CoreWeave, Inc. (NASDAQ: CRWV) Q2 2025 Earnings Breakdown

Is the AI Hype Justified or Overvalued?

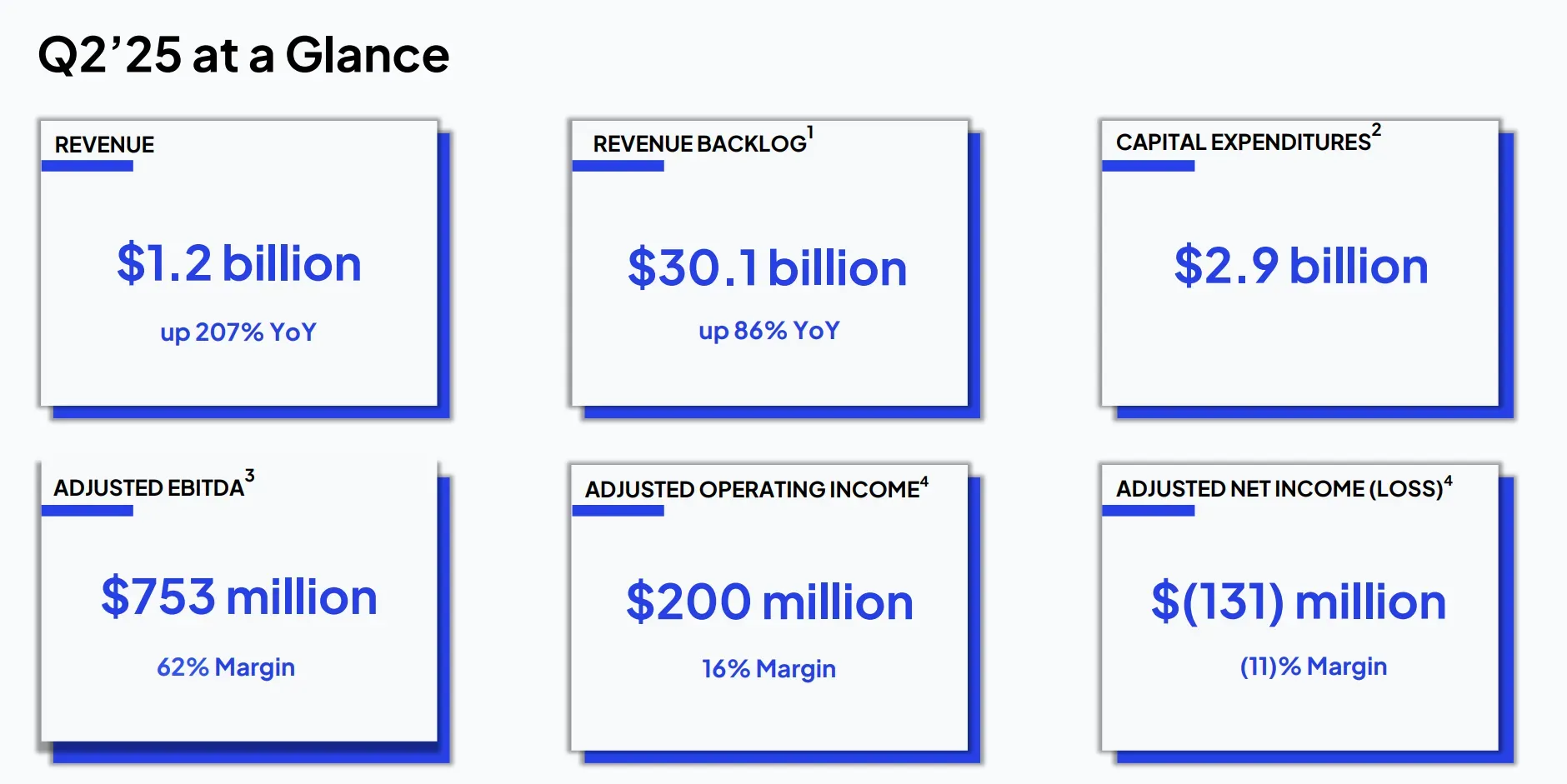

CoreWeave posted a monster top-line beat in Q2 2025, delivering $1.21 billion in revenue, sharply above the $1.08 billion expected - a 206% YoY surge, powered entirely by their AI infrastructure segment.

Remarkably, this is the fifth consecutive quarter of triple-digit revenue growth. But despite the massive sales jump and slender operating income of $24.2 million, the firm remains deeply unprofitable, with a net loss of $290.5 million, translating to EPS of –$0.21.

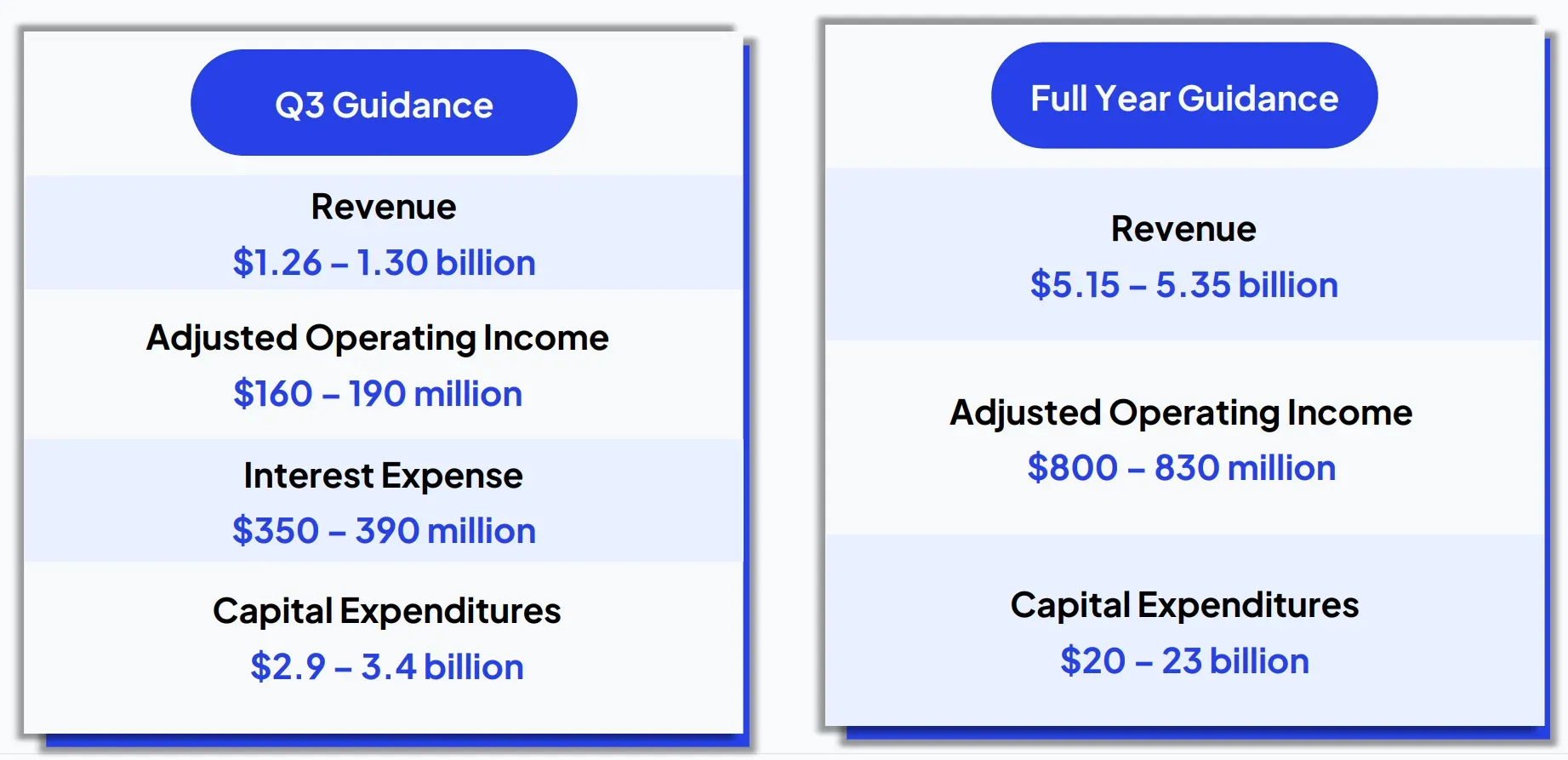

What stood out to me wasn't just the scale of top-line growth, but the guidance - management raised full-year revenue expectations to $5.15B–$5.35B, ahead of the Street's previous view ($4.9B–$5.1B). That said, EPS remains guided at -$0.80 to -$0.70, highlighting continued heavy investment.

Market reaction so far has been cautious. Despite strong numbers, the stock posted mixed action with early spikes fading - likely due to valuation concerns and broader risk-off sentiment around overbought AI plays.

Earnings Highlights

- Revenue: $1.21 billion (↑206% YoY; beat est. of $1.08 billion by 12%)

- Net Income: -$290.5 million (Loss narrowed 10% YoY)

- EPS: -$0.21 (no prior EPS estimate provided)

- Operating Income: $24.2 million (2.0% margin)

- Gross Margin: Not disclosed

- AI Infrastructure Revenue: $1.21 billion (↑206% YoY)

Guidance:

- Q3 Revenue: $1.26B–$1.30B (Street est.: $1.25B)

- Q3 EPS: -$0.21 to -$0.19

- FY25 Revenue: $5.15B–$5.35B (Up from $4.9B–$5.1B prior)

- FY25 EPS: -$0.80 to -$0.70

Financial Analysis

For a company engaging in a land-grab of AI infrastructure dominance, the results generally support the bullish narrative. Here's how I'm parsing the financial dynamics:

- Revenue Drivers: Virtually all of CRWV's revenue stems from its AI infrastructure arm. This isn't built on vapor - their continued expansion with OpenAI as a major client and the acquisition of Weights & Biases point to real traction.

- Profitability vs. Scale: While top-line growth is textbook exponential, CRWV is clearly burning cash to get there. Net margins remain deeply negative (-24%), and there's still no clarity around when this model turns self-sustaining.

- Operating Leverage: The slight move into positive operating income ($24.2M) on $1.2B revenue (~2% margin) is an early positive sign. If they can tighten CapEx and monetization into H2, we just might see an inflection point by FY26.

- Forward Valuation Risk: At current prices, the revenue multiple remains very rich. Whether that eventually collapses, normalizes, or is justified by sheer scale depends on execution — and patience.

Technical Analysis Summary

CoreWeave is displaying classic high-beta momentum characteristics - sharp moves, strong trends, and pronounced volatility. Based on the chart, recent price action has respected the Fibonacci retracement levels, particularly between approximately $90 (0.618) and $125.85 (0.382), with the range from roughly $125.85 to $147.84 (the 0.382 to 0.236 Fib levels) acting as a key resistance band.

- Golden Fibonacci Setup: Price recently rallied to test the $147.84 zone (the 23.6% retracement), a notable Fibonacci level that historically can act as resistance during retracements. A decisive breakout and retest of this area - ideally with strong volume - could open up targets toward $183 (the prior swing high) or interim levels such as $153, close to the mid-range between major Fibs.

- Downtrend Channel Watch: After peaking at $183.39 (the swing high, not $187), CoreWeave retraced sharply, bottoming out near $90.30 (the 61.8% Fib) before rebounding. Since then, higher lows have formed, indicating potential for a mid-term reversal, especially if the price continues to hold above the $125.85 support (0.382 Fib).

- Momentum Indicators: Trading volumes have surged on each retest of resistance zones. The daily MACD indicator is turning upward after a prolonged neutral phase, suggesting renewed buying pressure, though a confirmed breakout has not yet materialized.

Summary/Trade Plan: CoreWeave currently sits at a key decision point. If price sustains above $125.85 and breaks out over $147.84 with convincing volume, this may offer a strong entry for trend-followers. Conversely, a close below $108 (the 50% Fib) could warrant caution or an exit, as it would question the strength of the current reversal.

Community Sentiment and Risk/Reward Narrative

Among retail traders and long-range investors, sentiment has become distinctly mixed. Here's the backdrop I see forming:

- Bullish Camp: A sizable group remains committed to the long-term future of CoreWeave, citing growing demand in the AI compute market, heavier reliance by partners like OpenAI, and a belief that the current losses reflect "necessary investment."

- Bearish Concerns: But others are increasingly skeptical - some citing intrinsic value estimates as low as $2.44 (versus a current triple-digit share price), suggesting a bubble forming in AI infrastructure players that haven't proven sustainable profitability yet.

- Wait-and-See Crowd: There's also a visible contingent waiting patiently for stronger margin conversion by 2026–2027. These investors acknowledge the platform's potential but are unwilling to hold through ongoing dilution or volatility in the short term.

The most resonant summary? There's clearly physiological and financial "buy-in" from large swaths of traders - but growing doubts around whether this growth engine ever matures into a real business with economic moats, not just meteoric top-line numbers.

🟩 My Take: HOLD, but with Conditional Upside

CoreWeave is a fighting bull of a company riding one of the most powerful secular waves in tech: AI compute infrastructure. Fundamentals show staggering revenue growth and improving, albeit still weak, cost control. Technically, we're hovering near a critical breakout zone.

But with EPS still negative and investor sentiment split right down the middle, I think this stock has become a momentum + narrative play more than a fundamentals-based investment… for now.

- Buy only on confirmed breakout ($135+ on volume) — add to positions if $153-155 breaks.

- Set alerts for potential downside breakdown below $110-112 — that would invalidate the current structure.

Until we see margin expansion or clear cash flow guidance, I won't call this a long-term core holding — but as a trend-following, nimble-position opportunity in a resurgent AI market, CoreWeave remains one of the most exciting tickers on the board.

Let the price lead. Momentum rules here.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.