Dot rolls out, DASH (DASH) rolls dice

Why I’m watching Doordash’s robot push and what it means for the stock

I’m digging into DoorDash (DASH) because the company just put its own delivery robot-Dot-on real streets in metro Phoenix and rolled out restaurant reservations. That combo says “bigger logistics play,” not just food delivery. But the market’s reaction has been muted so far, so I want to weigh the upside vs. the friction in the real world.

Dot goes fast, price slows

The DASH daily chart shows a mature ABCD / rising wedge structure from point A up into the D area near ~$270 (green line). Price is pressing into overhead supply around the prior highs while the wedge narrows, and the diagram plots a potential breakdown path. Key levels are marked at $216.07 (first major support/target if the wedge fails) and a deeper $164.32 base from the spring advance.

Momentum confirms risk: the RSI panel flags a clear bearish divergence- lower highs on RSI while price pushed higher - suggesting waning upside pressure. As long as price stays capped below the D/ATH zone, probabilities favor a pullback toward $216; a decisive close back inside the wedge with rising RSI would be the first sign the bearish setup is negated.

Fundamentals & news

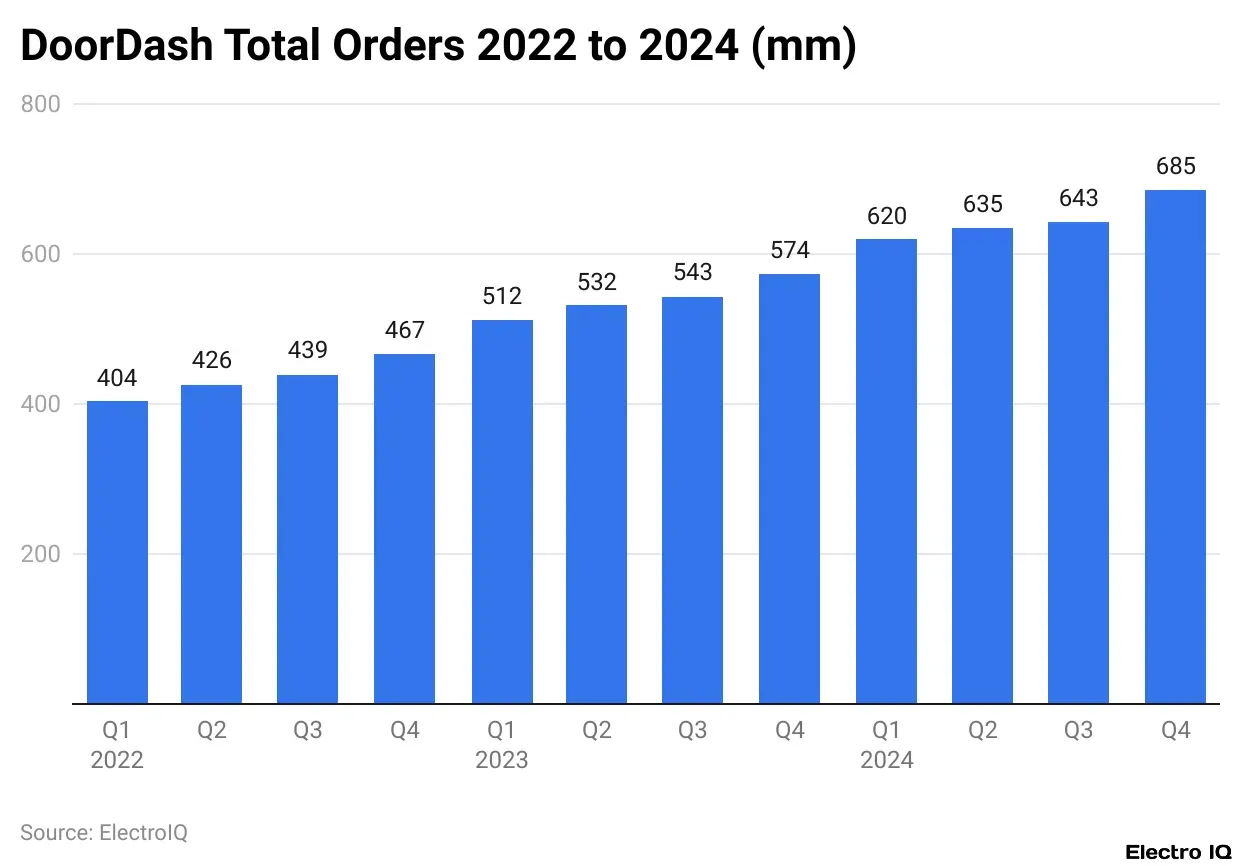

Q2 numbers were strong: 761M total orders (+20% YoY), GOV +23% to ~$24.2B, and revenue +25% YoY-why shares pushed to new highs last month.

New moves now: a reservations product and a hybrid autonomy platform that routes orders across Dashers, drones, sidewalk bots, and Dot. Investors looked lukewarm on day one (shares slipped after the reveal), which I read as “show me unit economics.”

Technology Outlook

The Dot robot is capable of speeds up to ~20 mph, carrying up to 30 pounds, with a battery life of ~6 hours. It can travel on roads, bike lanes, and sidewalks. While technologically promising, practical challenges remain: stairs, doorways, pedestrian traffic, wheelchairs, bicycles, pets, and complex curbside environments. Issues of safety, regulation, and maintenance may slow deployment and scaling, even if the technology is viable. Insider selling in late September (COO ~30k shares) is also noteworthy, though not thesis-changing.

My take

DoorDash continues to demonstrate strong core business performance, while expanding its total addressable market through autonomy and reservations. Technical levels suggest a potential short-term pullback, but the broader trend remains intact if key supports hold. Successful proof of improved delivery density and lower cost per order will determine whether Dot’s deployment becomes a long-term driver of profitability.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.