Palantir Technologies Inc (NASDAQ: PLTR) - Earnings & Sentiment Outlook, August 2025

By a financial analyst and full-time trader - sharing my personal take after watching this develop closely over the past quarter.

As someone who’s tracked Palantir closely since its direct listing, I found this quarter’s report fascinating - not because the numbers were surprising, but because it reaffirmed several essential truths about investing in premium-growth names with packed expectations.

Earnings Highlights

Q2 2025 Key Numbers:

- Revenue: $937 million (↑44% YoY), beating consensus (~$928M)

- EPS (GAAP): $0.10 per share (↑67% YoY)

- Net Income: $210 million (↑48% YoY)

- Operating Margin: 36%

- Free Cash Flow Margin: Exceeded 40%

- Cash Reserves: $4 billion

- Guidance (Q3): Revenue projected at $995M–$1.01B

- FY2025 Update: Raised full-year revenue guidance to $3.85B–$3.9B, previously $3.8B

Palantir achieved a new quarterly revenue record - just shy of that psychological $1 billion mark. The company continues to leverage both the AI hype and real traction with its AIP (Artificial Intelligence Platform), especially in federal and defense contracts.

Financial Analysis

Top-Line Strength

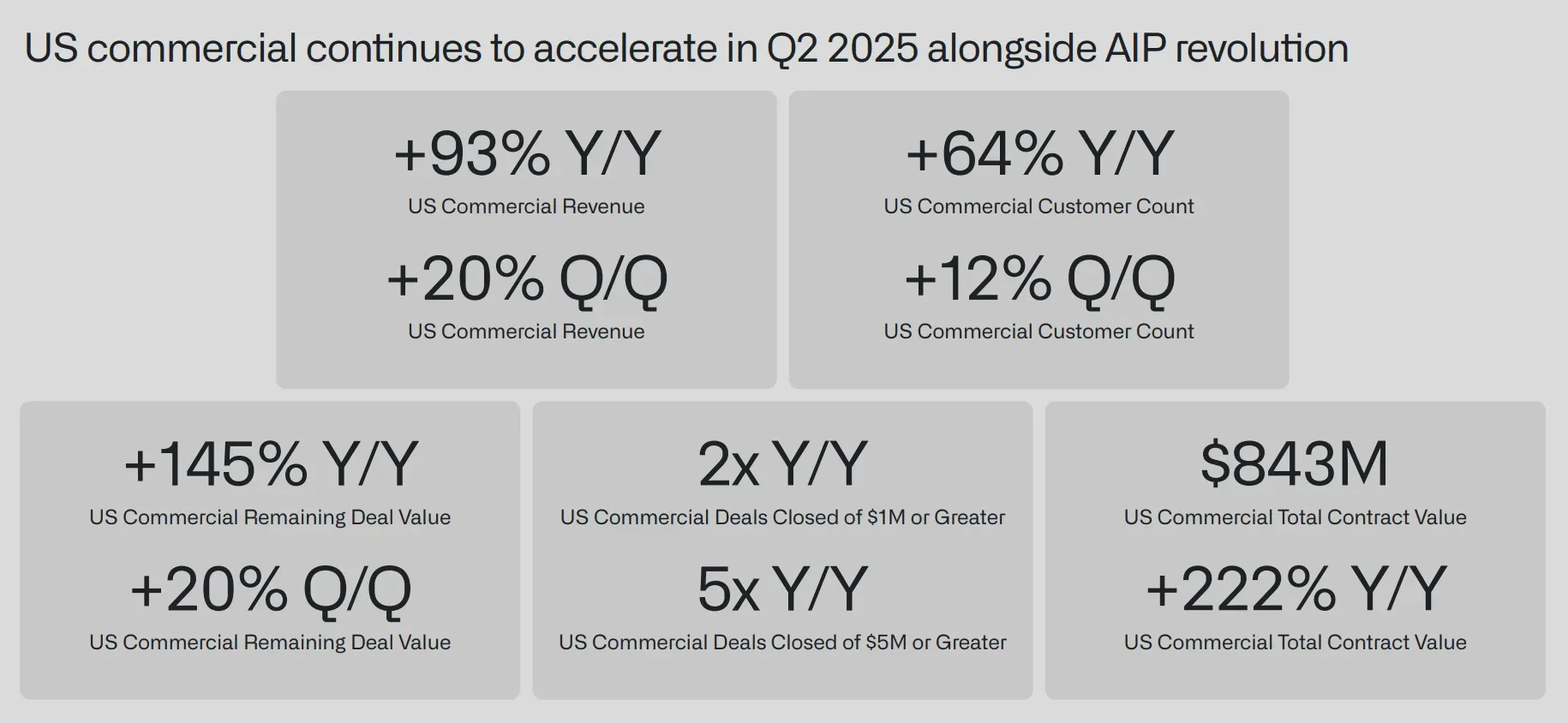

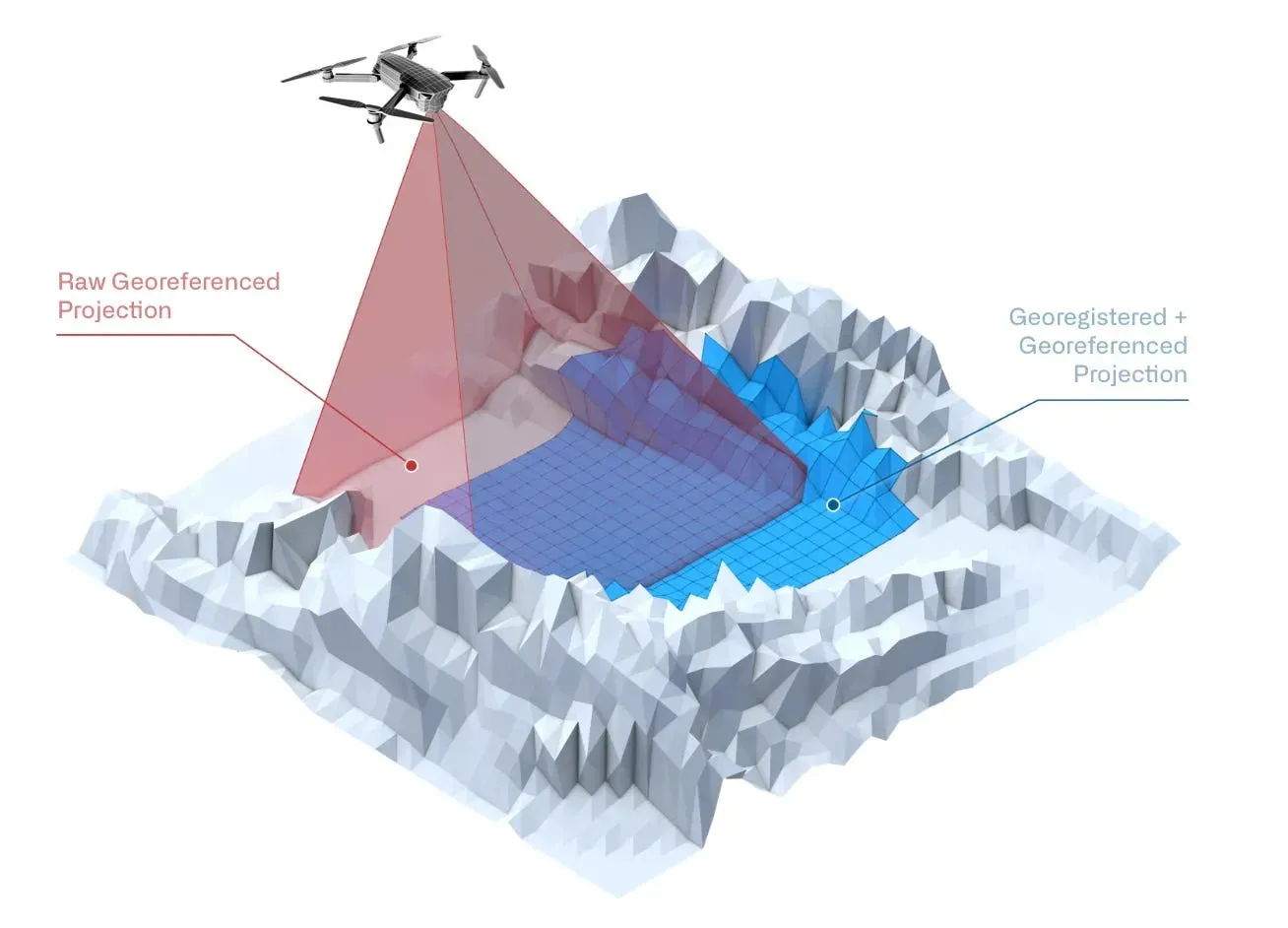

Revenue growth again came in hot - up 44% YoY, led by U.S. Commercial growth (+93% YoY). The company is converting well on its bootcamp-to-client model, onboarding new clients and expanding existing engagements. One big win this quarter was the scale-up of Project Maven and broader battlefield AI systems, highlighting their role in modern defense tech infrastructure.

Margins & Cash Flow

Palantir is impressively capital-efficient. Operating margins continue to expand, now at 36%, with free cash flow surpassing $375 million this quarter. It’s shutting down arguments it can’t be both growth-centric and profitable. That said, absolute EPS remains slim - just $0.10 - which draws skepticism considering the $380B market cap.

Strategic Narrative

Investments in AI infrastructure are panning out, and the integration with partners like Accenture and Azure strengthens the moat. But let’s be blunt: valuation multiples like P/S of 90-120x and P/E of 200-230x are extremely rich, mirroring peak-tech sentiment of 2021. Curious to hear how $1bill in quarterly revenue = $380bill market cap. Feeling a bit like a bubble.

Technical Analysis Summary

From a purely chart-driven perspective, PLTR looks primed for a short-term retrace. We’ve seen a textbook rising wedge pattern play out over recent months, and volume declining into resistance on the weekly is a red flag.

Key Chart Levels:

- Immediate Resistance: $160, then $169

- Support Zones: $154 → $145 → $137

- Breakdown Watch: A close below $140 would expose the $128–132 zone quickly.

The rising wedge - particularly when paired with light volume and RSI divergence - is a classic bearish formation if not resolved by a fresh catalyst. We’re also seeing the stock float just above the short put strike from numerous neutral-to-bearish options setups, a strong signal that institutional traders are pricing in short-term weakness.

As I noted in my previous journal, the volume profile around $155 is soft, and sentiment shifts below $152.50 could open up real downside.

Now, I'm not forecasting a crash to sub-$80, but I do believe that $132–137 is a much more realistic re-entry point for adding long exposure.

My Verdict

Trimmed My Core Holding - Watching for Lower Entry

This is a Hold → Wait for Pullback situation in my book. I trimmed 40% of my core PLTR position post-earnings and am now holding with a neutral delta. I see a high probability of a dip below $145 in the coming weeks, potentially toward $132 before new institutional buyers step up.

Bullish Catalysts to Watch For:

- New federal & NATO contract upgrades

- Surprise uptick in commercial adoption or a mega AIP client announcement

- Broader AI policy/tax incentives

But in the absence of those, my stance is:

Good company. Great mission. Terrible price - for now.

If you’re long-term, don’t panic - but if you’re short-term swing trading, this setup looks heavy. I’ll personally reload around $132–135, with a reserve bid around $120 if it gets fast and ugly.

Stay nimble. Stay solvent.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.