META Q2 2025 Earnings analysis: Personal investment view

Executive Summary: STRONG BUY - Adding to Position

META delivered a knockout quarter that validates my thesis on their AI transformation. I’m increasing my position on any post-earnings dip and holding for the long haul. The combination of stellar fundamentals, aggressive AI positioning, and technical setup screams opportunity.

Financial Performance: 🟢 EXCEPTIONAL

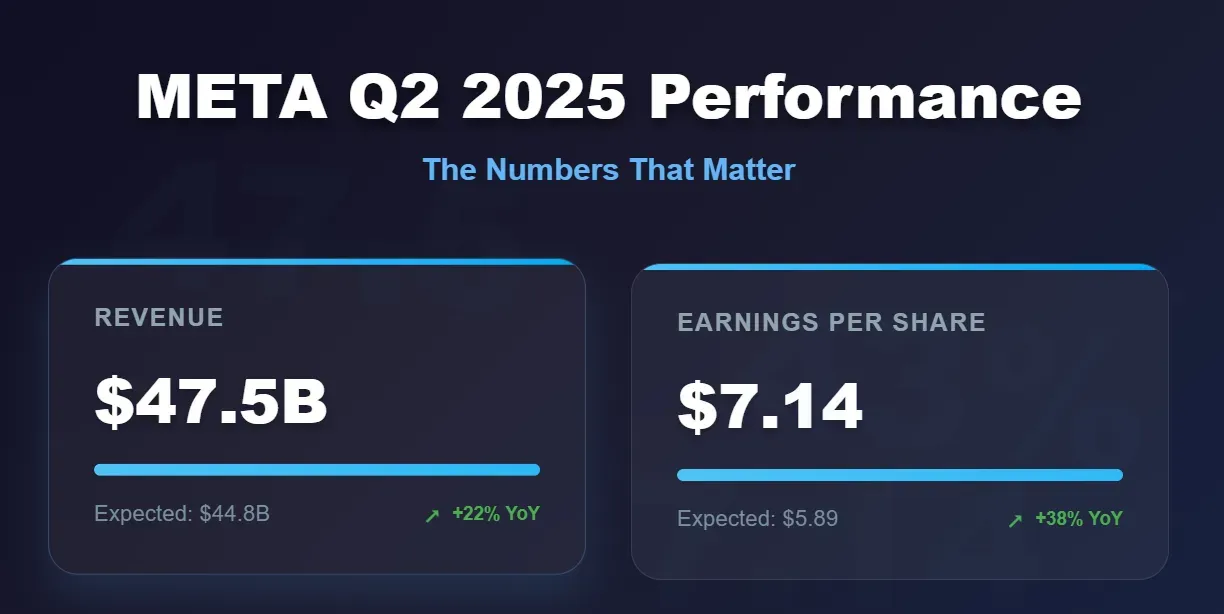

- Revenue: $47.5B vs. $44.8B expected (+22% YoY)

- EPS: $7.14 vs. $5.89 expected (+38% YoY)

- Operating Margin: 43% vs. 38% last year

- Net Income: $18.34B (+36% YoY)

- Daily Active Users: 3.48B vs. 3.45B expected

My Take: These aren’t just good numbers - they’re exceptional. The revenue beat of $2.7B is massive, and the margin expansion while investing heavily in AI shows incredible operational discipline. This is a company firing on all cylinders.

Strategic Position: 🟢 VISIONARY BUT EXPENSIVE

Meta is going all-in on what Zuckerberg calls “personal superintelligence.” The scale is breathtaking:

- $15.1B in Q2 investments, including Scale AI stake

- $66-72B projected capex (raised from $64-72B)

- Multi-billion dollar talent acquisition - poaching from OpenAI, Apple, GitHub

- Hundreds of billions for multi-gigawatt data centers

My Investment Thesis: This is either going to be the most successful tech transformation in history or a very expensive lesson. But Zuckerberg’s track record (mobile pivot, Stories, Reels monetization) gives me confidence. The man doesn’t make small bets - and his big bets usually pay off spectacularly.

Reality Labs: Still Bleeding

- $4.5B operating loss on $370M revenue

- Better than expected loss, but revenue underperformed

- The metaverse vision remains commercially unproven

My View: I’m writing this off as R&D for now. The real value is in AI applications across the core platform.

Technical Analysis: 🟡 MIXED SIGNALS

Current Setup (as of July 31, 2025)

- Current Price: ~$773 (after -2.46% pre-earnings dip)

- 52-Week Range: $450.80 - $784.55

- All-Time High: $784.55 (July 31, 2025)

Key Technical Levels

- Resistance: $738-784 (previous and new highs)

- Support: $686 (trend line), $597 (volume support)

- Moving Averages: 50-day at $706.9 above 200-day at $640.3 (bullish golden cross)

Technical Indicators

- RSI: 46.3 (neutral, room to run)

- Pattern: Potential bull flag formation

- Volume: Increased on recent selling (potential capitulation)

My Technical View: The stock pulled back from all-time highs and is consolidating. The 10%+ post-earnings pop validates the bull case. I see this as a healthy pullback before the next leg higher. The golden cross and neutral RSI give plenty of room for upside.

Investment Decision: 🟢 AGGRESSIVE BUY

Why I’m Buying More META

- Monopolistic Position: 3.48 billion daily users is an unassailable moat

- AI First-Mover Advantage: Their data advantage in AI training is massive

- Margin Expansion: 43% operating margins while investing heavily shows pricing power

- Technical Setup: Post-earnings volatility creates entry opportunity

- Valuation: 27.4x P/E for this growth profile is reasonable

My Position Strategy

Entry Points:

- Zone 1: $700-710 (current levels) - 40% of planned allocation

- Zone 2: $680-690 (if we get a deeper dip) - 40% of allocation

- Zone 3: $650-660 (major pullback) - 20% of allocation

Targets:

- Short-term: $800-850 (6-12 months)

- Long-term: $1,000+ (18-24 months)

Stop Loss: Below $600 (major technical breakdown)

Risk Assessment

What Could Go Wrong:

- AI investments don’t monetize as expected

- Regulatory crackdown on data usage

- Competition from TikTok/emerging platforms

- Macro recession hurting ad spending

Risk Management: Position sizing at 8-10% of portfolio max. The upside potential far outweighs the downside risk given their cash generation and market position.

Market Sentiment: 🟢 BULLISH MOMENTUM

- Analyst Consensus: 25/27 analysts rate it “Buy”

- Average Price Target: $761.55 (+6% upside)

- Recent Upgrades: Guggenheim raised target to $800

- Post-Earnings: Stock jumped 10%+ after results

Wall Street Gets It: The institutional money is flowing in. When you have this kind of consensus from smart money, you don’t fight it.

Final Verdict: META is a Generational Opportunity

This earnings report crystallized why META is my largest tech holding. We’re witnessing a company with:

- Unmatched scale (3.5B users)

- Massive cash generation ($18.3B quarterly profit)

- Visionary leadership willing to bet big on AI

- Technical momentum breaking to new highs

The AI spending looks scary, but remember: this is optional for Meta. Their core business is so profitable they can afford to swing for the fences. When the AI monetization kicks in (and it will), this stock will be trading at multiples of today’s price.

I’m not just holding META- I’m actively adding to my position. This is a 5-10 year wealth-building opportunity disguised as short-term earnings volatility.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.