Micron (MU) just dropped earnings: AI tailwinds, big beats, and what I’m watching next

Stock doubled this year but can the momentum keep up?

I’ve been following Micron (MU) pretty closely this year because the stock basically turned into an AI trade proxy. Yesterday’s earnings confirmed why - the company crushed estimates and raised guidance, but the market’s reaction has been a little more nuanced.

Micron (MU) Fundamentals

Earnings highlights:

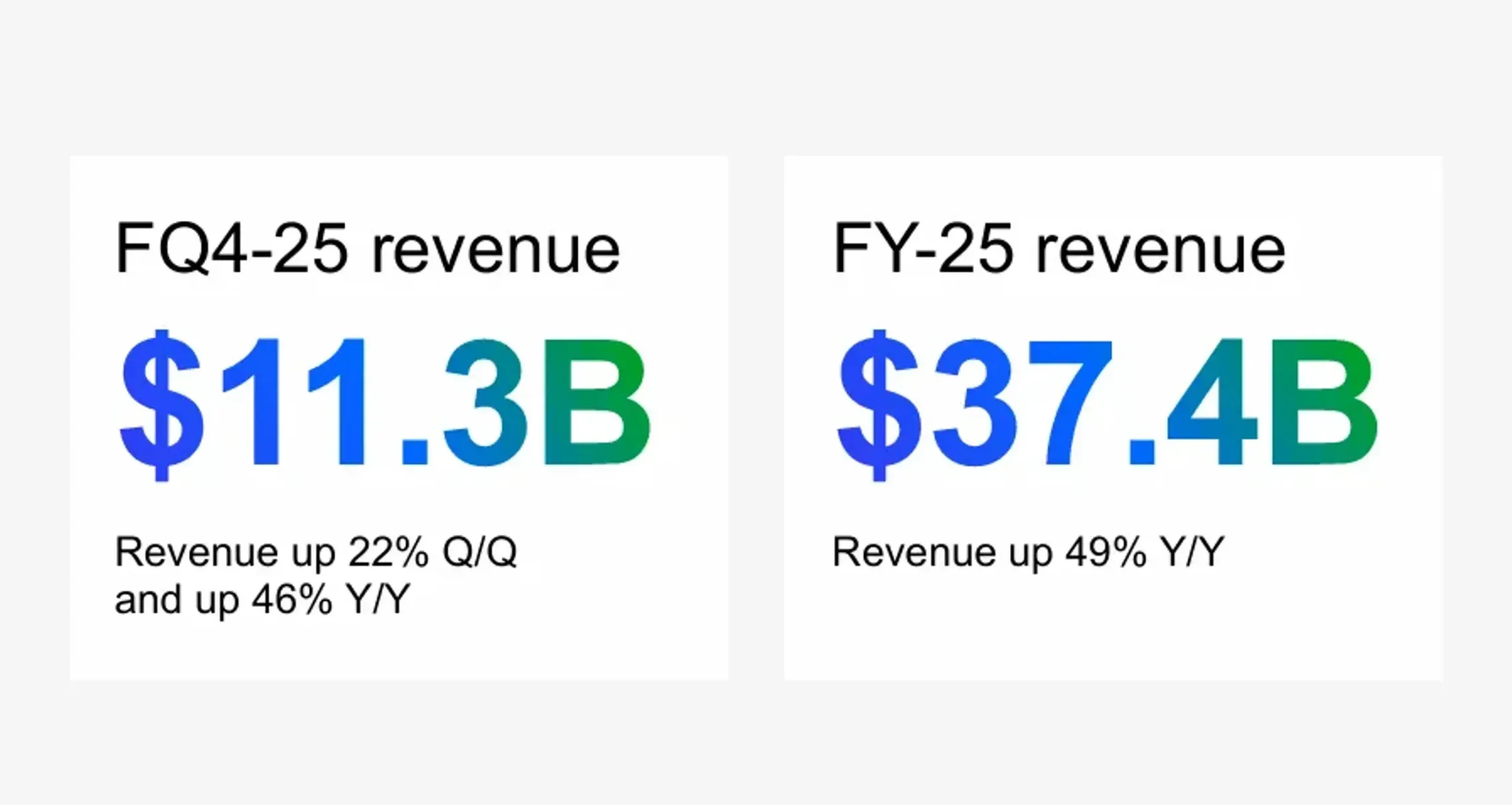

- EPS came in at $3.03 adj vs $2.86 expected.

- Revenue hit $11.32B vs $11.22B expected.

- Guidance for next quarter: $12.5B (street was at $11.94B).

- Net income surged to $3.2B vs $887M YoY.

Basically, MU is firing on all cylinders. Annual revenue is up 46% YoY, gross margins improved to nearly 45%, and they’re finally throwing off free cash flow again.

Why the street is hyped

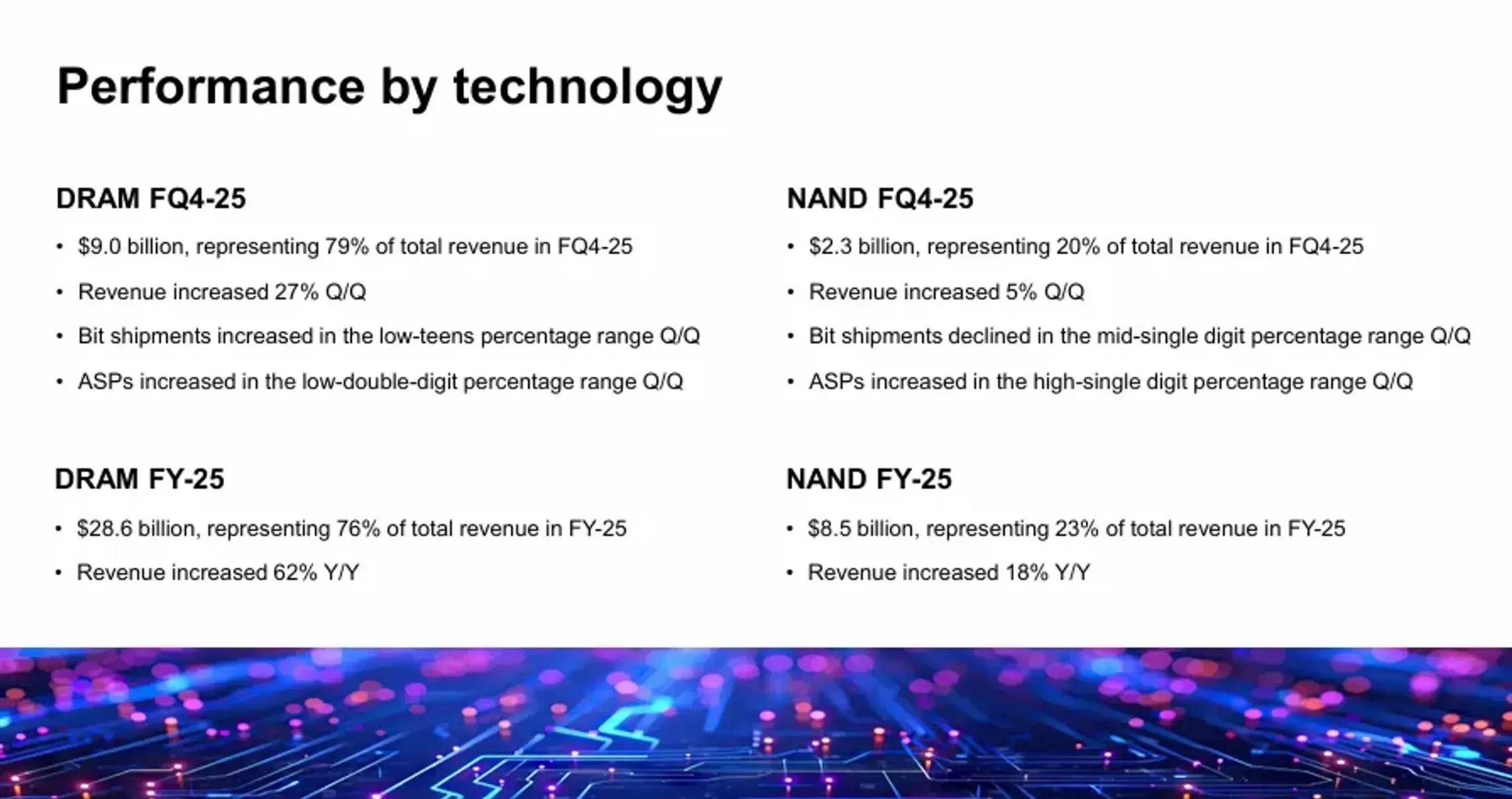

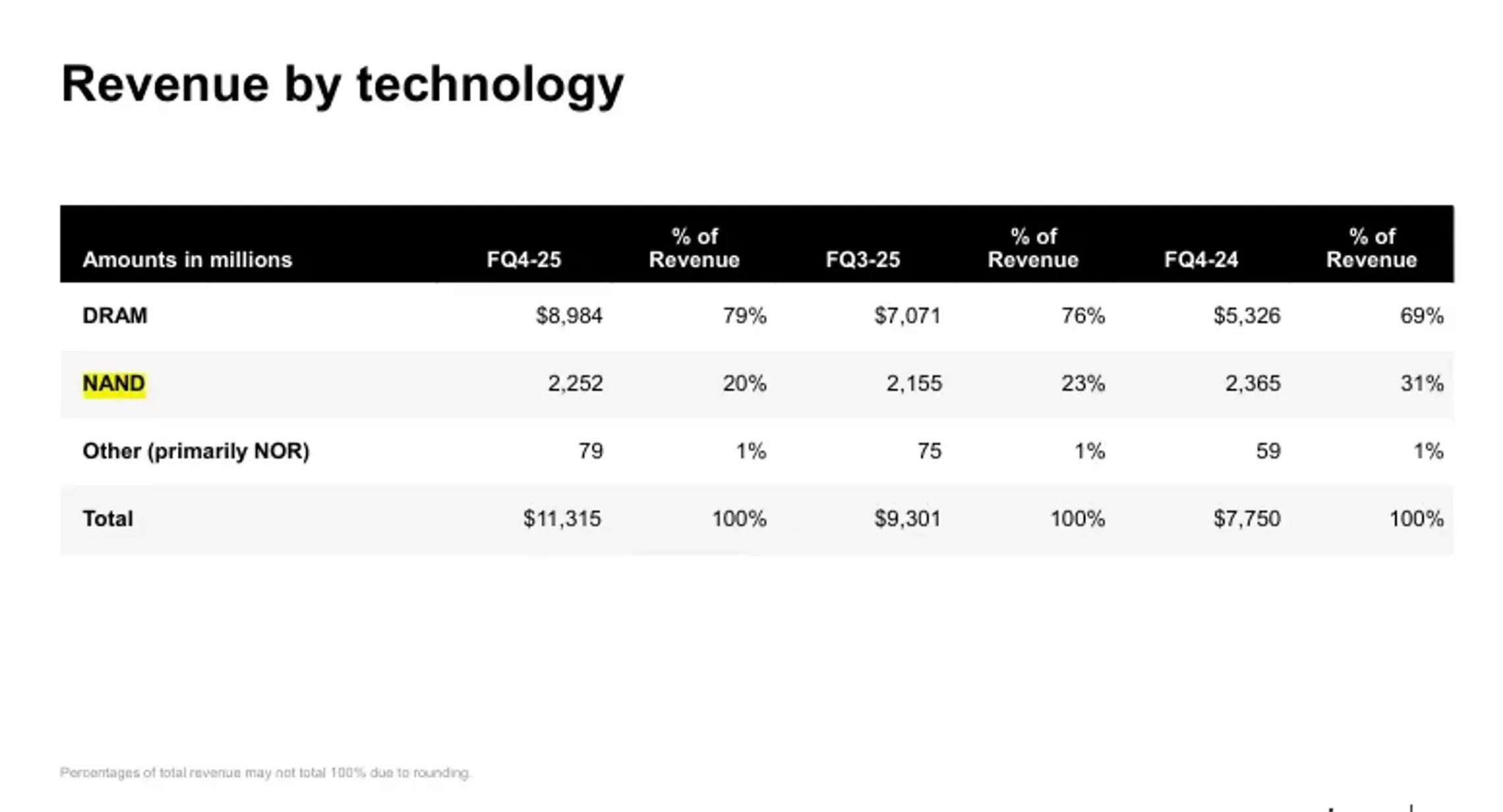

The driver is clear: high-bandwidth memory (HBM) demand from Nvidia and other AI chip players. DRAM revenue grew 69% YoY, HBM specifically is nearing a $2B quarterly run rate. Six firms raised price targets right after the report - Rosenblatt even slapped a $250 PT (stock sits around $165 now).

Insider/political angle

CEO Mehrotra’s commentary was also bullish:

Trillions will be invested into AI infrastructure over the coming years, and as the only U.S. memory manufacturer, Micron gets a privileged spot in that capital cycle.

But it’s not all perfect. Couple of things to keep in mind:

- Core data center unit sales actually dropped 22% YoY to $1.57B. That’s odd considering all the noise around AI servers.

- NAND (20% of their business) is basically flat and could remain a drag.

MU still lags SK Hynix in HBM share, so they’re not the undisputed leader yet.

Technical view

Also, the stock has nearly doubled in 2025 already. Even if fundamentals are improving, some of the AI premium might already be priced in. No surprise shares popped after hours, then faded slightly this morning as traders took profits.

Nevertheless, the stock price looks quite positive. We’ve already broken through the 52-week high, and nothing is holding the stock back from further growth. Moreover, three support levels, including the major one around $110–111, provide good opportunities to add to the position.

My take

I’m bullish long-term. The AI wave isn’t a one-quarter story - we’re looking at a multiyear demand cycle where DRAM/HBM are the bottlenecks. Micron has visibility, strong pricing power, and U.S. government backing (CHIPS Act funding for new fabs in Idaho).

Short-term though, I wouldn’t be shocked by volatility. MU has a history of “boom-and-bust” cycles, and after a 100% run this year, any hiccup in guidance or AI momentum could cause a sharp pullback. For me, dips are buys - but chasing here at $165 feels riskier unless you’re in it for 2026+ when HBM4/4E ramps.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.