Palo Alto Networks (PANW) Latest Earnings Take - August 2025

Palo Alto Networks delivered a strong set of results for its fiscal Q4 2025, clearly outpacing Wall Street’s expectations and offering upbeat guidance for the year ahead. The company’s ongoing momentum in next-generation security and cloud business was obvious, yet there were a few notable financial swings to watch.

Key Earnings Highlights

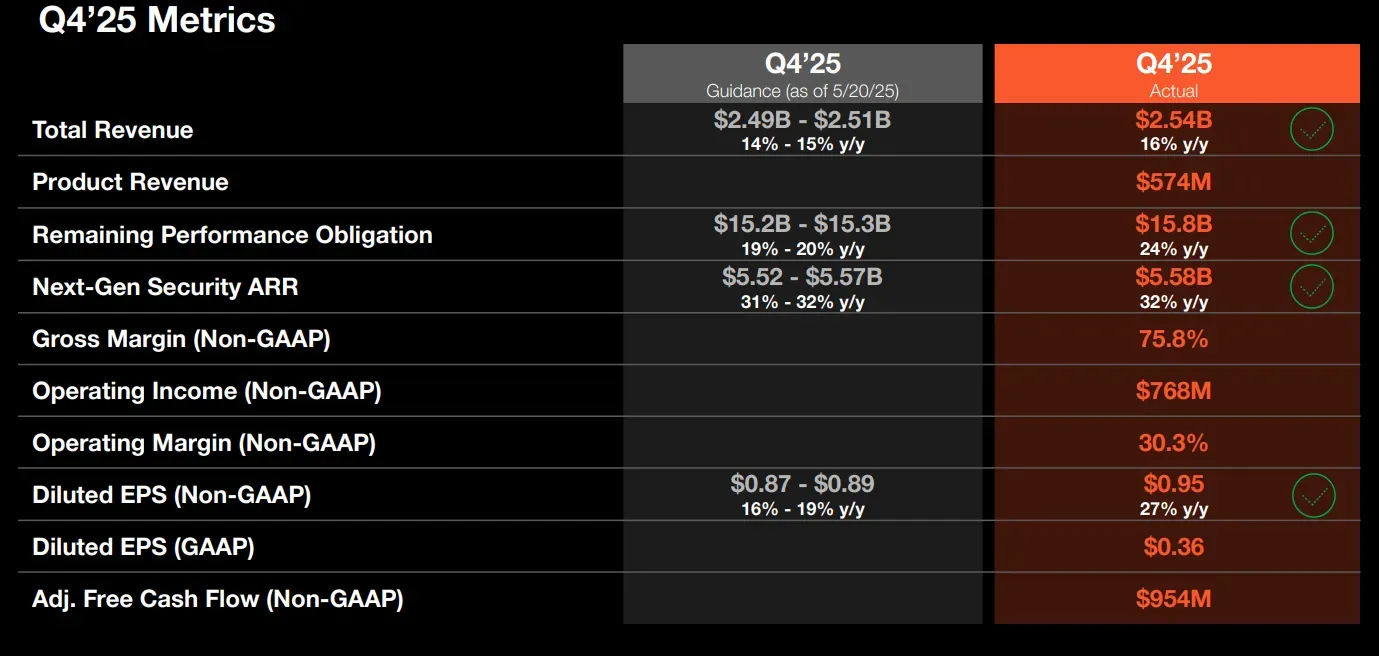

- Q4 Revenue: $2.54 billion, up 16% YoY, beating analyst estimates by about 1%.

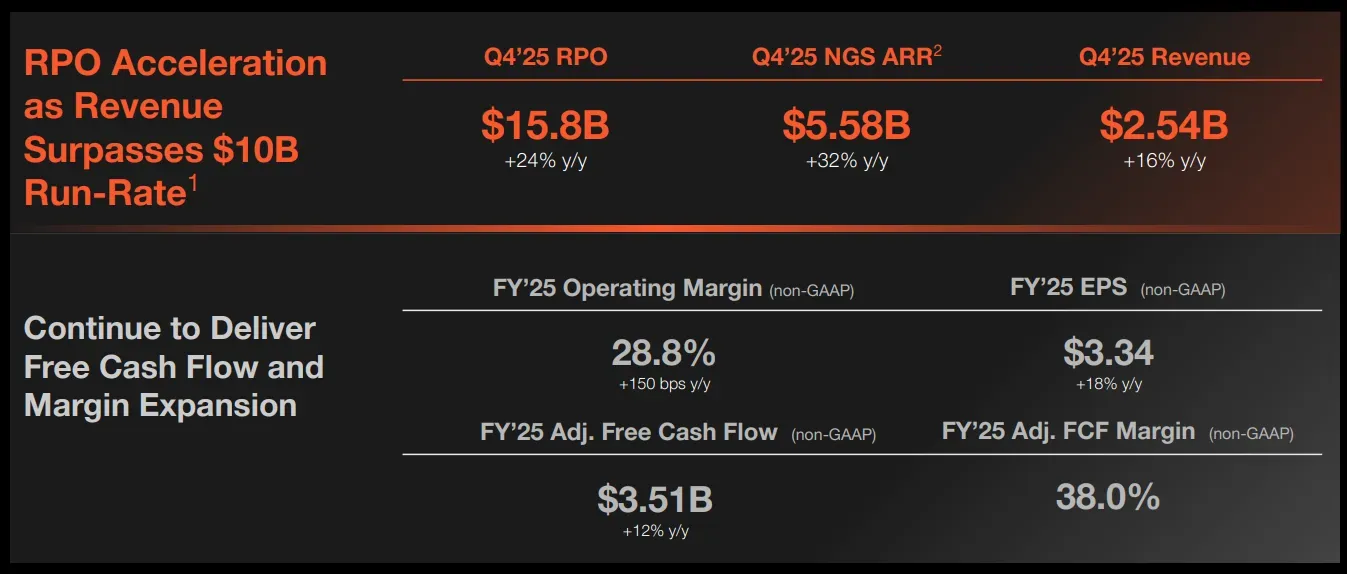

- Full Fiscal Year Revenue: $9.2 billion, registering 15% growth YoY.

- Adjusted EPS: $0.95 for Q4, a 27% increase, and considerably above analyst consensus.

- GAAP Net Income: $253.8 million, or $0.36 per share, down from $357.7 million a year earlier - highlighting increased costs or tax adjustments.

- Next-Gen Security ARR: Up 32% YoY to $5.6 billion, reinforcing their cloud transition success.

- Remaining Performance Obligation: $15.8 billion, up 24% YoY.

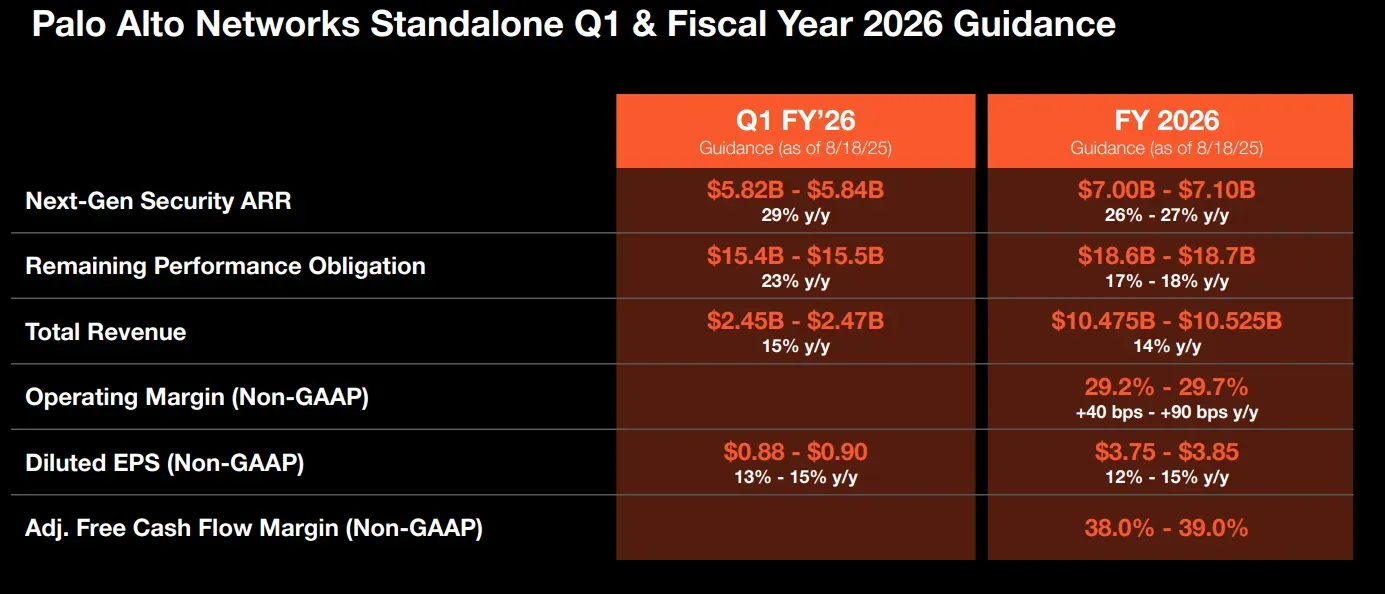

- Full-Year Guidance: Projected revenue range of $10.48-$10.53 billion and adjusted EPS of $3.75–$3.85, both ahead of consensus estimates.

My Take on the Results

Growth Engines Remain Strong

PANW’s recurring revenue from cloud and services (ARR) surged, reflecting deepening enterprise investment in cybersecurity and AI-driven risk defense. Their double-digit revenue growth streak continues - impressive at scale.

Profit Picture Mixed

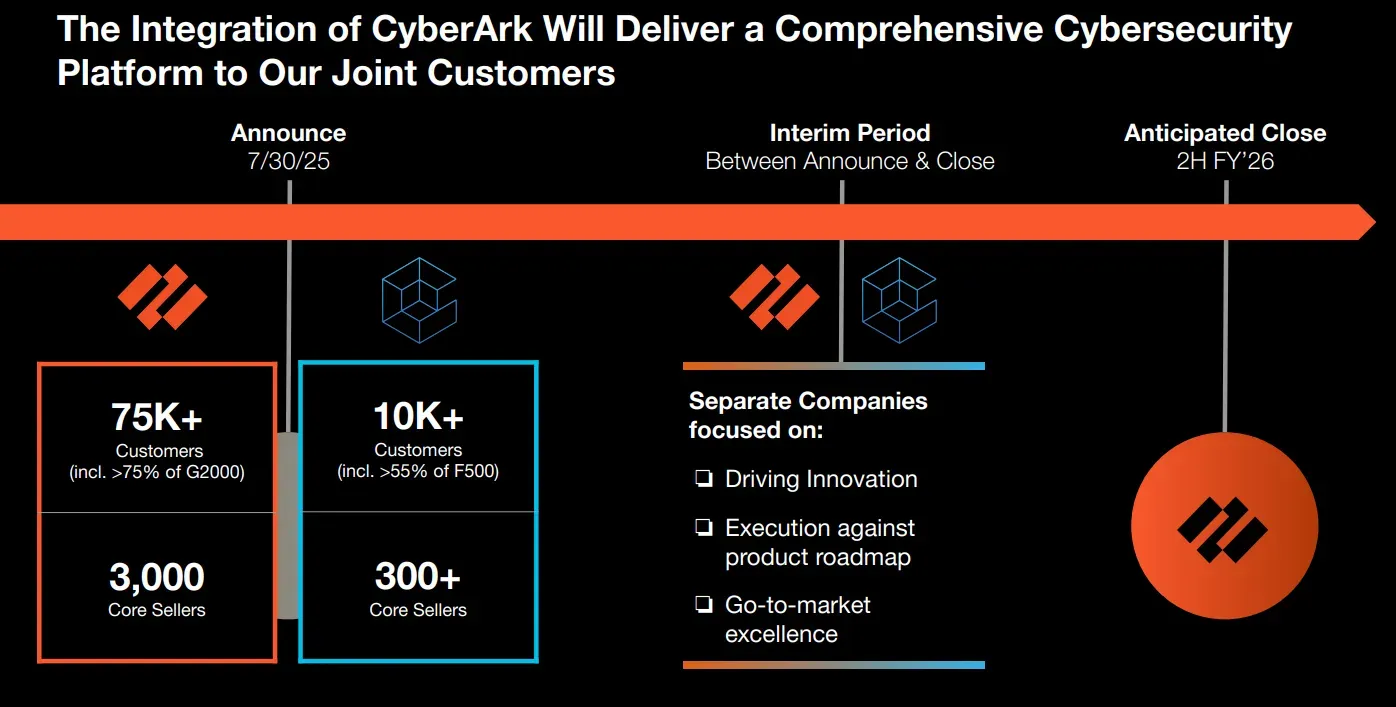

While non-GAAP/pro forma profits showed robust expansion, GAAP net income actually shrank (down 29%) - a sign that acquisition costs (notably CyberArk) and higher investments are impacting margins. This is a yellow flag for investors who prioritize bottom-line profitability and cash conversion.

Guidance Is Bold

Management is confident, setting guidance comfortably above Street forecasts and emphasizing upside from major customer contract backlogs and the adoption of AI-enabled defenses.

Stock Reaction

The market initially reacted positively, with shares climbing 5-6% in after-hours trading - a signal that investors were prioritizing long-term growth and scale over near-term earnings volatility. Yet, on July 30, 2025, the stock fell sharply following the announcement of a $25 billion acquisition of CyberArk. While the deal was framed as a strategic move to strengthen the company’s position in identity security and zero-trust cybersecurity, investors were unsettled by its scale and cost. The stock has yet to recover from that drop.

Technical picture: neutral-bearish

PANW remains weak after the sharp July 30 selloff, trading near $176 and well below its pre-drop $200 level. The gap down is still unfilled, showing investors haven’t regained confidence. Momentum remains bearish with the MACD negative, while RSI around 35 signals oversold conditions but no clear rebound yet. Key support sits at $165-170, with resistance at $185–190; until price reclaim that zone, the technical picture stays bearish-to-neutral.

Valuation: overvalued (like the whole market)

PANW’s P/E remains stretched (over 100x, per Zacks) versus the security industry average - investors are paying a premium for leadership and growth.

Strategic Moves

M&A Impact: The pricey CyberArk deal ($25 billion) created short-term uncertainty, but should broaden PANW’s solution set. Investors are watching closely to see how quickly the synergy value appears.

Leadership Changes: Founder Nir Zuk stepping down as CTO signals a transition, potentially bringing fresh vision but also some near-term cultural risk

Bottom Line

Palo Alto Networks looks well-positioned for further growth, but faces ongoing margin pressure and the challenge of integrating large acquisitions. The company is making all the right moves in next-gen security, and its guidance reflects strong confidence. Investors should enjoy the momentum but keep an eye on cost discipline and execution in the months ahead.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.