Intel’s earnings beat didn’t save the stock

And I think the sell-off makes sense

I’ve been watching Intel ($INTC) closely this year - not because I expected a big comeback, but because I wanted to see if the bottom was finally in. After all, the stock had already lost 60% of its value in 2024. So when Intel posted Q2 results that beat on revenue and guidance, I was prepared for a pop.

What we got instead was a 9% drop - and frankly, I get it.

The Numbers Weren’t Bad. But the Story Was.

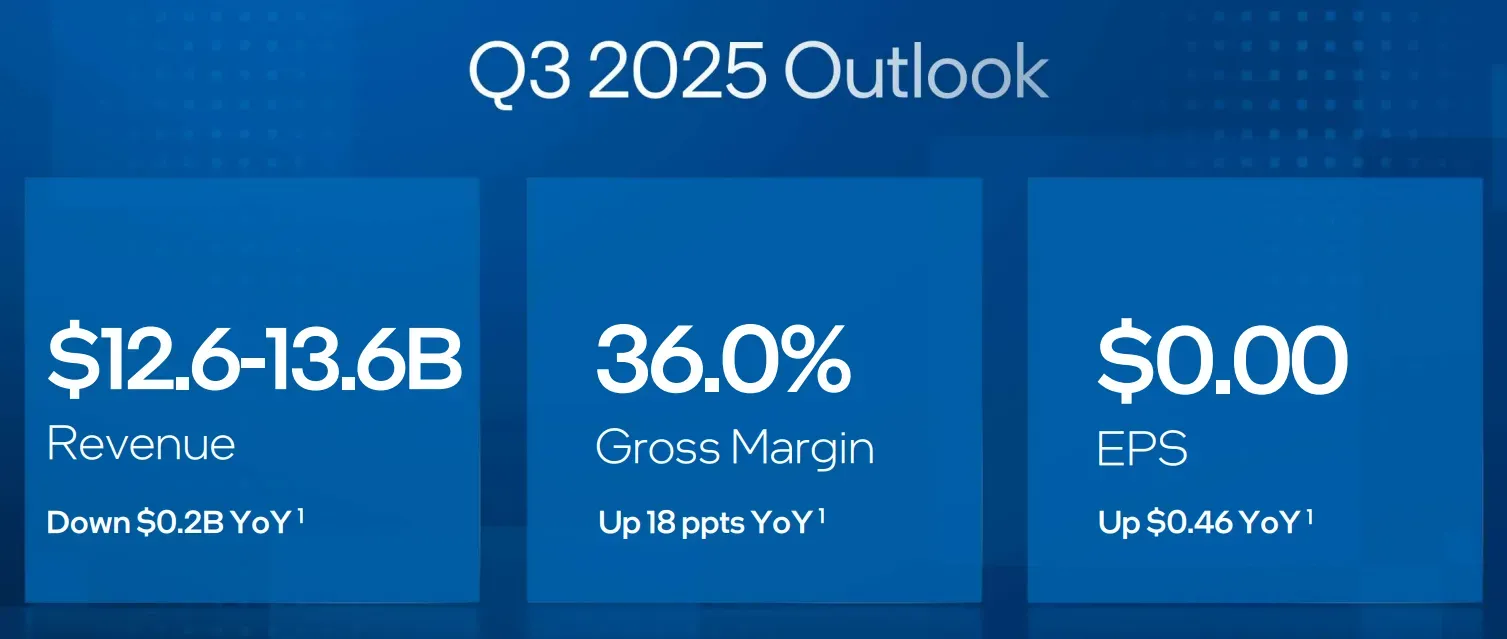

Let’s be clear: Intel beat on the top line. Q2 revenue came in at $12.9 billion vs. the expected $11.8 billion. They even guided Q3 revenue to $12.6–13.6B- again, above consensus.

But the earnings miss was sharp: adjusted EPS came in at -$0.10, versus an expected +$0.01.

The company recorded an $800 million impairment charge, citing “excess tools with no identified re-use.” That line alone tells you everything you need to know about how bloated and disorganized Intel’s capex has been.

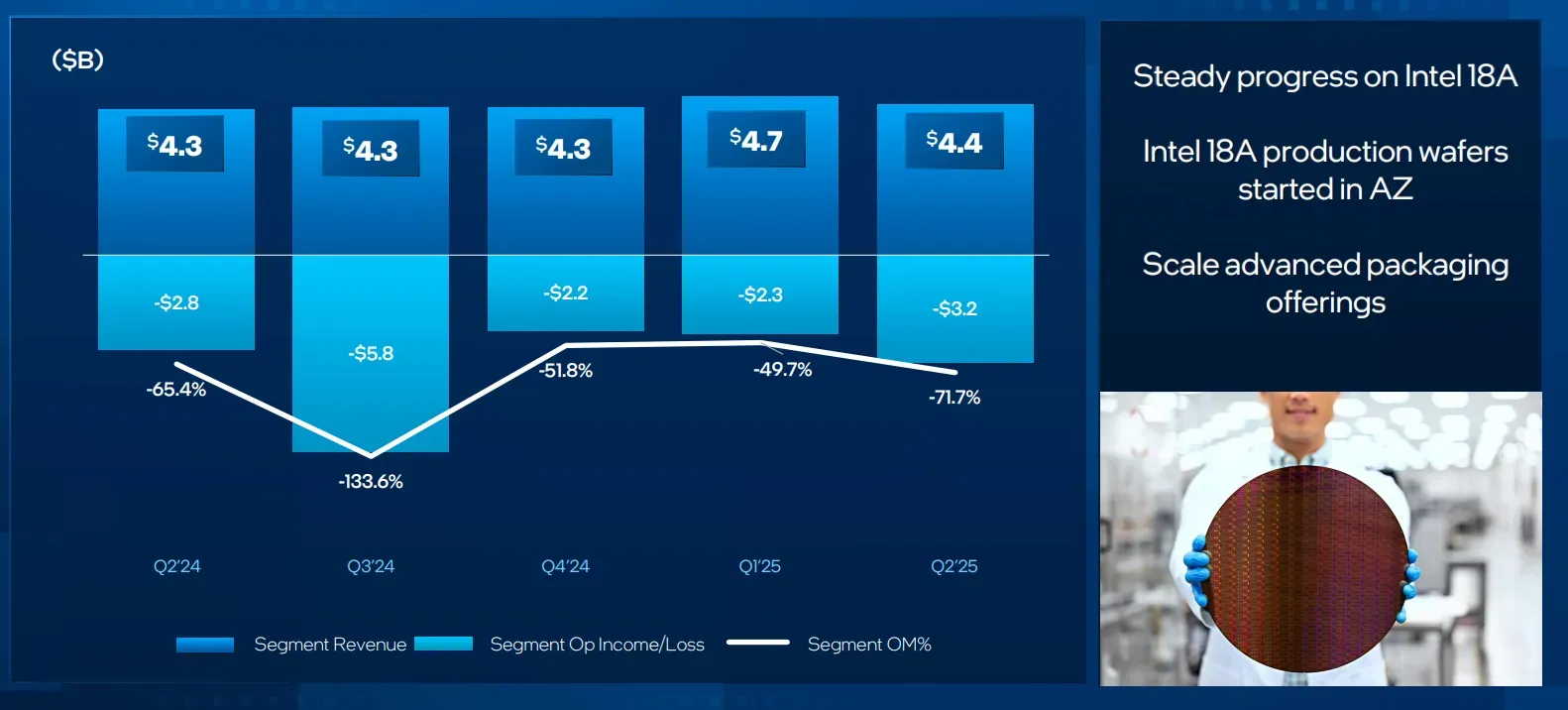

Then came the bombshell: the foundry business - Intel’s big bet to rival TSMC and become a contract chip manufacturer - might be on the chopping block. In their own SEC filing, Intel said it may “pause or discontinue” its foundry business if it can’t lock in customers for its next-gen 14A node.

I didn’t expect that kind of language. Markets didn’t either.

The Foundry Plan Is Falling Apart

This foundry story has been a mess for years. Under Pat Gelsinger, Intel went all-in on building fabs across the US and Europe. Ohio, Germany, Poland - the works. The idea was to regain manufacturing dominance and win external customers like Amazon and Microsoft.

But now new CEO Lip-Bu Tan is slamming the brakes. The Germany and Poland plants? Canceled. Ohio? Slowed down. Internal note? “No more blank checks.”

And what’s worse - they still haven’t secured any major foundry clients for 14A. None. Zero.

So what we’re left with is a $100 billion asset footprint with no meaningful commercial demand behind it. And now they’re hinting at shutting it down. That’s a staggering reversal.

Retail Sentiment Paints a Bleak Picture

Let me just say this: if you think I'm being harsh, go spend 10 minutes on Reddit.

A top comment summed it up like this:

How has Intel fumbled the bag so hard during an AI boom that should see them soaring?

The sentiment isn’t just bearish - it’s confused, disappointed, and borderline nihilistic.

Others are digging deeper. One user pointed out how Intel had the first shot at the breakthrough ASML lithography tool - and declined. TSMC took the risk, and the rest is history. That single decision arguably shaped the entire landscape of semiconductor leadership we see today.

And it's not just one missed opportunity. Another user broke it down perfectly:

while AMD innovated with chiplet architecture - allowing better yields and performance - Intel slept at the wheel.

Add that to unstable leadership (five CEOs in a decade vs. Lisa Su’s steady hand at AMD), and you’ve got a company whose failures feel systemic.

Even former bulls admit it: the only thing holding up Intel's story now is whether the 18A process delivers in 2025–2026. If it does, there's a shot. If it doesn't, it's “absolute disaster.”

Why the Market Is Right to Panic

I’ve seen a lot of earnings overreactions, but this isn’t one. Intel’s drop is rational. The revenue beat is irrelevant if the core turnaround thesis is dying.

Without a successful foundry business, Intel remains stuck in the past. Their consumer chip business is getting squeezed by AMD. Qualcomm is creeping into the PC space with its new Snapdragon X line. And of course, Nvidia is eating everyone’s lunch in AI- which is where all the investor money is flowing right now.

Look at the chart below. Since late 2022, Nvidia (purple) is up nearly 1000%. AMD (yeallow) up over 150%. Intel flatlined. That’s not just underperformance - it’s irrelevance.

And the revenue picture doesn’t help. Outside of a brief uptick in early 2024, Intel’s quarterly growth has been red for years.

A Broken Board and a Broken Vision?

Here’s something that hit me hard reading retail feedback: Intel’s board may have torpedoed its own last shot. Pat Gelsinger, for all his overpromising, had a vision to bring Intel back through aggressive investment in 18A and foundry leadership.

And just as the 18A payoff window was opening… they fired him.

Now we’re stuck with interim leadership, a demoralized workforce after 15% layoffs, and rumors that the board tried and failed to sell the foundry business - leaving the company in limbo.

There’s no visionary at the wheel. No confirmed strategy. No government backing (Trump appears to favor TSMC). And unless something massive changes, Intel is living or dying based on one technical milestone 12 months from now.

My Take

I’m not shorting Intel, but I’m not buying this dip either. The foundry narrative was supposed to be the lifeline. Now it’s on life support. If Intel exits the foundry game entirely, what exactly is left to be bullish about - besides a vague hope that PCs and servers stabilize?

With a forward P/E of 42.5, Intel is still more expensive than AMD and not much cheaper than Nvidia. That doesn’t make sense.

Until this company can prove it belongs in the AI-driven future of semis - not just by cutting costs, but by winning real deals - I’m staying out.

Let the dust settle. This one’s not ready to turn the corner.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.