BBAI: The AI Microcap No One’s Ready For (Yet)

I’ve been pounding the table on $BBAI (BigBear.ai) for months. This post isn’t me jumping on the hype train — it’s me explaining why I never got off. The recent Easy Lease partnership news just gave me the push I needed to lay it all out.

Why all the attention right now?

On June 28, BigBear.ai announced a strategic partnership with Easy Lease, a UAE-based equipment leasing company that's transitioning toward predictive analytics and automation. BBAI is deploying its Modzy AI platform to optimize asset performance and reduce downtime. This is a real-world, revenue-generating use case.

Here’s why that matters:

- They’re actually commercializing AI, not just talking about it.

- Middle East contracts = deep pockets and long-term value.

- This isn't a pilot or a vague LOI — they're deploying product now.

Add to that the DoD contracts already in play, and you’re looking at a small-cap company that’s getting its tech used by both defense and private sectors. That’s not fluff — that’s execution.

Why I’ve Been Bullish for Months

I’m not buying the hype. I’m buying value in disguise.

Most people don’t realize that BBAI was already deeply embedded in defense/intel long before the AI bubble inflated. When Palantir and C3.ai started mooning, I thought: “Why isn’t BBAI catching a bid?” Turns out most people just weren’t looking.

Here’s what you probably missed:

1. The Modzy platform is legit.

Unlike many AI shops that rely on third-party models or basic automation, Modzy lets users plug in, train, and deploy AI models in secure, mission-critical environments. That’s a serious differentiator — especially for government clients.

2. Defense footprint is strong and sticky.

They’re working with the U.S. Army, Air Force, and multiple intelligence agencies. That’s contractual revenue that doesn’t churn easily. Their work on predictive maintenance, logistics, and battlefield simulation is the kind of stuff Palantir gets praised for — but with a fraction of the market cap.

3. Leadership turned over. And it’s working.

New CEO Mandy Long has focused on operational discipline, cutting burn and targeting scalable partnerships. They’ve moved from being a “federal services” shop to a product-first AI company. That’s not a pivot — that’s a redefinition.

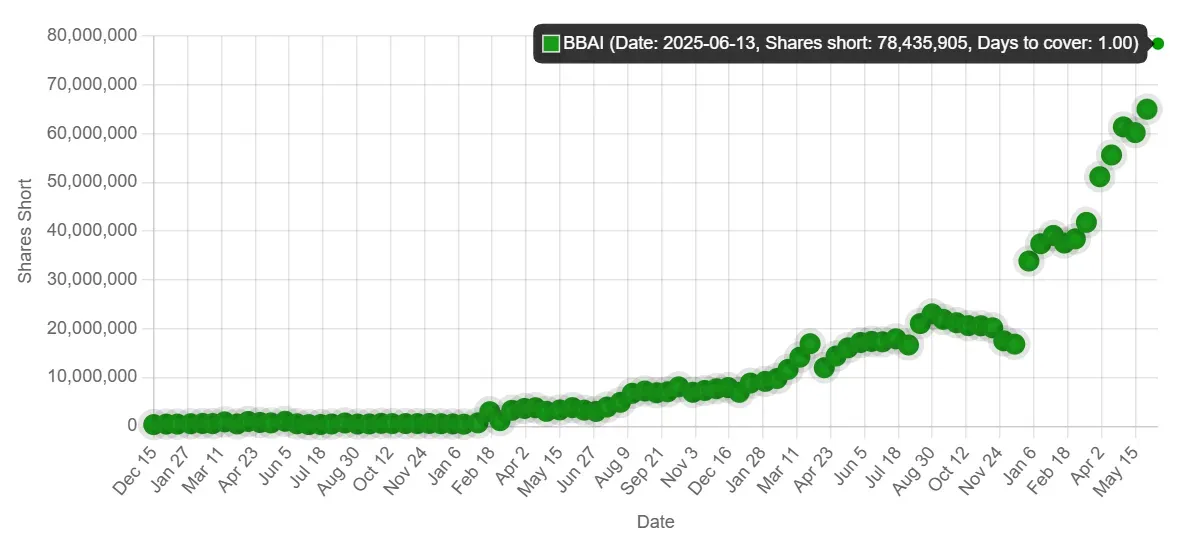

4. Short interest is still massive.

The latest data still shows ~20% short float. And yet, institutional ownership is rising. That’s a recipe for a squeeze if (when) this thing re-rates.

5. AI tailwinds still intact.

Everyone wants to play the AI wave — but not everyone can afford $PLTR or $NVDA. BBAI is the under-the-radar play that’s still priced like a penny stock, yet has actual contracts, a real product, and a roadmap to profitability.

BBAI is what Palantir used to be — scrappy, hungry, and still small enough to grow 10×

Overbought but Not Over?

Let’s break down the technicals — because they’re screaming just as loud as the fundamentals.

- Overbought and Breaking Out

On the daily chart, BBAI is clearly in overbought territory. RSI is nearing 80, suggesting strong momentum — but also caution for short-term entries. What’s more important though is the price action: the stock is now challenging levels last seen in February 2025, when it briefly spiked before correcting hard. If it breaks $7.17 (the top from that run), we could be entering a new price discovery phase. - Volume Confirms the Move

Volume has surged dramatically post-consolidation (April–May) — and we’re now seeing the highest buying pressure since the Q1 rally. This isn’t retail chasing candles. This looks like institutional-sized accumulation, especially given how it broke above resistance levels with ease. - Well Above the 50/100-Day SMAs

BBAI is now significantly above its 50-day ($3.81) and 100-day ($4.23) moving averages. These SMAs are turning upward, suggesting not just a breakout — but the start of a new trend cycle. When price gets this extended, yes, it’s vulnerable to a pullback — but it also confirms that momentum is real.

💡 What’s the Play?

Whether you buy here depends entirely on your style:

- Momentum traders may continue riding this breakout — just be aware it’s stretched. A close above February highs could invite another leg up.

- Swing traders might wait for a pullback to support — ideally toward the $5.20–$6.00 zone or the upper Bollinger Band ($6.19).

- Long-term bulls (like me)? Any dip that holds above the 50/100-day moving averages is a gift. I’ll be watching closely for RSI cooldowns or bull flag consolidations before adding more.

The chart is overextended — but that’s what breakouts look like. If BBAI holds above previous resistance, this could be the start of a full revaluation, not the end of a short squeeze.