Nvidia just crushed earnings - here's why I'm loading up

The AI king delivers again and the bears got it wrong

Nvidia just dropped earnings that absolutely destroyed expectations, and I'm seeing a massive opportunity here. The stock popped 6% after hours, but honestly, that's just the beginning of what I think is coming.

The numbers that made my jaw drop

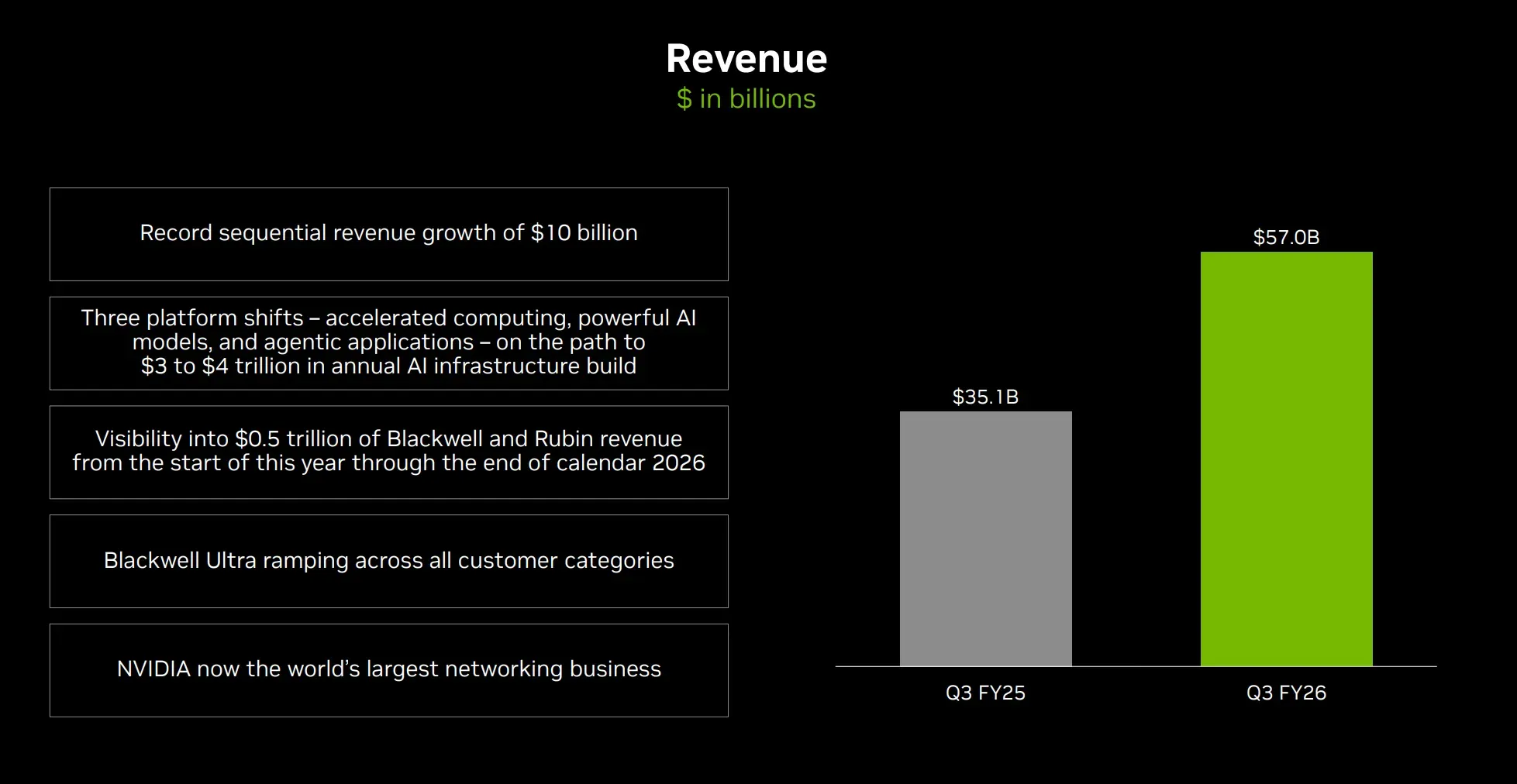

I've been trading tech earnings for years, and these numbers are absolutely insane. Revenue came in at $57.01 billion versus the $54.92 billion analysts expected. But here's what really got me excited - they're guiding for $65 billion next quarter when the Street was only expecting $61.66 billion.

That's not just a beat, that's a statement. Net income surged 65% to $31.91 billion. When a company this size is still growing profits at that rate, you pay attention.

The technical setup looks explosive

Looking at the charts, we've had some consolidation over the past month with the stock pulling back about 10% from its peak. That's healthy action after the monster run we've seen. The after-hours move is pushing us right back toward resistance, and with numbers like these, I'm expecting a clean breakout.

The key level I'm watching is the previous all-time high. If we clear that with volume (and with these earnings, we should), the next target becomes a measured move that could take us 15-20% higher from here.

The fundamentals tell the real story

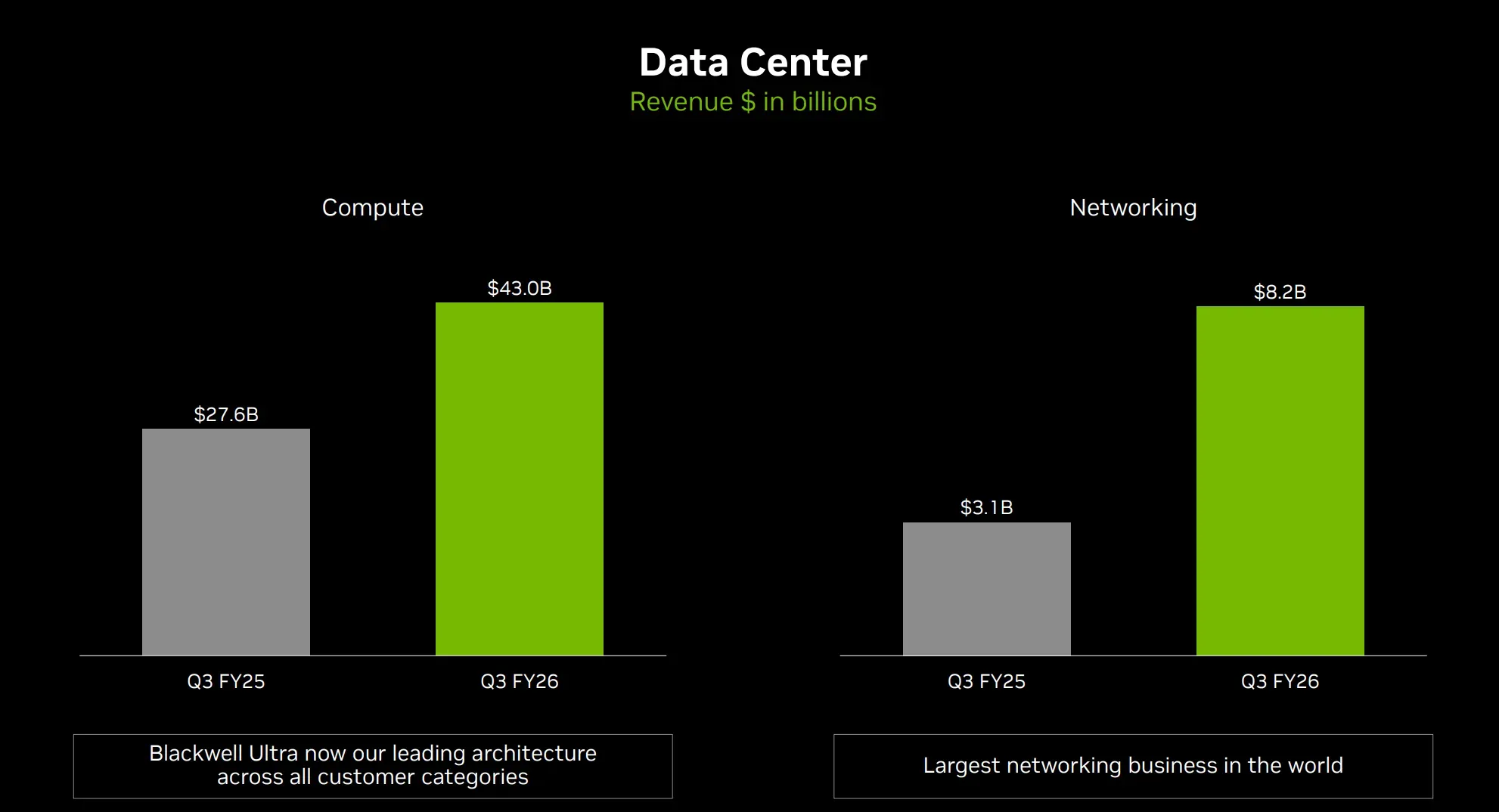

Here's what the bears are missing - data center revenue hit $51.2 billion, crushing the $49.09 billion estimate. Of that, $43 billion was pure GPU compute revenue. Jensen Huang said Blackwell sales are "off the charts" and cloud GPUs are completely sold out.

The company has $500 billion in orders for 2025 and 2026 combined. Think about that - they've already got nearly half a trillion dollars of revenue locked in. And Colette Kress said that number will grow.

Why the AI bubble narrative is dead wrong

I keep hearing about an "AI bubble" and honestly, it's laughable. Microsoft, Meta, Amazon, and Alphabet are collectively spending over $380 billion this year on AI infrastructure. These aren't speculative startups burning VC money - these are the most profitable companies on Earth reinvesting their cash flows.

Jensen Huang addressed this directly: "There's been a lot of talk about an AI bubble. From our vantage point, we see something very different." The man has visibility into every major tech company's AI plans. When he says the party's just getting started, I listen.

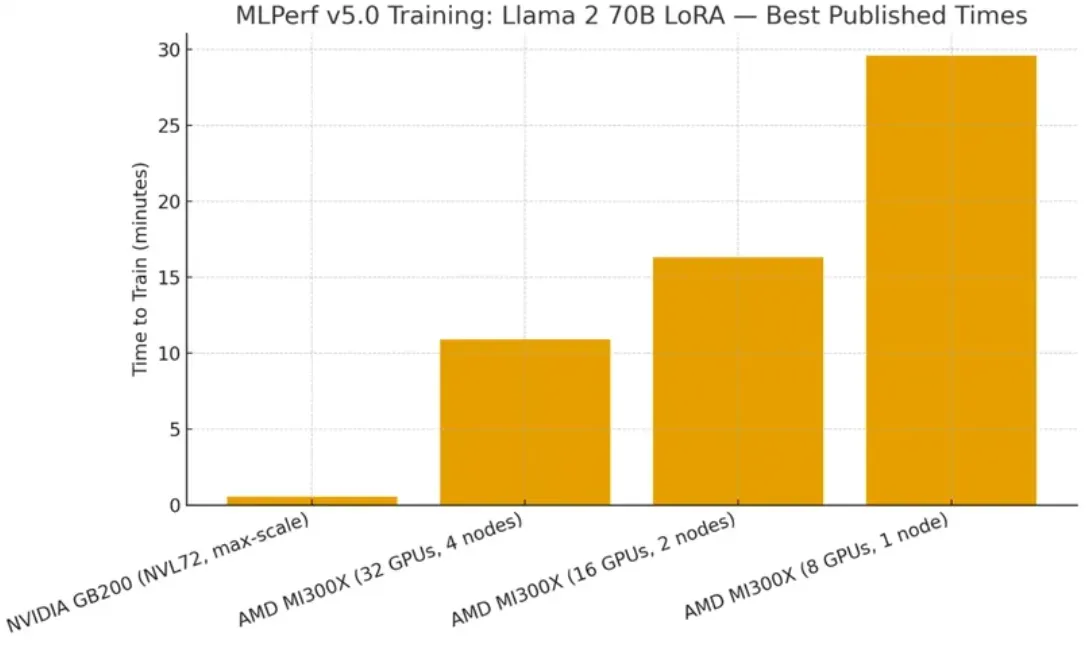

The competition doesn't exist

Here's the brutal truth - Nvidia has no real competition in AI training chips. AMD is years behind, Intel is a joke in this space, and the hyperscalers' custom chips can't match Nvidia's ecosystem. The company "excels at every phase of AI from pre-training to post-training to inference."

Even with China restrictions hurting them (only $50 million in H20 chip sales), they're still crushing numbers. That tells you how strong demand is everywhere else.

My trading plan

I'm going full bull mode here. This is one of those moments where the fundamentals, technicals, and market dynamics all align perfectly.

My entry strategy:

- Primary entry: Any dip toward $140-145 (if we get it)

- Secondary entry: Breakout above previous highs with volume

- Position size: Going heavy - this is a core holding

Price targets:

- First target: $165 (previous high retest)

- Second target: $185 (measured move from breakout)

- Long-term target: $200+ by Q1 2026

Stop loss: Below $135 (only if fundamentals change)

The bottom line

I've seen a lot of earnings reports, and this is as good as it gets. Revenue growth of 62%, profit growth of 65%, and forward guidance that destroys expectations. The AI revolution isn't slowing down - it's accelerating.

The shorts like Michael Burry who bet against this are getting absolutely torched.

The market was worried about peak AI, and Nvidia just showed them we're nowhere close. With $500 billion in forward orders and every hyperscaler throwing money at them, this train isn't stopping.

I'm backing up the truck here. When you see a company dominating the most important technology trend of our generation with no real competition and accelerating growth, you don't overthink it. You buy, you hold, and you get rich.

This isn't financial advice, but I'm putting my money where my mouth is. Nvidia isn't just winning the AI race - they've already won it. Everyone else is just fighting for second place.