Intel (INTC) just shocked everyone with these Q3 numbers

The government is now their biggest shareholder and Nvidia is investing billions

Intel has been the ultimate value trap for years now, but what happened last night might finally change the narrative. After years of getting destroyed by TSMC and losing ground to AMD, something just shifted dramatically. The Q3 earnings dropped last night and honestly, I'm reconsidering my entire thesis on this beaten-down chip giant.

The Technical Setup Looks Promising

Let's talk technicals first. INTC has been stuck in a brutal downtrend for 3 years, but we just saw a massive 7-8% spike after hours on huge volume. The stock's been building a base around $35-38 for months, and this earnings beat might be the catalyst to finally break above the $41 resistance that's capped every rally attempt this year. RSI just jumped from oversold territory to neutral - that's bullish momentum building. If we can hold above $40 and push through $41.50 on sustained volume, I'm looking at $45-48 as the next target zone.

Fundamentals: The Real Game-Changer

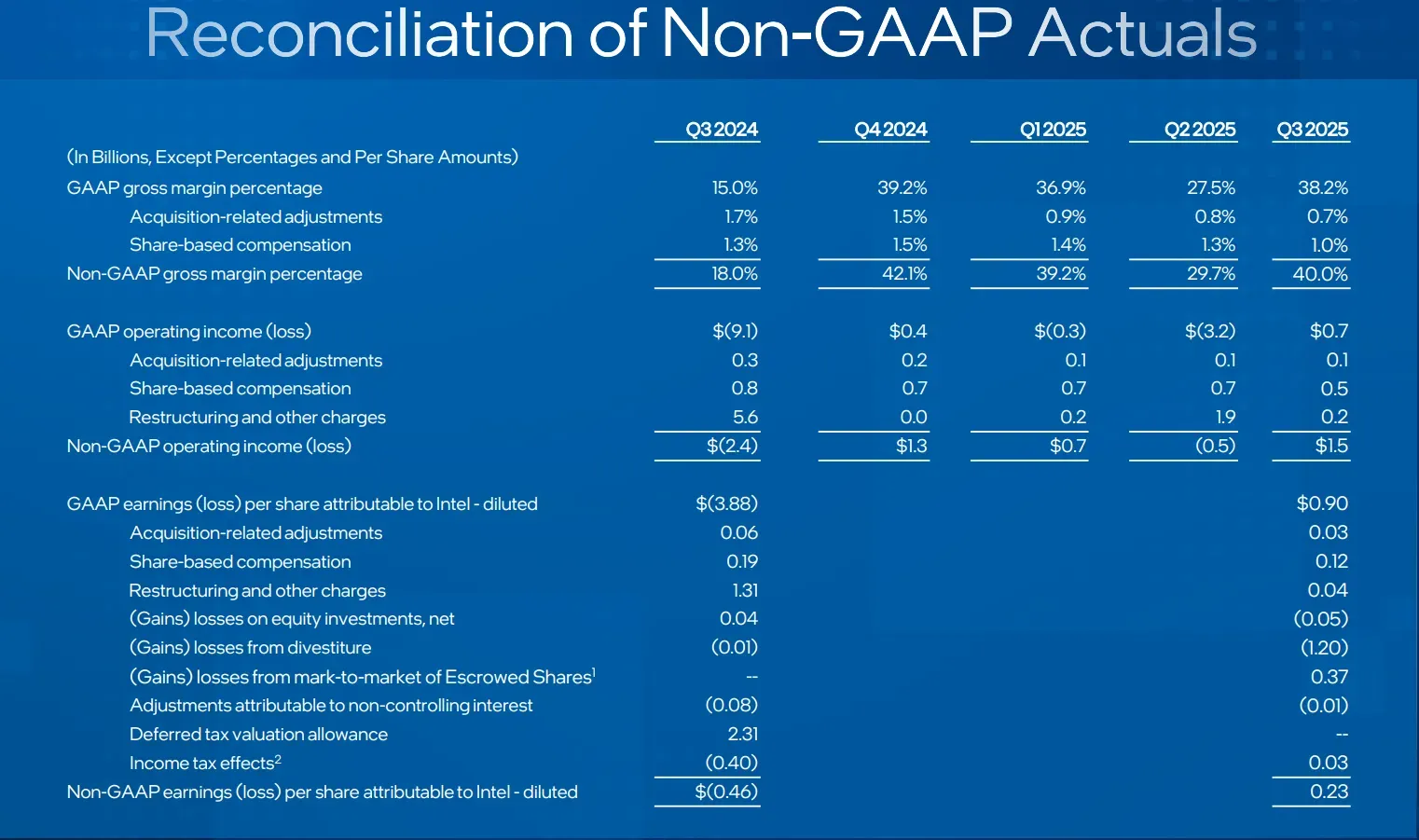

The fundamentals are where things get really interesting. Revenue came in at $13.7B (beat by $550M), and they actually posted positive adjusted EPS of $0.23 when Wall Street expected basically breakeven at $0.01.

But here's what has me really intrigued - the U.S. government just became their largest shareholder with a 10% stake ($8.9B investment), and NVIDIA just committed $5 billion. When Jensen Huang is putting serious money into your competitor, you know something's brewing. They're partnering to integrate Intel CPUs with NVIDIA's AI accelerators, which could be massive for data center revenue. Plus, Intel just announced they're going after Broadcom's custom chip business - that's a $100B+ market opportunity nobody saw coming. The foundry losses are still ugly at $2.3B, but improving from $5.8B last year.

I'm turning cautiously bullish here. Yes, they're still burning cash on the foundry and yes, AMD and NVIDIA are miles ahead in AI chips. But with $30.9 billion in cash, government backing, and demand exceeding supply through 2026, this feels like the first real inflection point in years.

The risk/reward at these levels is compelling - downside seems limited with government support, while upside could be 30-40% if they execute on even half these initiatives. I'm starting a position on any pullback to $38-40 and will add if we break cleanly above $41.50.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.