Costco (NASDAQ:COST) Q4 FY2025 Earnings Analysis: Strong Results Amid Market Caution

Summary: Solid Q4 results, but market caution and rich valuation mean watch key technical levels before adding size.

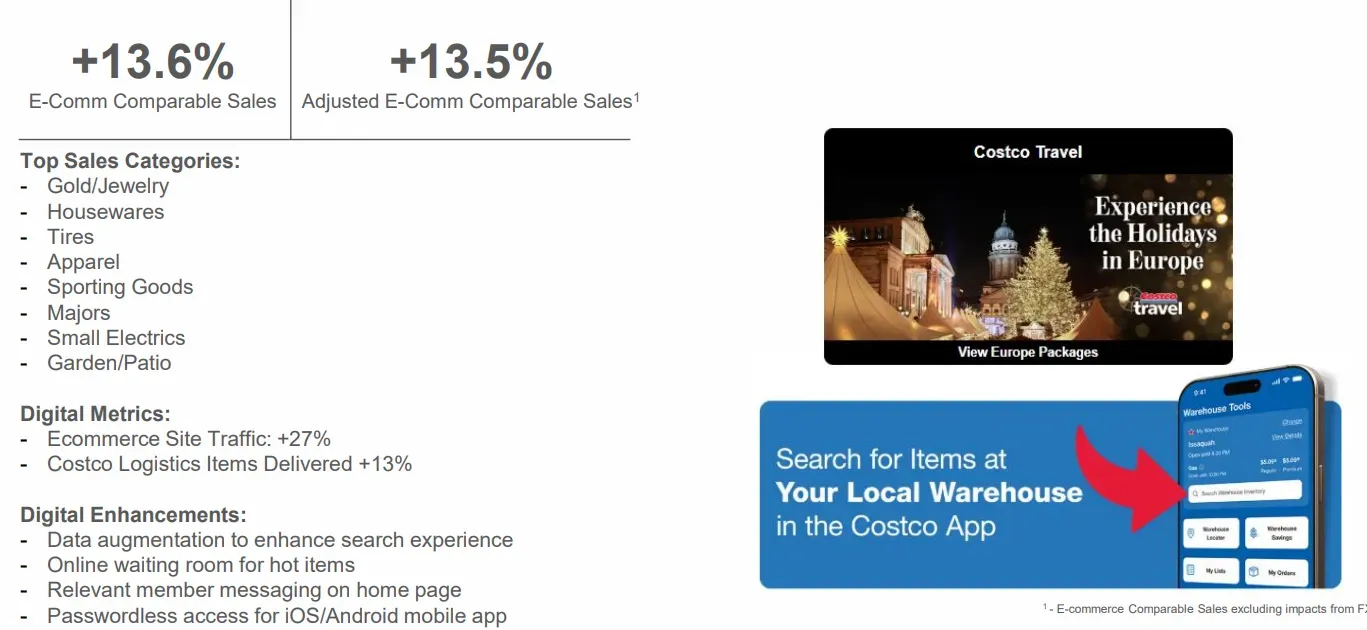

I’ve been closely tracking Costco for years - it's a steady performer in a volatile market, and its latest Q4 FY2025 earnings gives me reasons for cautious optimism. Costco posted a revenue of $86.16 billion, slightly beating analysts' expectations of $84.4 billion and growing 8.1% YoY. EPS came in at $5.87, also ahead of the $5.80 consensus and up 11.6% YoY. This quarter reinforced Costco’s core strengths: efficient operations, loyal membership base, and strong cost discipline. What stood out to me was the 13.5% jump in e-commerce - a clear sign the retailer is executing on its omnichannel strategy effectively.

However, despite the solid report, the stock didn’t pop post-earnings. It’s been trading lower since its February highs, and I suspect that’s due more to broader economic caution and valuation concerns than anything Costco did wrong. Several sentiment signals suggest traders are positioning for potential downside in the short-term, even though the long-term thesis remains intact. Valuation remains rich - which opens the door for a pullback if momentum doesn’t return quickly.

In my view, we’re at one of those classic Costco crossroads: fundamentals are strong, but the market wants a reset on price. I’m watching key technical levels closely before making any sizable move.

Earnings Highlights

- Revenue: $84.4 billion (+8.1% YoY, beat by 0.18%)

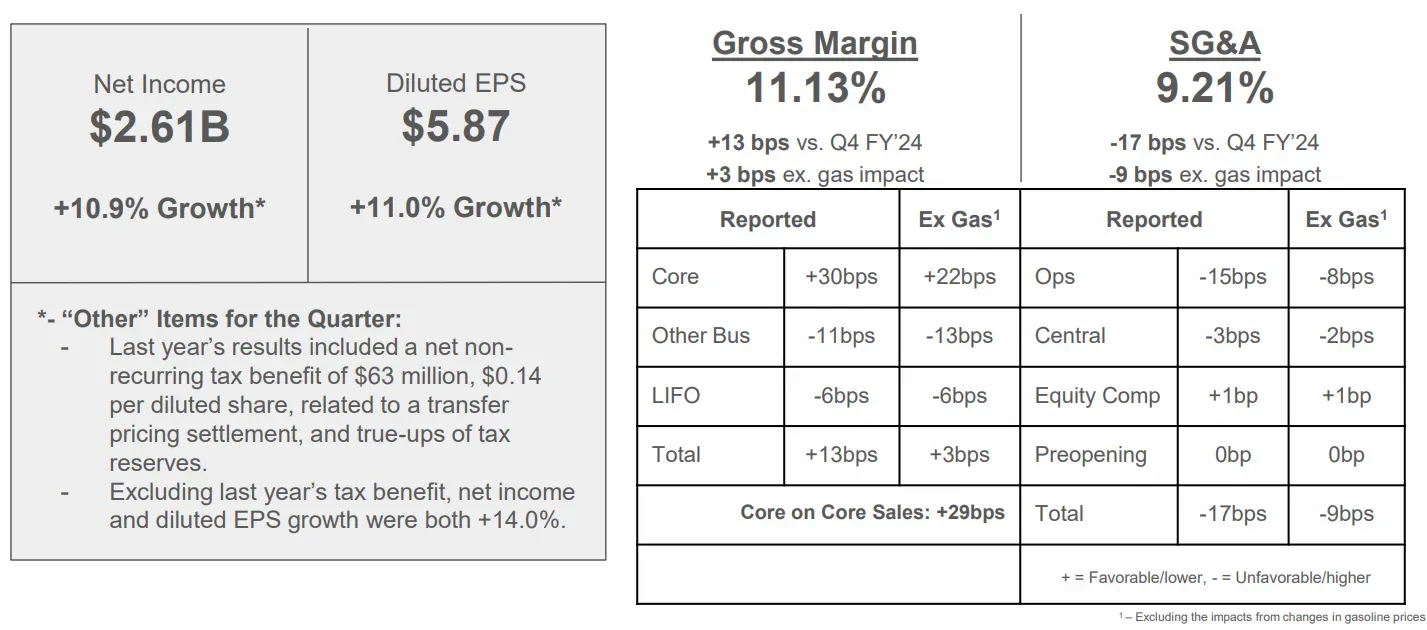

- Net Income: $2.61 billion (+11.6% YoY, net margin 3.0%)

- EPS: $5.87 (+11.6% YoY, beat by 1.2%)

- E-commerce Growth: +13.5% YoY

- Guidance: Not provided for the next quarter or fiscal year

Financial Analysis

Costco once again put up a resilient set of numbers in Q4. The driving force behind the top-line growth was higher volumes across grocery, fresh foods, and health categories, coupled with a significant boost in e-commerce activity. That 13.5% e-comm growth isn’t just a blip - it's part of a broader transformation where Costco is modernizing its digital presence to better connect with younger consumers. Management hinted at this shift during the call, citing increased engagement from new Gen Z members.

Margins stayed healthy (3.0% net income margin) and expanded YoY, which is impressive in a cost-sensitive climate. While the report didn’t provide specific gross or operating margins, the EPS growth outpaced revenue, which suggests continued discipline in SG&A and inventory management.

What worries me slightly is that guidance was a no-show. That could be due to macro uncertainty, perhaps stemming from pricing pressures or FX headwinds. But as a trader, when companies with strong execution histories start withholding outlooks, that’s usually an early signal of upcoming turbulence - whether from slowing same-store sales growth, wage inflation, or intensified discounting pressures.

Valuation is another concern. At ~52x forward earnings - compared to Walmart at 39x and Amazon at 35x - Costco is priced for perfection. Any slowdown, even modest, could trigger a repricing.

Technical Analysis Summary

Looking at the charts, COST is in a classic consolidation phase and shows a neutral-to-bearish bias in the near-term. The weekly chart reveals a symmetrical triangle forming, with support near $945 and resistance up at $1,034 -consistent with a tightening range between the 23.6% Fibonacci retracement level and broader resistance from earlier this year.

Two patterns caught my eye:

- Head and Shoulders (Weekly): From a swing trade perspective, this is concerning. The right shoulder failed to breach prior highs, and the neckline is hovering near $900. A break below that could trigger a more pronounced correction.

- Pennant Formation (Daily): This suggests a buildup in volatility. With Bollinger Bands tightening and RSI sitting at 48.17 (neutral), the next move could be larger than average. COST typically moves ~$34 on earnings day historically, and while that didn’t happen this time, the pressure is still building.

MACD is flat, signaling indecision, and the stock is still below its 200-day SMA (~$976), which is the level I’m watching for a bullish pivot. If that breaks, we could see a run back toward $1,035. However, if $940 gives way, there's room down to $910 or even $863 based on past retracements.

Risk-reward right now favors patient accumulation - but only after a convincing reversal signal.

Analyst Verdict

So where do I land on Costco right now?

- Rating: Hold (Short-Term), Buy (Long-Term)

- Buy Zone: Below $900-910 (oversold risk/reward significantly improves)

- Watch For: Breakout above $976 (could signal renewed uptrend); breakdown below $940 (short-term weakness)

Costco delivered on its fundamentals - solid revenue, growing EPS, and strong e-commerce momentum. But tech-heavy valuation multiples, trading under key averages, and mixed short-term signals tell me we’re not out of the woods yet.

Personally, I’m not rushing in at current levels. I’ll be waiting to see if support at $940 holds. If it does and volume picks up, I could scale into a position ahead of a potential Q1 holiday-driven boost. But if it breaks, I’ll look to buy deeper into weakness because long-term, Costco is best-in-class.

As always, discipline and patience win the game over chasing every move. Let's see what the next few sessions bring.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.