Microsoft Q4 FY2025 earnings - why I am adding to my position despite being "overvalued"

This AI transformation is just getting started

As someone who's held MSFT for the past 3 years and watched it become my biggest position, these Q4 FY2025 results just reinforced why I think we're witnessing something truly historic. The stock jumped more than 9% after hours, and for good reason.

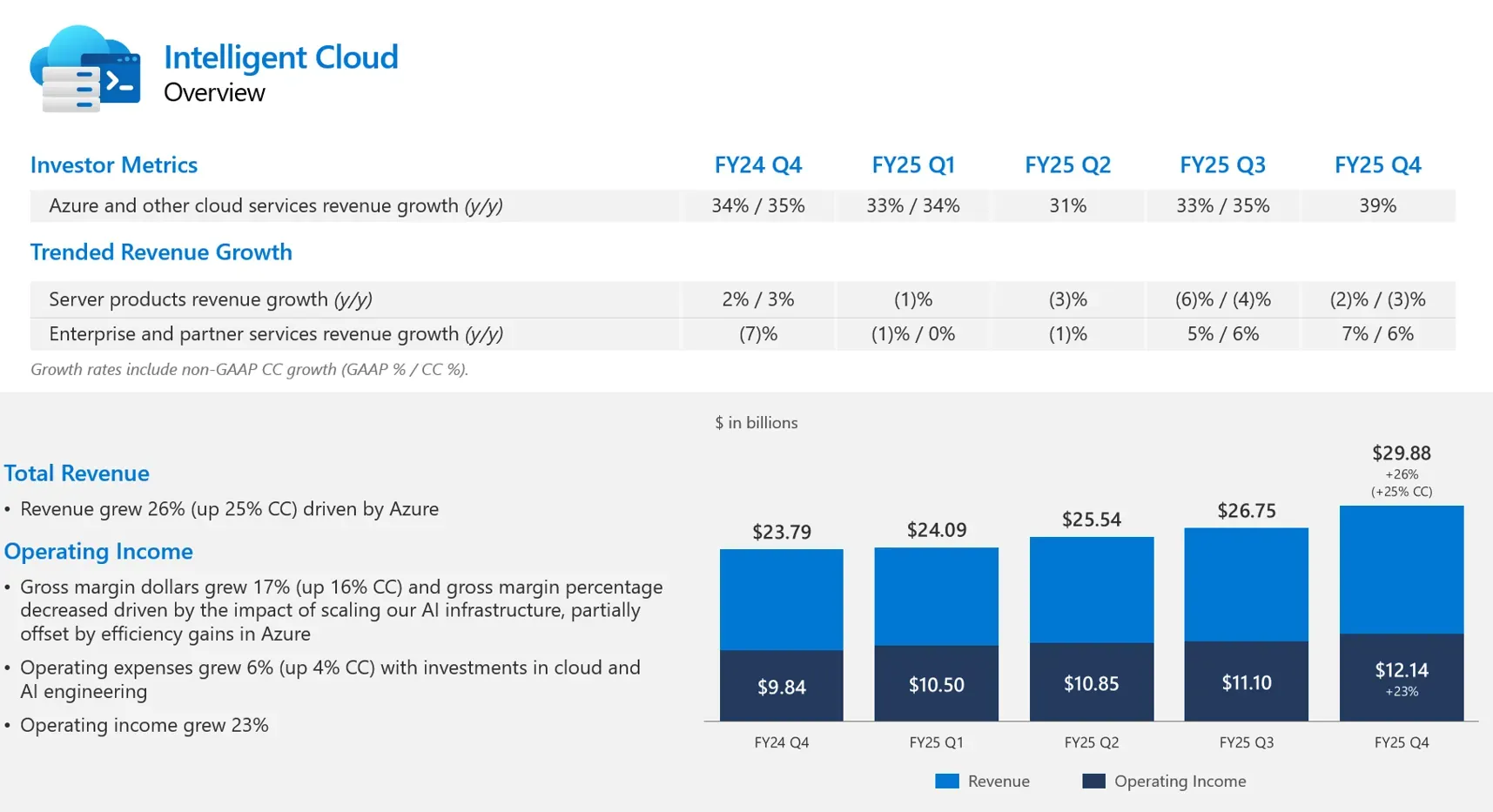

Azure hit $75 billion in annual revenue (disclosed for the first time), grew 39% in Q4, and Microsoft's AI business is now at a $13 billion run rate. This isn't just beating expectations - it's redefining what's possible.

Why I'm doubling down on MSFT: For the first time ever, Microsoft disclosed Azure's actual revenue in dollars - $75 billion annually, growing at 34% for the full year. While everyone debates whether AI is real, Microsoft just proved they're monetizing it at massive scale. The integrated platform strategy is working exactly as planned.

Key financial highlights that blew me away

Revenue performance - beats across the board

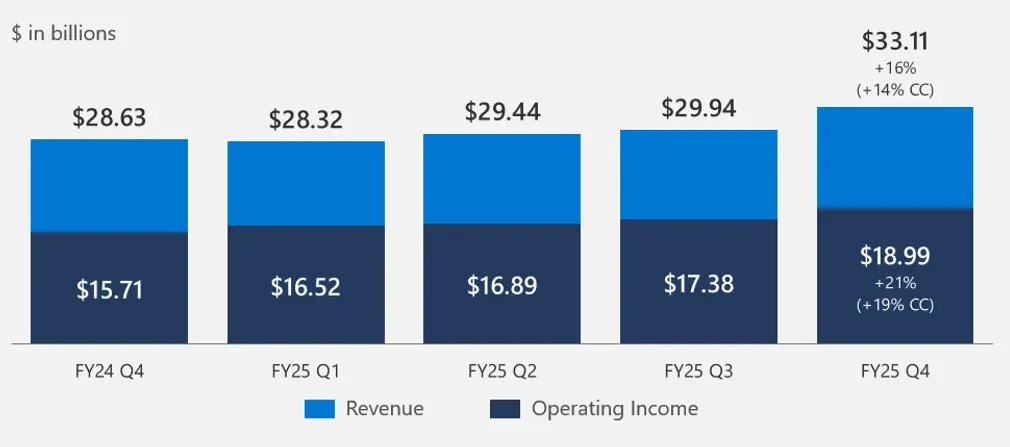

- Total revenue: $76.44 billion vs $73.81 billion expected (+18% YoY)

- Earnings per share: $3.65 vs $3.37 expected (massive beat)

- Net income: $27.23 billion vs $22.04 billion prior year

- Operating margin: Strong performance despite heavy AI investments

The Azure revelation - finally showing their cards

- Azure annual revenue: $75+ billion disclosed for first time, up 34% for FY2025

- Q4 Azure growth: 39% vs analyst expectations of 34-35%

- Intelligent Cloud segment: $29.88 billion vs $28.92 billion consensus

- Microsoft Cloud revenue: Strong momentum continuing

AI business momentum is undeniable

- AI business: Multi-billion dollar run rate with triple-digit growth

- Copilot adoption: 230,000+ organizations now using Microsoft's AI tools

- Enterprise momentum: 90% of Fortune 500 companies engaged with Copilot

Why this validates my thesis completely

The AI monetization is happening at scale

While competitors are still figuring out pricing models, Microsoft is generating massive AI revenue right now. The Azure growth being driven significantly by AI workloads shows this isn't experimental spending - it's production deployments.

My view: This quarter proved that enterprise AI adoption isn't a question of "if" but "how fast." Microsoft is capturing the majority of that growth.

The competitive moat is actually widening

Microsoft's integrated approach continues to differentiate:

- Azure provides the AI infrastructure foundation

- Office 365 Copilot embeds AI into daily workflows

- GitHub Copilot dominates the developer experience

- The OpenAI partnership delivers cutting-edge models

Personal perspective: Once enterprises start using Copilot across their workflows, the switching costs become enormous. This is platform lock-in at its finest.

What makes me want to add more shares immediately

1. The $75 billion Azure disclosure changes everything

Finally having concrete numbers on Azure's scale ($75B annually) puts the growth story in perspective. This isn't a small cloud business anymore - it's one of the largest software businesses on the planet, still growing 30%+.

2. AI capacity constraints = good problem to have

Management mentioned ongoing AI capacity constraints, meaning demand is outpacing their ability to build data centers. In a supply-constrained environment, pricing power typically follows.

3. Enterprise AI adoption is accelerating

230,000 organizations using Copilot products, including 90% of Fortune 500 companies, tells me this has moved from pilots to production at enterprise scale.

4. The financial model is beautiful

Massive recurring revenue base, expanding margins despite heavy investment, and strong cash generation. This is exactly how you want to see a platform business scale.

My investment thesis - why i'm buying more aggressively

The bull case is stronger than ever

- Market leadership in AI infrastructure: Azure is becoming the backbone of the AI economy

- Platform effects are accelerating: The more AI workloads run on Microsoft's stack, the stickier customers become

- Multiple expansion opportunities: Early innings in Copilot monetization across the enterprise

- Proven execution: Management continues to deliver on ambitious growth targets

What could still change my mind

- OpenAI relationship deteriorates (still my biggest concern)

- Competitors significantly close the gap in integrated AI offerings

- Enterprise AI spending slows dramatically due to macro conditions

- Regulatory intervention in big tech AI dominance

My current thinking

This earnings report eliminated most of my remaining doubts about Microsoft's AI strategy. The $75 billion Azure disclosure, 39% Q4 growth, and broad-based AI adoption across enterprise customers validates everything I've been betting on.

Bottom line: This feels like one of those rare moments where a great company reports transformational results and the market appropriately rewards it.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.