Hood (HOOD) breaks out as Robinhood pushes prediction markets higher

Stock sits near record after 4b contracts milestone and overseas talks

I’m looking at Robinhood (HOOD) right now because the stock just broke into record territory - touching $142.48 before easing back a bit. The catalyst? A mix of prediction market growth, possible overseas expansion, and the SEC’s push on blockchain-based stocks.

Fundamentals

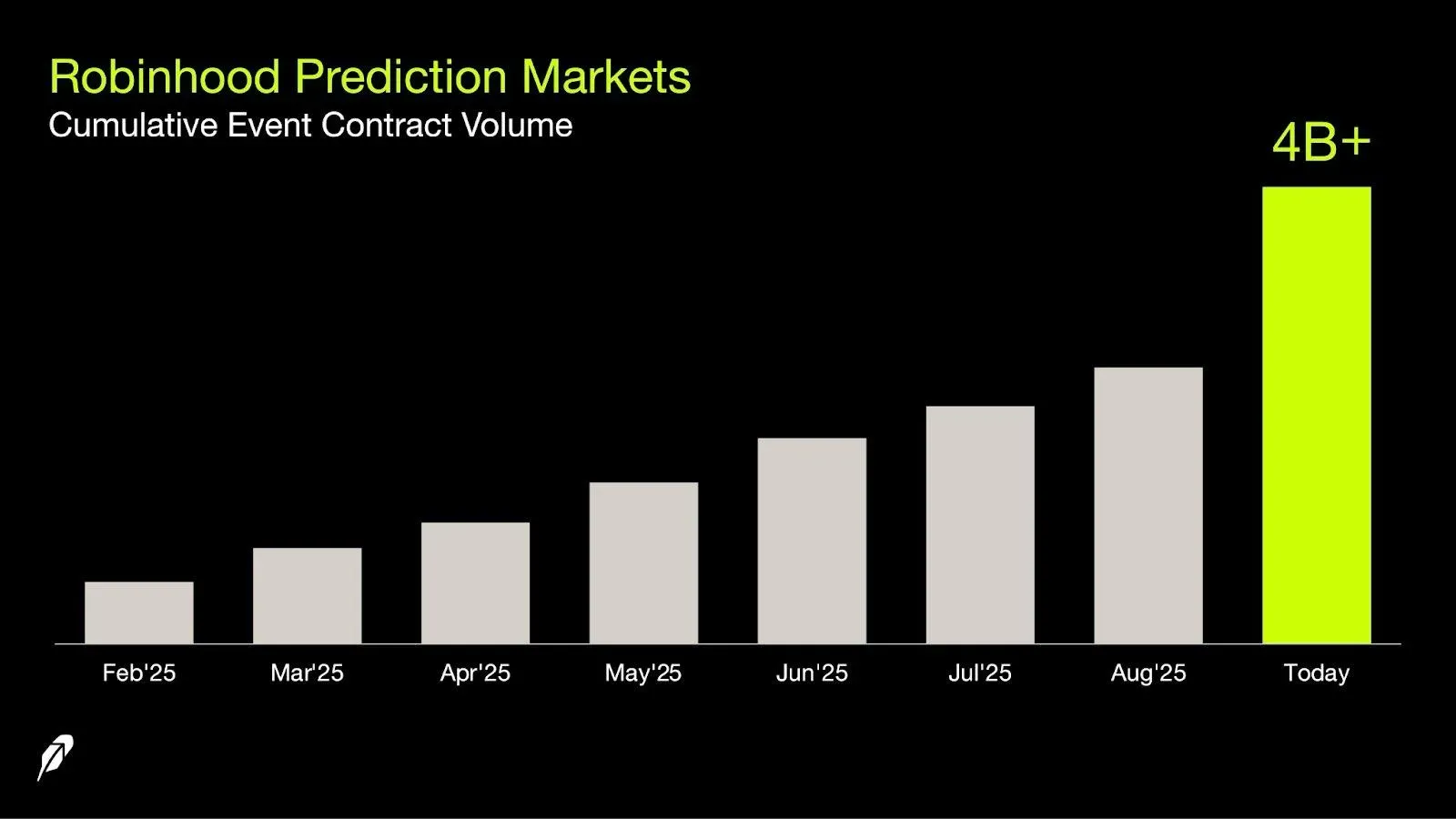

On the fundamentals side, Robinhood’s prediction markets are scaling faster than I expected.

Vlad Tenev said they’ve already handled 4 billion contracts, with half of that volume just in Q3. That kind of growth is eye-catching because it shows strong user demand and gives HOOD a shot at building a new recurring revenue stream outside of its core brokerage model. If they can push into markets like the U.K., it could open up another growth leg - though regulators abroad may treat this as gambling, not finance.

Recent EPS surprises highlight the strength of momentum:

• Jun 2025: reported $0.42 vs forecast $0.31 (+35.5%)

• Mar 2025: reported $0.37 vs forecast $0.31 (+19.4%)

• Dec 2024: reported $0.54 vs forecast $0.42 (+28.6%)

• Sep 2024: reported $0.17 vs forecast $0.18 (-5.6%)

Technicals

Robinhood (HOOD) is in a strong daily uptrend, riding an ascending path from the spring lows and recently tagging the 100% Fibonacci projection near ~138 before backing off. The first support to watch is the 78.6% Fib zone (~120s), then 61.8% (~110s); a daily close back above ~138 would reset momentum and opens space toward the 161.8% extension (upper 190s/200 area). Trend bias stays bullish while price holds above the dashed rise line and the 61.8% band.

Momentum is hot but cooling: RSI spiked into overbought (>70) and rolled back to the mid-60s, hinting at a short-term pause or chop rather than an immediate breakdown. If RSI bases above 50 while price respects 120–122, dips look buyable for a retest of 138; a decisive RSI break below 50 alongside a loss of 61.8% would shift risk toward a deeper retrace into the low-100s.

Bigger Picture

The bigger picture adds another angle: the SEC’s plan to allow tokenized stock trading could play right into Robinhood’s strengths. They’ve already been vocal about real-time settlement, and if they get early-mover advantage in tokenized equities, that could strengthen their competitive moat versus legacy brokers. Of course, there’s pushback from Wall Street giants like Citadel, which means delays and regulatory battles are possible.

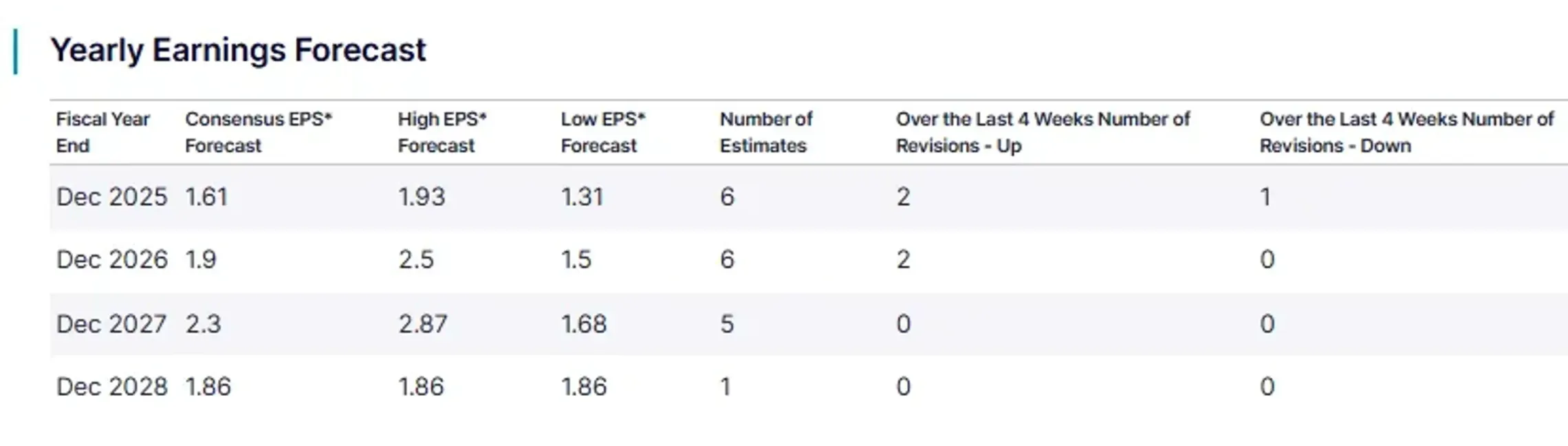

Analyst yearly EPS forecasts stand at:

- Dec 2025 = 1.61

- Dec 2026 = 1.90

- Dec 2027 = 2.27

- Dec 2028 = 1.86

My take

I’m bullish here. The fundamentals are showing new growth engines, the technicals back the move, and the regulatory catalysts - while messy - give Robinhood optionality that most brokers don’t have. Near-term pullbacks are likely after a big run, but I see dips being bought as long as the $130-$138 support holds.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.