Netflix: Why I’m watching this dip in NFLX

Miss, Tax hit, and What the chart says now

I’m watching Netflix because a clean "beat-beat-raise" streak snapped: Q3 missed on revenue and EPS, the stock dropped ~10%, and now the bull case has to clear valuation + margin questions after a Brazil tax hit.

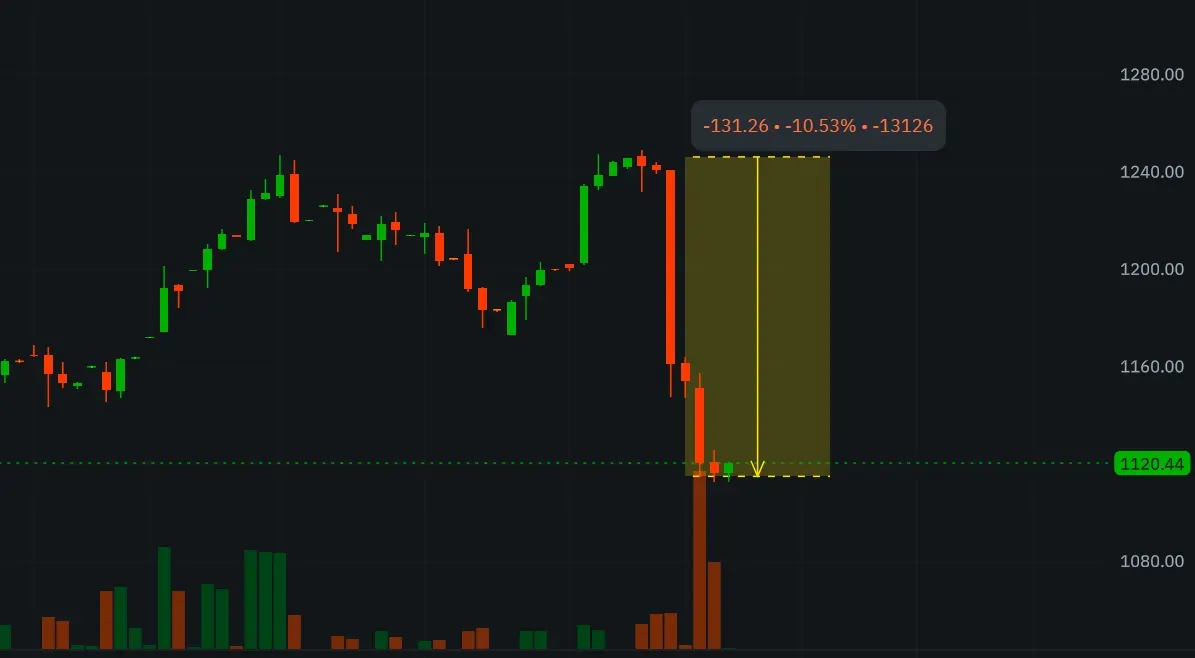

What the chart says (levels that matter)

We gapped down to ~$1,115, creating fresh resistance near $1,100–$1,115 (the gap/supply zone). First support sits around $1,080–$1,100 (late-summer base), with the 200-day MA further below. Momentum cracked (high volume, RSI slide). For me, longs get interesting only on a reclaim of the 20/50-day MAs or a higher low that holds above ~$1,080.

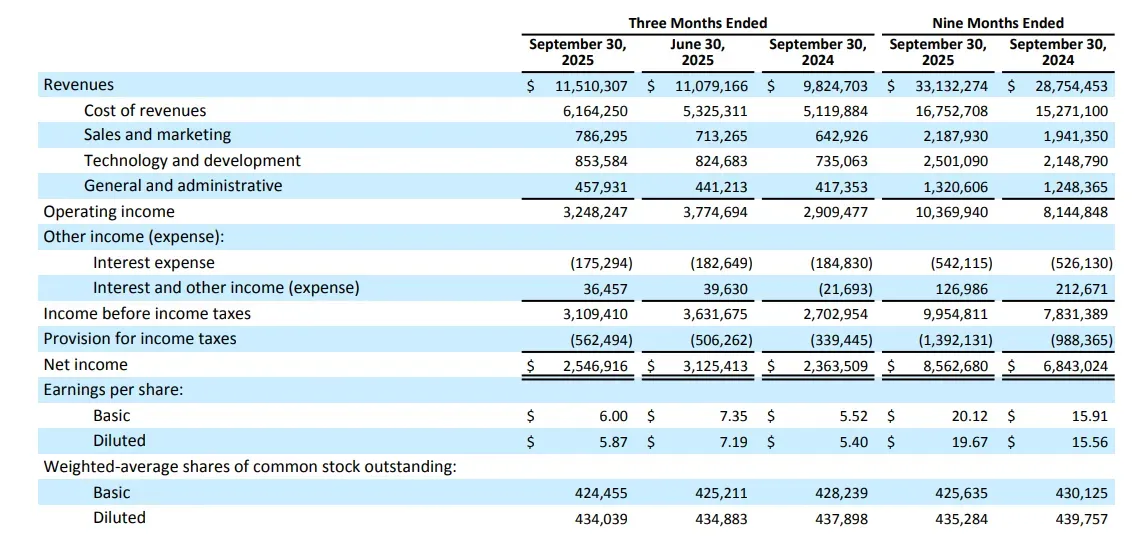

Print and guide (the quick read)

Revenue $11.51B (just under est.) and EPS $5.87 (below ~$6.9 est). Operating margin was 28% vs. 31.5% guided due to the Brazil tax dispute charge; ex-charge, they say they’d have beaten margin. Q4 guide: revenue $11.96B, EPS $5.45—both a hair above Street. FY25 revenue outlook $45.1B (upper end prior range), but FY25 margin trimmed to 29% (from 30%).

Ads, slate, and pipes (what still works)

Engagement looks healthy; slate delivered (Canelo vs. Crawford, “KPop Demon Hunters”), and the ad tier is scaling from a small base - helped by the Amazon DSP integration for better buying and measurement. Peer price hikes support NFLX’s pricing power, and year-end tentpoles (e.g., “Stranger Things” final season) are real catalysts. The rub: no more subscriber prints, so valuation (~40–45x forward) leans on revenue/margin execution.

My stance and triggers

Conclusion: neutral, short-term cautious. I’ll respect the gap and broken short-term trend. I prefer:

- Buy strength: Reclaim/hold above ~$1,180–$1,200 (gap resistance) with 20/50-day MAs back under price.

- Buy weakness: Base above ~$1,080 with improving RSI/breadth.

Structurally I still like the multi-year mix (ads/live/global IP), and the tax issue looks like noise, but a slight margin step-down at a premium multiple keeps risk/reward balanced until price and margins re-prove themselves.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.