Broadcom (AVGO): The custom silicon kingmaker riding Google's AI resurgence

I'm adding Broadcom to my portfolio. This isn't a momentum chase - it's a structural bet on the hyperscaler pivot away from off-the-shelf GPUs toward custom silicon. Broadcom owns 75% of the custom AI ASIC market, and the recent surge isn't about hype. It's about Google.

Alphabet just shifted from "AI loser" to legitimate contender with Gemini 3's reception. That repositioning pulls Broadcom's decade-long TPU partnership into focus. When Mizuho's trading desk flags rotation out of Nvidia and Meta into Google suppliers, the flow is already happening. Broadcom's market cap overtaking Meta since late October tells you how the market is repricing custom silicon versus application-layer AI exposure.

The Polen Focus Growth letter crystallized what's changed: they stayed out for 2.5 years because of cycle risk, then initiated in August. That's a fundamental shift in how quality-focused managers underwrite these businesses. The AI infrastructure buildout is being treated as structural, not cyclical.

What makes this different

The custom silicon moat

Broadcom doesn't compete with Nvidia - it serves the customers who want alternatives. Google's TPUs, Meta's MTIA, ByteDance's custom chips, and now OpenAI's accelerators all flow through Broadcom. The October OpenAI partnership is massive: 10 gigawatts of custom AI accelerators with rollouts through 2029, potentially worth $200 billion in incremental revenue.

The Google relationship alone generates over $10 billion annually. Seven generations of TPUs. A decade of co-design. That's not a vendor relationship - it's embedded IP.

The fourth customer catalyst

Management disclosed a fourth XPU customer placing orders exceeding $10 billion for the second half of fiscal 2026. Context matters here:

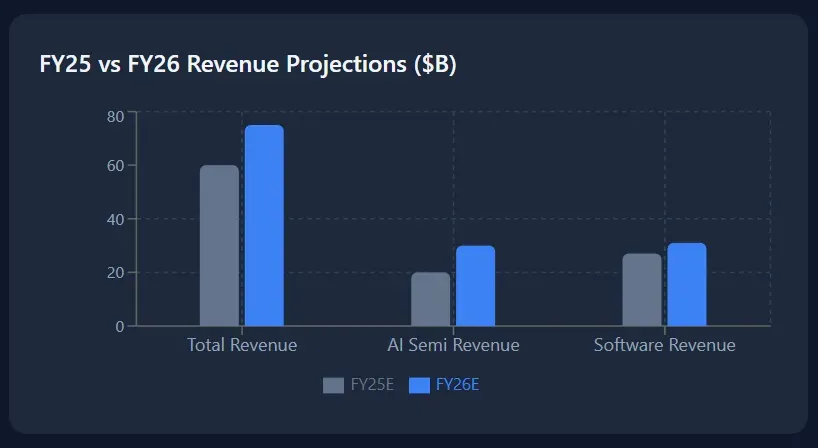

A single customer adding $10 billion fundamentally changes the growth trajectory. The Street is modeling mid-teens growth. this suggests upside.

VMware cash flows

Raymond James flagged the "underappreciated software cash flows" in their initiation. Infrastructure software delivered $6.8 billion in Q3, up 17% year-over-year, with $8.4 billion in total contract value booked. This isn't semiconductor volatility - it's enterprise software recurring revenue providing margin stability.

Key metrics that matter

- Q3 FY25 Revenue: $16.0B (+22% YoY)

- Q3 AI Semiconductor Revenue: $5.2B (+63% YoY)

- Q4 FY25 Revenue Guide: $17.4B (+24% YoY)

- Q4 AI Semiconductor Guide: $6.2B (+66% YoY)

- Backlog (Record): $110B

- Infrastructure Software (Q3): $6.8B (+17% YoY)

- Adjusted EBITDA Margin Guide: 67%

- Custom ASIC Market Share: ~75%

Catalysts I'm watching

- December 11 earnings: Q4 guidance is already set at $17.4B revenue and $6.2B AI revenue. The question is whether management raises the FY26 outlook given the fourth customer ramp.

- 3nm XPU rollout: Next-generation custom processors hitting late fiscal 2025. Google's TPU v7 roadmap incorporates this process node.

- OpenAI deployment timeline: Mid-2026 rollout begins. Any acceleration or expanded scope moves numbers.

- Non-AI semi recovery: Management called it a "U-shaped recovery" with full normalization by mid-2026. Broadband upgrades including DOCSIS 4.0 are near-term tailwinds.

- CEO tenure extension: Hock Tan committed through 2030, with compensation now tied to AI revenue growth. Alignment matters.

What could go wrong

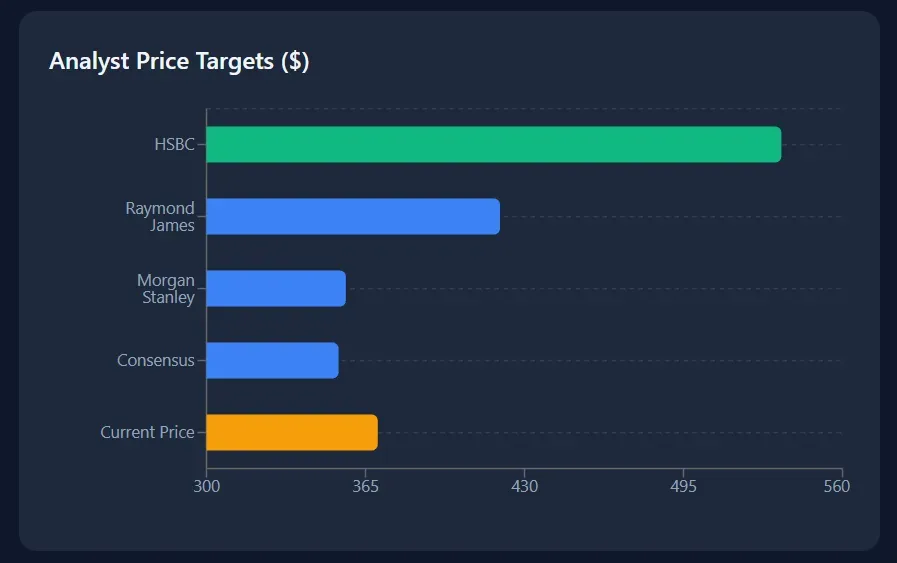

- Valuation stretch: Raymond James uses 30x FY27E EPS for their $420 target. HSBC's new $535 target is aggressive. Any multiple compression on a growth deceleration hurts.

- China exposure: About 30% of revenue comes from China versus Nvidia's 15%. Tariff escalation creates disproportionate risk here.

- Customer concentration: Google, Meta, ByteDance, and OpenAI represent the lion's share of custom silicon revenue. Losing any one relationship moves the stock materially.

- Non-AI drag: The ~$4 billion non-AI semi business remains sluggish. Enterprise networking, server storage, and industrial segments haven't inflected yet.

- Competition: Google's dual-sourcing strategy with MediaTek signals diversification away from single-supplier models. Margin pressure possible as hyperscalers negotiate harder.

What the Street says

- HSBC: Buy $535 (Street High)

- Raymond James: Outperform $420

- Morgan Stanley: Overweight $357

Institutional flow supports the bullish view. Jefferies boosted their position by over 1,100% in Q2. Lone Pine, Altimeter, and Prudential all increased stakes. The bipartisan congressional buying - Fields, Khanna, and McCaul in the same window - usually reflects briefing-level confidence in domestic chip buildout.

Technical picture

AVGO bounced hard Monday, rallying 8-9% to reclaim the $370 level after pulling back roughly 10% from the late-October high near $386. The stock trades in a wide ascending channel with the lower trend floor around $336. Key moving averages cluster in the $343-$351 zone, providing near-term support.

The 52-week range of $138 to $386 shows the magnitude of this year's move - up over 125% from the lows. Volume picked up on Monday's advance, which you want to see on breakout attempts. RSI sits neutral around 45, leaving room for continuation without overbought conditions.

My take

Broadcom is the pick-and-shovel play on the hyperscaler custom silicon buildout. The Google TPU partnership, the OpenAI deal, and the mystery fourth customer create a multi-year revenue ramp that the Street hasn't fully modeled. VMware provides margin stability while non-AI semis recover.

The December 11 earnings report is the next catalyst. I'm positioned ahead of it. This isn't about chasing the Monday pop - it's about owning the infrastructure layer of the AI stack before the FY26 guidance cycle begins.

Bullish.