Nike (NYSE:NKE) Q1 FY2026 Earnings Breakdown: Mixed Signals Amid Margin Pressure

Strong top-line beat, but margin compression, earnings decline, and weak guidance keep sentiment cautious. Key technical levels will decide whether Nike finds its footing or continues sliding.

As someone who’s been analyzing markets and equities for the better part of a decade, I’ve come to appreciate that earnings reports are often as much about interpretation as they are about the numbers. In this quarter Nike delivered a mixed bag - a revenue beat that surprised many, but meaningful underlying margin and earnings concerns that shouldn’t be ignored. From the apparent beat to the guidance and structural DTC weakness, this report raises more questions than it answers - and for traders that creates opportunity on both sides.

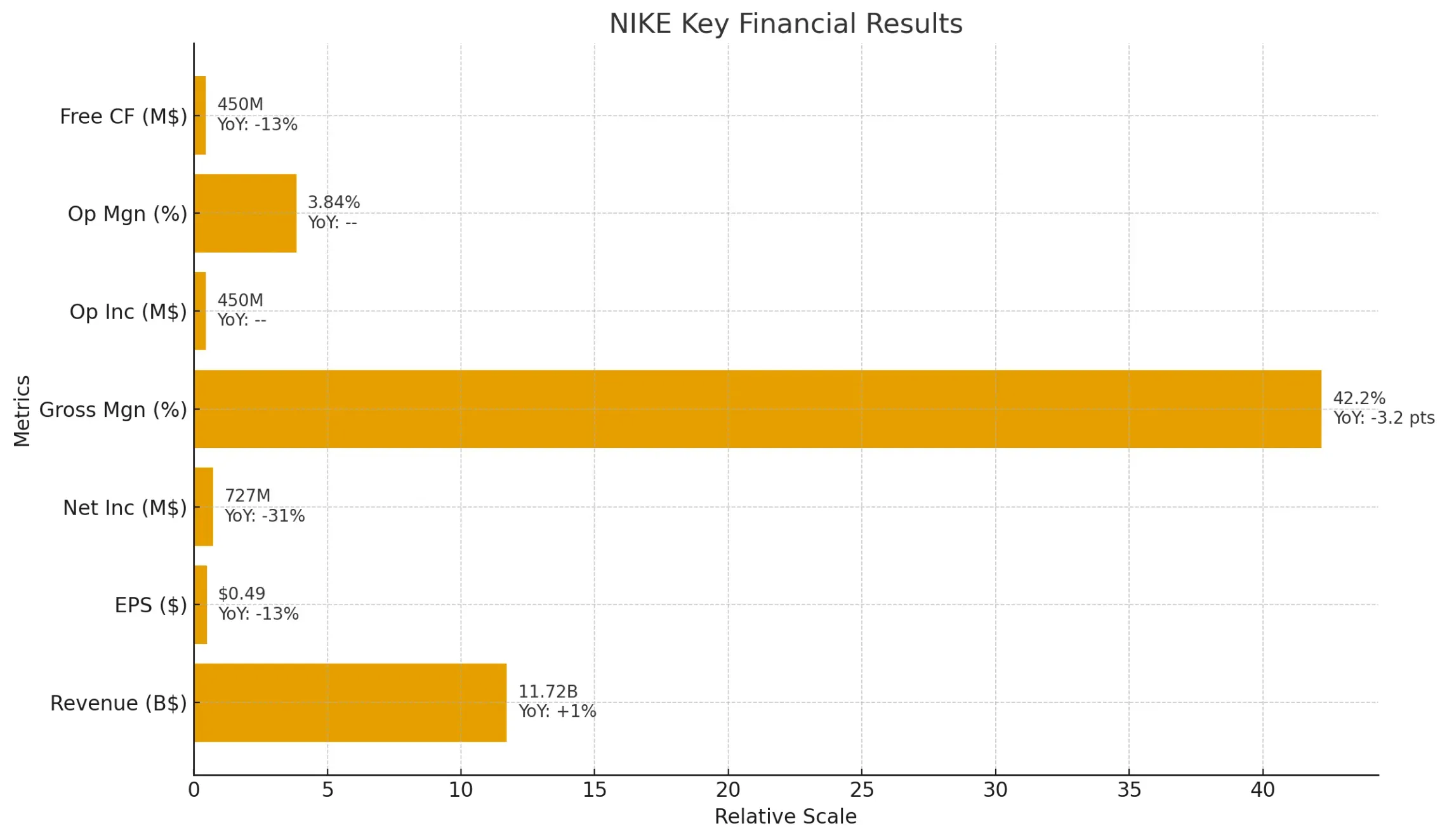

Earnings Highlights

- Revenue: $11.72 billion (vs. $11.0B consensus) - revenue surprised to the upside; +1% YoY.

- EPS: $0.49 (vs. $0.27 consensus) - beat but down ~13% YoY from $0.70.

- Net Income: $727 million (-31% YoY).

- Gross Margin: 42.2% (down ~320 bps YoY).

- Operating Income / Margin: $450 million; ~3.84% operating margin.

- Free Cash Flow: $450 million (-13% YoY).

Segment details:

- NIKE Direct: $4.7B (-13% YoY) - clear weakness in the DTC channel.

- Wholesale: $6.4B (-8% YoY) - more resilient than feared.

- Converse: $501M (-15% YoY).

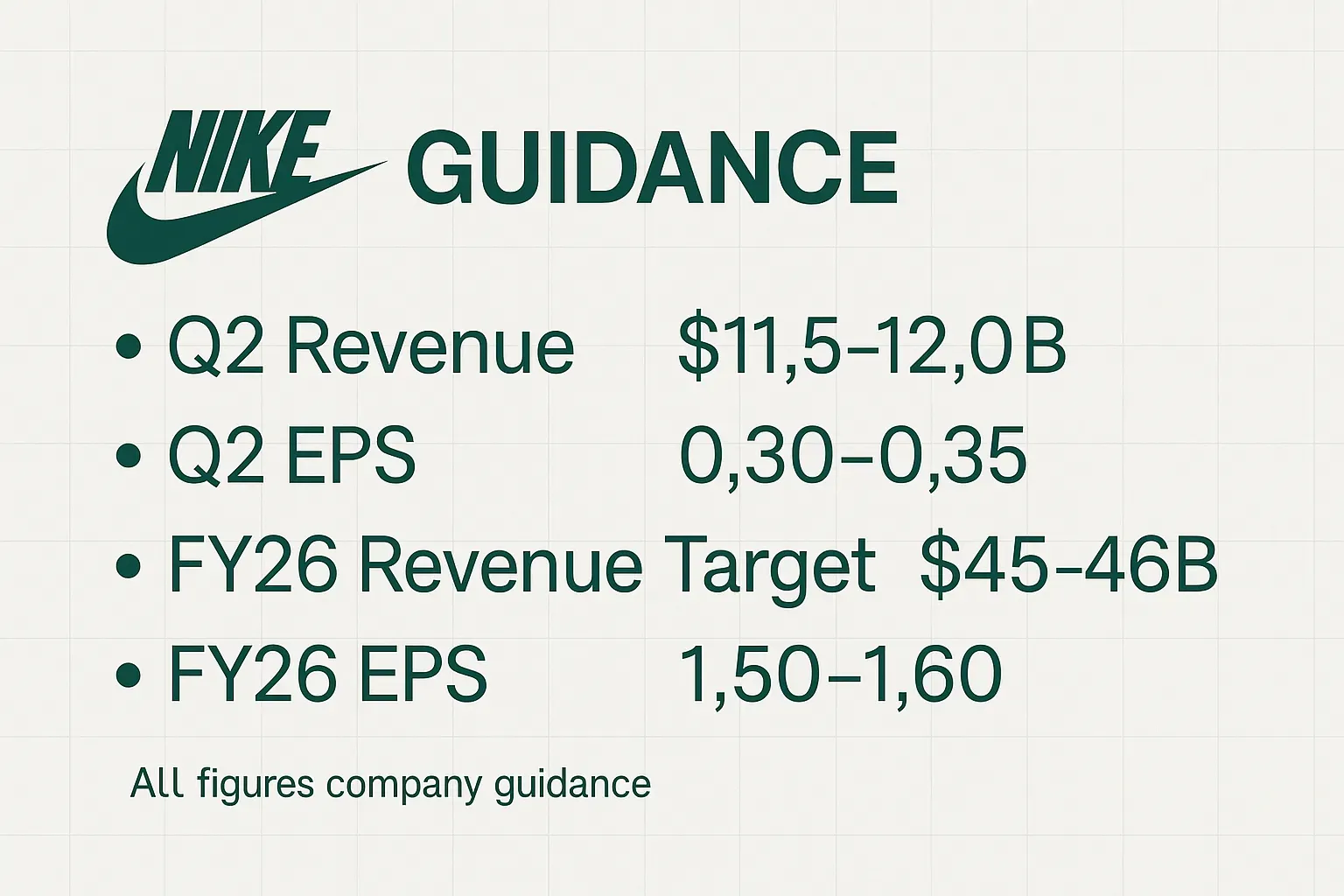

Guidance:

- Q2 revenue $11.5-12.0B

- Q2 EPS $0.30-$0.35

- FY26: revenue target $45-46B;

- EPS $1.50-1.60.

- Management says DTC growth unlikely until FY2026.

Financial Analysis

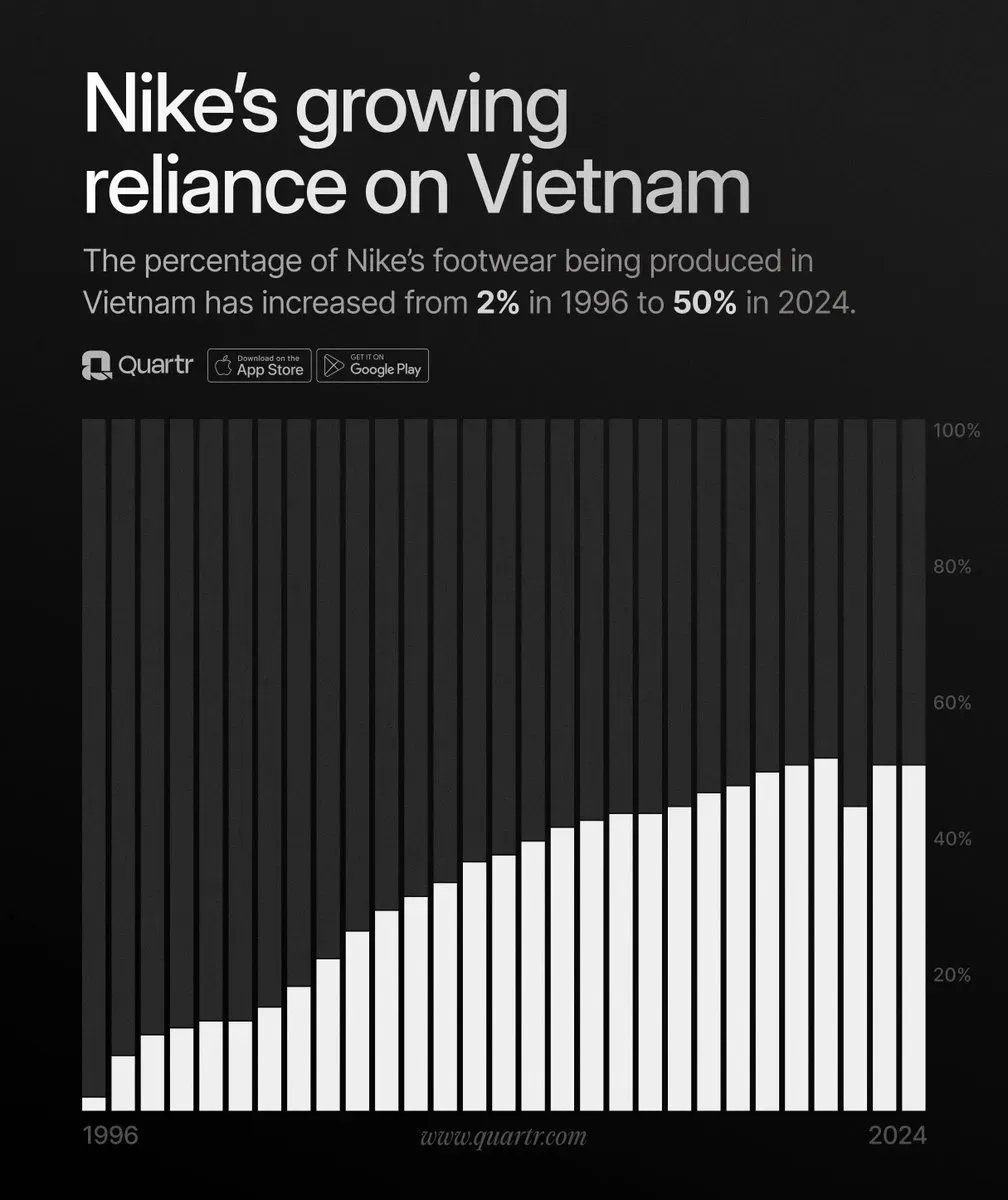

Nike surprised on the top line largely because expectations were depressed - wholesale held up better than feared while NIKE Direct fell 13%, highlighting structural weaknesses in digital execution and consumer engagement. The quarter’s standout negative is margin compression: gross margin down to 42.2%, hit by roughly $1.5B in tariffs on Vietnamese imports plus FX and cost pressures. Even before this print, the setup didn’t look attractive - and the stock price had already been telling that story. Now, rising costs tied to reducing dependence on Vietnam (supplier diversification, retooling, logistics rerouting) make the equity case even less compelling in the near term, adding more pressure on margins and sentiment.

Net income, operating income and free cash flow all declined ~13%, and operating margin around 3.8% is soft for a premium brand. The EPS beat versus lowered estimates doesn’t erase the fact that EPS fell materially versus last year - the divergence between top-line strength and bottom-line health is a red flag. CEO Elliott Hill’s commentary (and the callouts about DTC not rebounding until FY2026) suggests this is more than a cyclical lull - it’s a multi-year repositioning rather than a quick turnaround play.

This is more than a cyclical lull - it’s a multi-year repositioning rather than a quick turnaround play, - said Nike's CEO Elliott Hill

Technical Analysis Summary

Nike (NKE) remains in a multi-year downtrend, contained by a descending channel (yellow). Price is below the 200-week SMA (~99.4), confirming a long-term bearish bias, and is chopping just around/below the 50-week SMA (~70.8). The recent rebound stalled right at the upper channel boundary and horizontal supply near 80, where sellers previously stepped in.

Key levels:

- Resistance at ~73 (pivot/weekly close zone) and ~80 (supply + channel cap).

- A weekly close above 80 would break the channel and open room toward 90–100 (200-week SMA).

- Support sits first around the 70–71 band (50-week SMA) and more importantly ~57.5 (major demand shelf). Lose 70 and the path of least resistance retests 57–58; hold above 73 and bulls get a chance to squeeze toward 80.

Market Sentiment & Investor Psychology

Sentiment skews cautious to bearish. Dominant themes in the market chatter include: weak China demand, margin pressure from tariffs and FX, potential brand fatigue among younger consumers, and strategic uncertainty after leadership transition. Some traders are using options strategies like bull-put spreads around $70/$67, betting support holds, but outright directional bullish conviction is thin.

Notably, commentary from Germany (a key European market) is especially cautious - sources with local industry ties report lower consumer spend on premium footwear, a trend that could persist. While a few voices push “buy the dip” based on lowered expectations, most experienced traders are in wait-and-see mode.

Analyst Verdict

- Rating: Hold (with a bearish tilt)

- Watch / Triggers: margin stabilization (~+100 bps would matter), China stabilization, or a technical breakout above $80 with volume.

- Key zones: $65-68 = tactical accumulation area for long-term believers; below $65 = material downside and a reason to reassess valuation with a bearish bias. If Nike breaks convincingly above the 200-SMA and $80 on strong volume, then a swing trade toward $80-85 becomes reasonable.

Bottom line: This is not a stock to chase on oversold bounces. For disciplined traders, the opportunity exists - but only after clearer signs of margin recovery or durable technical strength.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.