Lithium Americas (LAC) Stock Just Doubled - What Now?

Market reaction to Trump-administration stake talks and what it could mean long term.

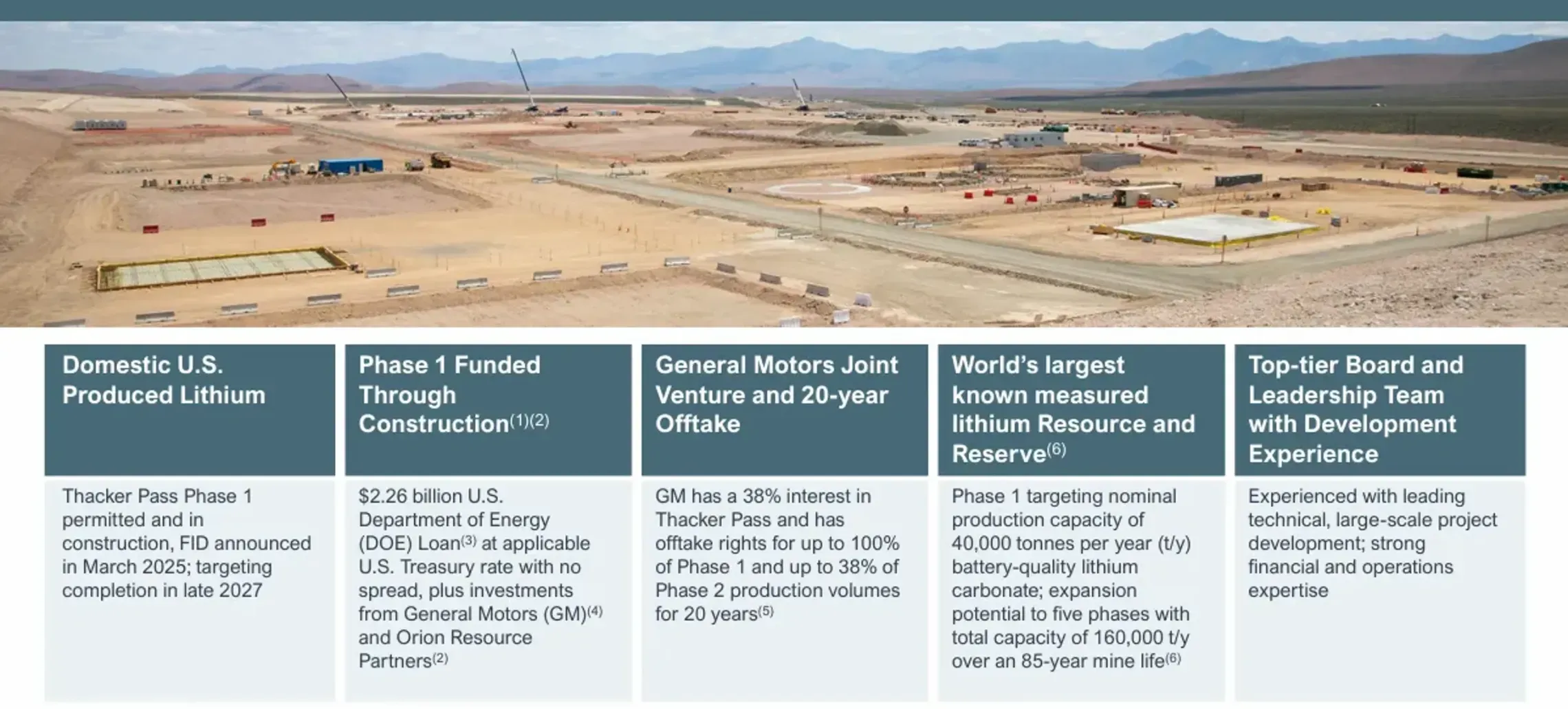

I’ve been watching Lithium Americas (LAC) for a while, mostly because of the Thacker Pass project in Nevada - one of the largest known lithium deposits in North America. But yesterday’s move caught me off guard. The stock literally doubled in a single session after news broke that the Trump administration is considering taking an equity stake in the company.

Insider/political angle

Why the sudden hype?

The White House is pushing for a 10% stake (though some reports say it might be smaller) as part of the renegotiation of a $2.2B Department of Energy loan. The logic is simple: LAC and GM wanted to stretch out repayments, and in exchange the government wants some equity as a buffer for taxpayers.

This is unusual for the U.S. - we don’t usually see direct government ownership in public companies, especially Canadian ones like LAC. But it fits the bigger theme: the administration wants more domestic control over critical minerals and less reliance on China, Chile, etc.

LAC Fundamentals

General Motors already owns 38% of Thacker Pass and has a binding offtake deal. That’s huge. If the government also steps in, it creates a kind of three-way guarantee: LAC runs the mine, GM buys the output, and Washington ensures financing/security. That’s about as strong a backstop as you can get in this sector.

Technical view

The stock ripped from ~$3 to over $6 in one day, hitting its highest level since April 2024. That’s a crazy move for a company still years away from production (first phase expected in 2027). Market cap is now ~$1.5B.

On the technical side:

- Immediate resistance is around $6.50–6.80, which was a supply zone last spring.

- Support is back near $5 if there’s a pullback.

- RSI is obviously overheated after a 100% daily candle.

This feels like the MP Materials trade all over again: initial government injection, then sustained momentum as the narrative builds.

Risks to keep in mind

- Execution risk: Thacker Pass isn’t producing yet. Any delays push revenue further out.

- Political flip-flop: As some redditors noted, Trump can change his stance quickly.

- Lithium prices: They’ve been sliding from 2022 highs. Even with government backing, commodity cycles matter.

- Canadian approval: Because LAC is domiciled in Canada, Ottawa might have to sign off on a U.S. government stake.

My take

Personally, I’m bullish long term but cautious in the short term. If you bought in the $3s, locking some profits here makes sense. I wouldn’t chase the pump at $6+ unless you’re ready for volatility.

That said, the setup looks strong: bipartisan support for U.S. mineral independence, GM’s involvement, and now possible White House backing. If Thacker Pass really delivers a million EV-worth of lithium a year, today’s $1.5B valuation could look tiny in hindsight.

For now, I’m holding my shares and will add on dips. This feels like a strategic asset play, not just another speculative miner.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.