OKLO hype or real growth?

Why I’m still cautious on the nuclear darling?

I’m watching Oklo (OKLO) closely right now because the stock has been on a wild run - up over 1200% in the past year and spiking nearly 20% on both the Tennessee fuel recycling news and the U.S.- U.K. $350B tech/nuclear partnership headlines. The market clearly loves the story, but I want to break down what’s real and what’s just momentum.

From a technical view, the stock has blown past key resistance levels after the Tennessee announcement. Momentum indicators show extreme overbought conditions, and while breakouts can extend, parabolic moves often retrace hard. I see the next support zone around 58-60 if sentiment cools, with resistance now shifting into the low 40s.

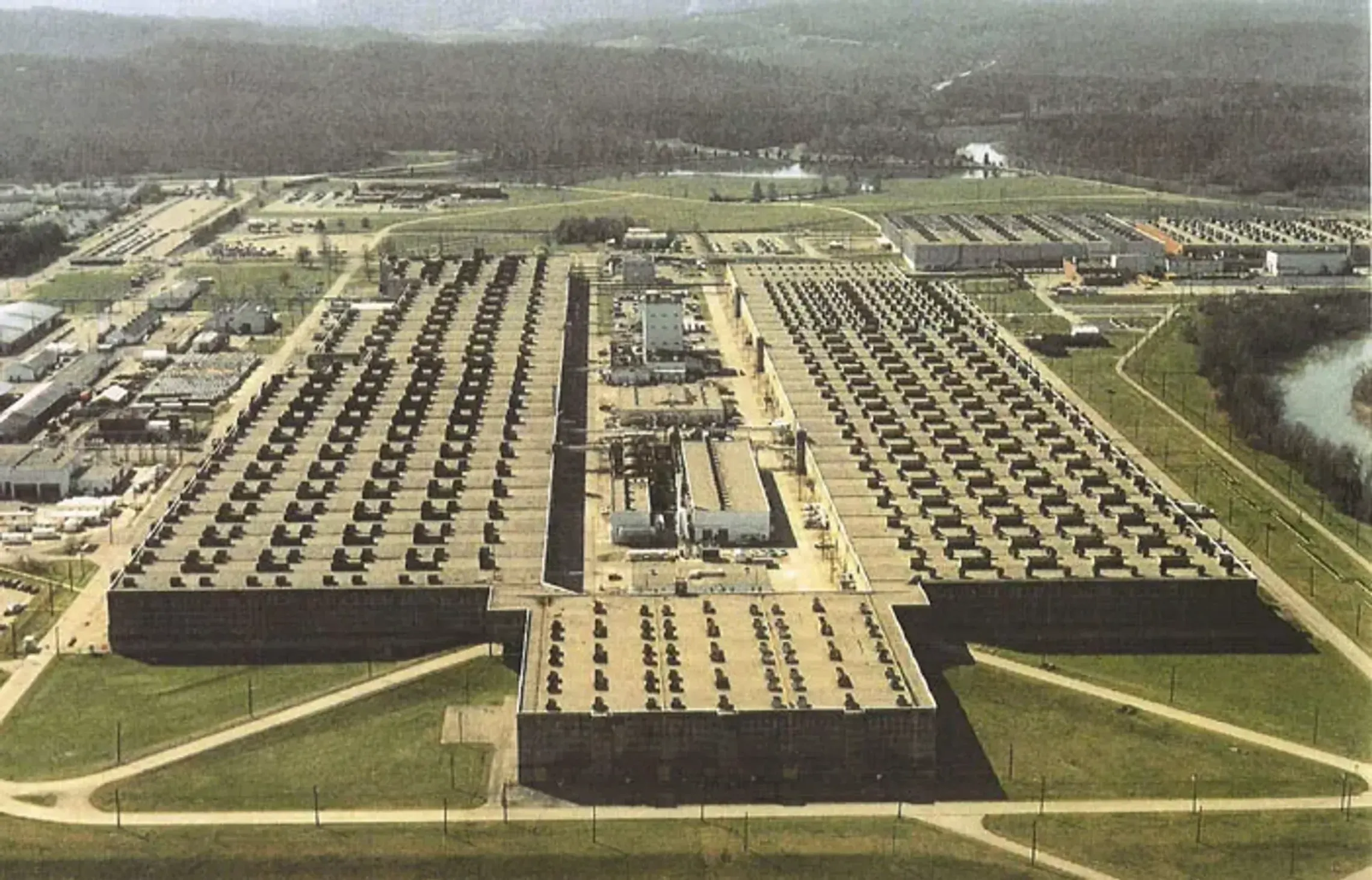

Fundamentally, OKLO is all about potential. The $1.68B Oak Ridge project is a first-of-its-kind recycling facility, which plays into the AI/data center energy demand narrative.

The company also talks up a 14 GW pipeline worth ~$5B annual revenues by 2028. Add partnerships with Liberty Energy, Vertiv, and Korea Hydro, and the vision sounds compelling. But here’s the reality: no commercial reactors until 2027-28, the recycling facility not until early 2030s, and cash burn of $65-80M per year. That means more dilution, as we saw with the $440M equity raise in June.

The insider angle? Despite the big headlines, OKLO wasn’t directly named in the U.S.-U.K. nuclear deals - most of the money is going elsewhere. What they do get is access to HALEU fuel, but commercialization is still years away. Regulatory risk also hangs over them, with the NRC having already rejected an earlier filing in 2022.

Bottom line: I’m neutral here. I see the promise - small modular reactors + AI-driven energy demand is a huge macro trend, and OKLO sits right at that intersection. But with no revenue, stretched valuation (P/B ~16), and years of uncertainty ahead, I can’t call it bullish beyond short-term momentum trades. For long-term holds, I’d rather look at proven nuclear operators like Constellation or even NuScale, which at least have regulatory traction.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.