Micron (MU) Stock Analysis: Earnings Strength, Growing Risks, and a Crucial Technical Zone

Micron just posted one of its strongest quarters in history - but if you look beyond the headlines, there’s a much more nuanced story.

Micron just delivered one of the strongest quarters in its history — and on paper, it looks like a no-brainer bullish setup. But when I step back and look at where we are in the broader cycle, the price action, and where investor expectations are heading, I think there’s more nuance to the story.

Here’s how I see it right now — fundamentally, technically, and emotionally.

Q3 FY25 Earnings: Exceptional Numbers, Clear Narrative

Micron’s Q3 results crushed expectations:

- Revenue: $9.30 billion (up 37% YoY and 15% sequentially)

- Adjusted EPS: $1.91 (vs. ~$1.60 expected)

- Gross margin: 39%

- Free cash flow: $1.95 billion

- Data center sales: More than doubled YoY

They also raised Q4 guidance:

- Revenue: $10.7B ± $300M

- Non-GAAP EPS: $2.50 ± $0.15

- Gross margin: Expected to expand to ~42%

The story here is all about AI. High-bandwidth memory (HBM) demand is ramping hard. DRAM revenue is surging. Micron is finally gaining pricing power again — and that’s something we haven’t seen in this space for a long time.

Stock Reaction After Earnings

The stock was already hot going into earnings — MU had rallied over 25% in the month leading up to the Q3 report. A lot of that was driven by broader AI hype and sympathy moves with Nvidia.

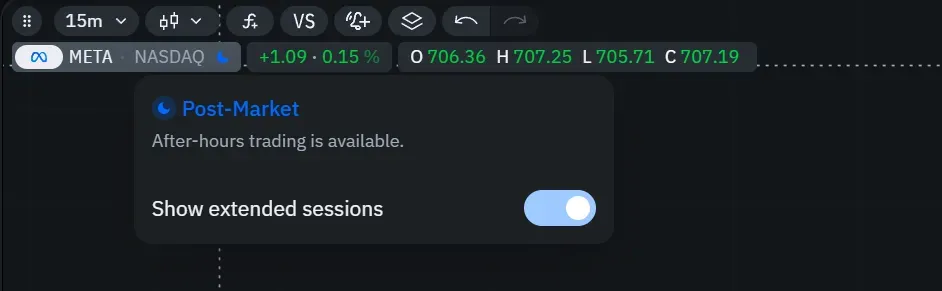

On the day of the announcement (June 26), Micron initially popped in after-hours trading, jumping nearly 8% as the headline numbers beat expectations across the board. But that spike didn’t hold.

The next regular trading session saw a gap up, followed by a fade, and the stock ended the day slightly red. That kind of price action isn’t unusual when a stock runs hard into earnings — it reflects “sell the news” behavior, even when the fundamentals are strong.

In the days that followed, MU continued to pull back slightly, consolidating in the $120–125 range. This doesn’t signal a breakdown — but it does show that expectations were high and that the market is digesting whether there’s more upside immediately or if we need to cool off.

My Take: Cautiously Bullish, But Not Complacent

The stock has doubled in the last six months — that’s not normal for Micron. It’s not that the rally isn’t justified, but it does raise questions.

PE came down to 25×… forward PE of 16×. Data center revenue up 400% YoY. This is still a buy. Micron’s capex is heavy but justified if HBM demand sustains. You’re not overpaying for this kind of growth. But a lot of optimism is already priced in — and the risk is that any stumble, even a small one, could trigger a harsh pullback.

But a lot of optimism is already priced in — and the risk is that any stumble, even a small one, could trigger a harsh pullback.

That said, I’m not bearish. I think the fundamentals are absolutely there — especially if AI infrastructure demand stays hot and DRAM/HBM supply remains tight. But this doesn’t feel like the right time to go all-in. It feels like rotating into AMD is better for more balanced exposure.

Technical Setup: Nearing the Top of a Bull Channel

Micron has been trading in a rising channel for years, and it’s still respecting that structure almost perfectly.

Highlights:

- Support trendline: Price bounced cleanly off ~$60-70 in late 2023 — that zone now acts as critical support.

- Resistance trendline: Sits around $125–145. Latest rally into this zone ended in rejection (fake breakout).

- Current price: Hovering mid-channel around $125 — not ideal for fresh entries.

If the stock breaks above $138-140 with volume, it could target $160-170. But from a probability standpoint, I’d rather wait for a retest of support around $90 to re-enter or add.

Final Thoughts

Micron is in a strong spot — no doubt. Earnings momentum is real, guidance is accelerating, and the AI cycle has given memory stocks a rare chance to lead. But it’s also a name that’s deeply cyclical, has a habit of overshooting both ways, and is currently trading closer to technical resistance than support.

I’m holding my position, not adding aggressively here, but ready to buy more if we pull back toward that $90-100 zone. If we break out above $145 and confirm, I’ll reevaluate — but I’m not chasing.