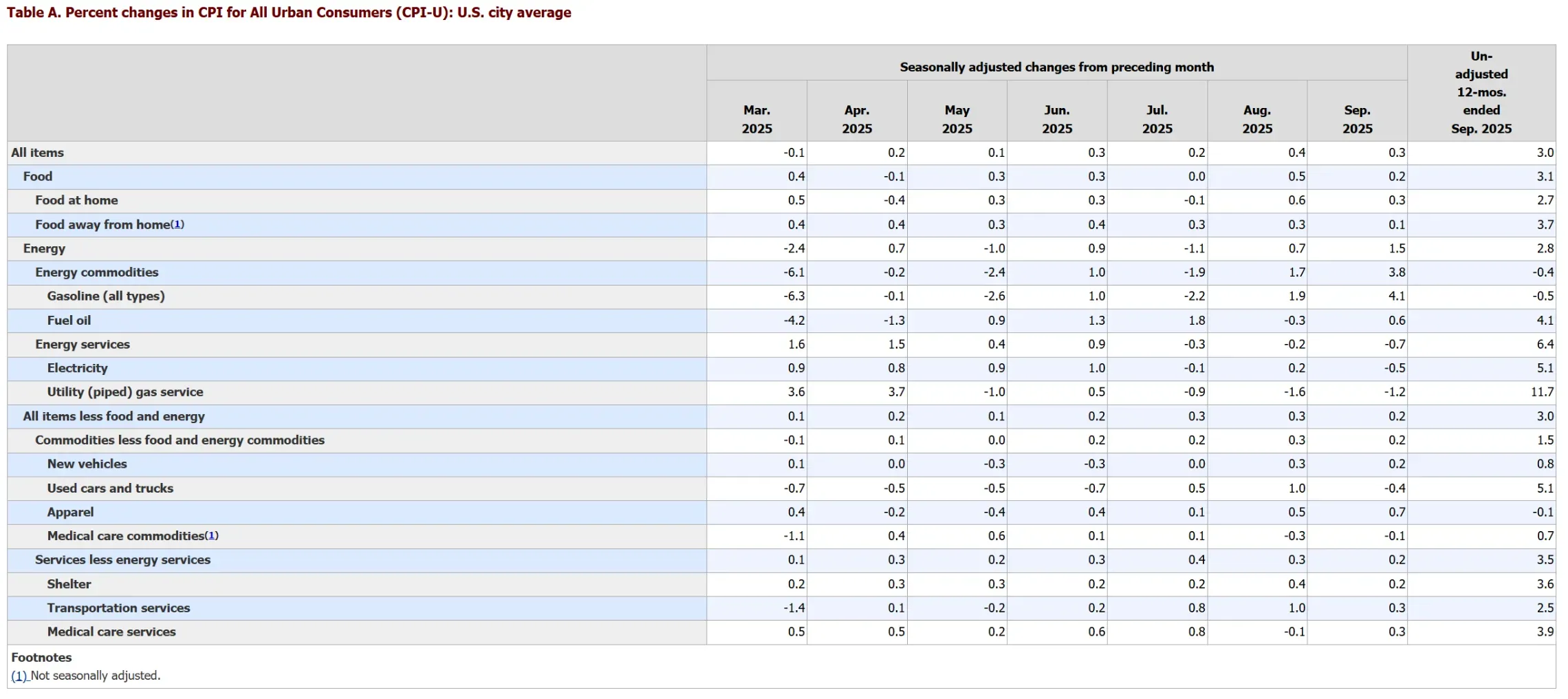

The biggest story inside the data was energy. Gasoline prices jumped 4.1% month-over-month, electricity costs also rose, and food remained sticky. But “core” prices - excluding food and energy - grew a modest 3%, suggesting inflation is leveling off. That balance was enough to calm investors who feared a re-acceleration.

What’s driving the trend

Economists point to President Trump’s renewed tariff push as a key inflation wildcard. New import duties on consumer goods are already lifting prices for furniture, apparel, appliances, and beef. Moody’s chief economist Mark Zandi estimates the effective tariff rate could rise to 15%, adding roughly $1,800 per household in 2025.

Still, most analysts - including Wells Fargo’s Mike Pugliese - expect inflation to drift lower by mid-2026 as tariff effects fade and supply chains normalize. The phrase they’re using is “sticky but stable” inflation - stubbornly above target, yet no longer threatening to spiral.

Market reaction: full-throttle rally

Equities exploded higher on the news. The Dow Jones Industrial Average closed above 47,000 for the first time in history, up 473 points (+1.0%). The S&P 500 gained 0.8%, and the Nasdaq Composite rallied 1.2%, fueled by tech and banking names.

Investor sentiment shifted instantly toward rate-cut optimism. Futures markets now price in a quarter-point cut at the upcoming Federal Reserve meeting, and potentially another in December. The VIX volatility index dropped 5%, while gold steadied after its sharp fall earlier in the week.

Even Ford (F) stood out - jumping 12% after strong Q3 results - underscoring how good earnings plus easier policy can amplify market momentum.

Broader backdrop and what comes next

The U.S. economy remains in an unusual spot: resilient consumer demand, tight labor markets, and fiscal uncertainty colliding with a politically charged trade environment. The Fed is set to navigate this without key employment or GDP data due to the shutdown. As Zandi put it, “In this data desert, they’ll stay on script — that means cutting rates.”

Markets are already looking ahead to next week’s Fed decision, plus heavy-hitting earnings from Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), Meta (META), and Amazon (AMZN). Combined, these reports will determine whether this inflation-driven rally has legs or just a relief bounce.

My outlook: bullish, with one caveat

The setup still favors risk assets. Cooling inflation, strong corporate earnings, and imminent rate cuts form a classic “Goldilocks” mix for stocks. I stay bullish on U.S. equities, especially large-cap tech and financials that benefit from lower rates and improving sentiment.

The caveat? If tariffs bite deeper or oil spikes again, the inflation narrative could flip fast — and the Fed’s flexibility with it. Until then, momentum remains firmly on the bulls’ side.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.