Robinhood just proved the bears wrong, and nobody cares

Record year, crypto getting crushed, stock down 50% from highs - and why I’m watching HOOD closer than ever

Robinhood just dropped Q4 2025 earnings after the bell and the stock immediately tanked another ~10% in after-hours.

This is now a stock that’s down roughly 50% from its October highs, down 27% year-to-date, and sitting at around $79.

The market’s reaction? Pure disappointment over a revenue miss. But if you look under the hood (pun intended), the story is way more nuanced than the headline suggests.

Here’s the thing - Robinhood just delivered a record year. $4.5 billion in revenue, up 52% year-over-year. Diluted EPS of $2.05 for the full year. $1.9 billion in net income. $68.1 billion in record net deposits. And the market sold it off because crypto revenue cratered in Q4. That’s the whole story in one sentence - and it’s exactly why this setup is interesting.

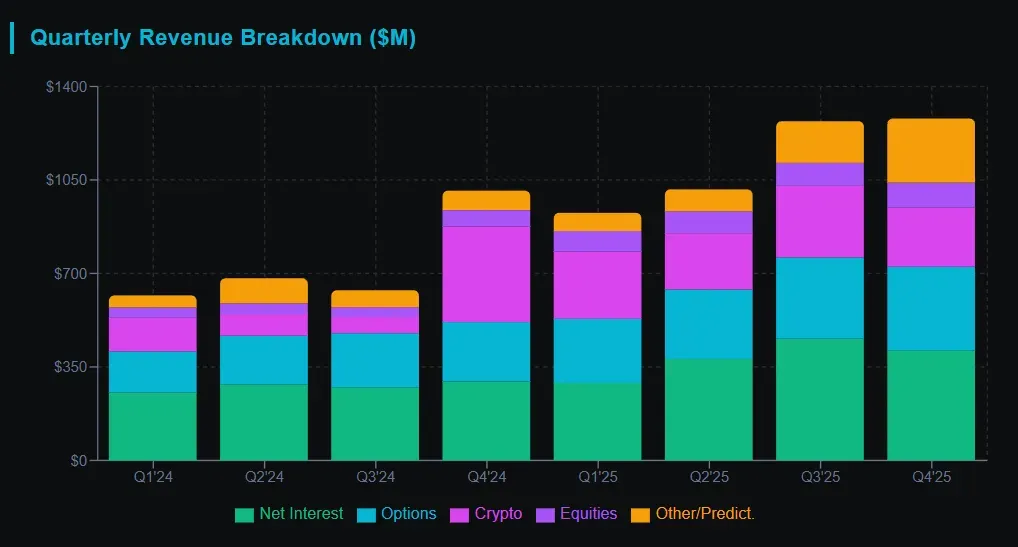

Q4 numbers breakdown

Let’s get into the actual numbers:

Q4 revenue came in at $1.28 billion, up 27% year-over-year but missing the Street’s $1.35 billion estimate. EPS hit $0.66, beating the $0.63 consensus. So a classic beat-and-miss quarter - bottom line solid, top line light.

Metric -- Q4 2025 -- Q4 2024 -- YoY Change

- Total Revenue: $1.28B -- $1.01B -- +27%

- Options Revenue: $314M -- $222M -- +41%

- Crypto Revenue: $221M -- $358M -- -38%

- Equities Revenue: $94M -- $61M -- +54%

- Other Transaction Rev: $147M -- $36M -- +308%

- Net Interest Rev: $411M -- $296M -- +39%

- Diluted EPS: $0.66 -- $1.01* -- -35%

- Adj. EBITDA: $761M -- $613M -- +24%

*Q4 2024 EPS included $0.47 one-time tax benefit and regulatory accrual reversal

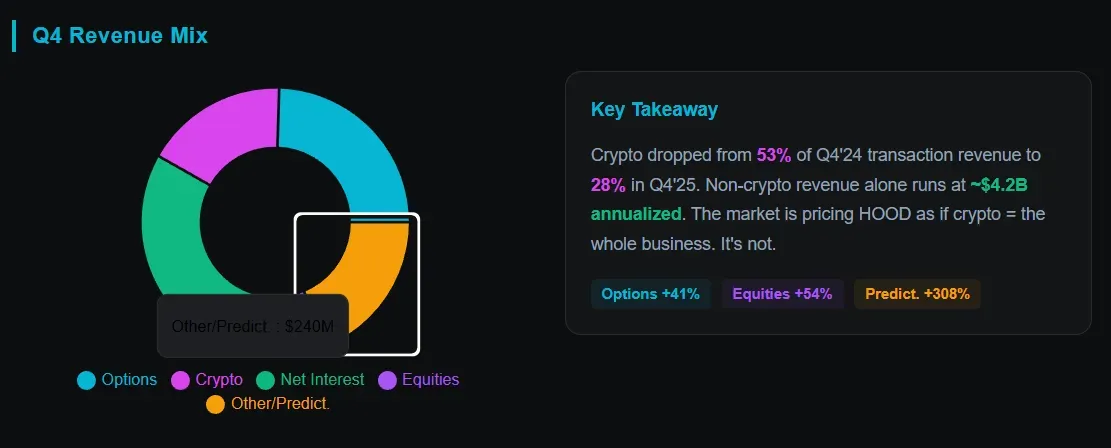

The revenue miss is almost entirely attributable to crypto. Crypto transaction revenue dropped 38% year-over-year to $221 million, well below even the reduced $259 million consensus.

Robinhood App crypto notional volumes were $34 billion, down 52% YoY. Meanwhile, everything else was firing - options up 41%, equities up 54%, and the “other” transaction category (primarily prediction markets) exploded 308% to $147 million.

The crypto problem - and why it matters less than you think

This is where the bear case gets interesting. Crypto was 28% of Q4 transaction revenue, down from 53% in Q4 2024. A year ago, Robinhood was essentially a crypto play dressed up as a brokerage. Crypto revenue was $358 million and everything else was secondary. Fast forward to today and the business looks fundamentally different.

In Q4 2025, options generated $314M, equities $94M, prediction markets and other revenue contributed $147M, and net interest income hit $411M. That’s over $1 billion in non-crypto revenue in a single quarter. The “Financial SuperApp” thesis Vlad Tenev keeps pushing? It’s actually showing up in the numbers.

Here’s what the Street is missing: even if crypto stays depressed through 2026, Robinhood’s non-crypto business alone is running at roughly $4.2 billion annualized. That’s almost the entire 2025 full-year revenue including crypto’s contribution. The diversification story isn’t just talk anymore.

Platform metrics that matter

Platform Metric -- Q4 2025 -- YoY Change

- Funded Customers: 27.0M -- +7%

- Investment Accounts: 28.4M -- +8%

- Total Platform Assets: $324B -- +68%

- Gold Subscribers: 4.2M -- +58%

- Gold Adoption Rate: 15%+ -- Up from 10%

- ARPU: $191 -- +16%

- Net Deposits (FY): $68.1B Record!

- Share Buybacks (Total): $910M, 22M shares

Gold subscribers hitting 4.2 million with a 15%+ adoption rate is a massive deal. This is recurring, high-margin revenue that has nothing to do with crypto or market conditions. Robinhood is locking in users with premium features, credit cards, retirement matching, and advisory services. This creates stickiness that the old Robinhood never had.

Net deposits of $68.1 billion for the year tell you customers are still moving money onto the platform even as crypto tanks. Platform assets at $324 billion, up 68% YoY. This isn’t a shrinking business - it’s a business where one revenue stream got hit while everything else accelerated.

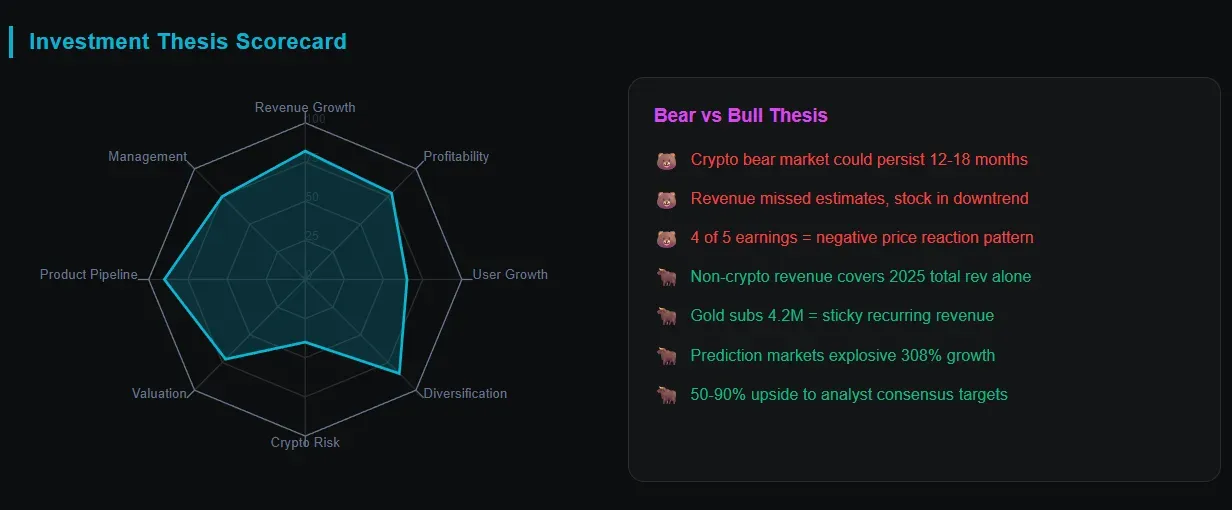

The crypto bear market stress test

Let’s model the worst case. In 2025, crypto contributed roughly $952 million to total revenue (based on quarterly crypto revenue figures). What if crypto revenue drops another 40-50% in 2026 due to a prolonged bear market?

Bear case crypto revenue 2026: $475-570M (down 40-50% from 2025)

Non-crypto revenue run rate: ~$4.2B+ annualized based on Q4

Total bear case 2026 revenue: ~$4.7-4.8B

Even in this scenario, Robinhood would still grow revenue versus 2025’s $4.5 billion, purely on the strength of options, equities, prediction markets, net interest income, and Gold subscriptions. The company guided 2026 adjusted operating expenses and SBC at $2.6-$2.725 billion, which means even in a crypto winter they’re looking at strong adjusted EBITDA margins.

The real question isn’t whether Robinhood survives a crypto bear market - it’s whether the market re-rates the stock when it realizes crypto is no longer the dominant revenue driver. At current levels around $79 with roughly $2.05 in trailing EPS, you’re looking at a ~38x trailing P/E. For a company growing revenue 27-52% with 11+ business lines generating $100M+ annualized revenue, that’s not exactly expensive - especially compared to where the stock traded 4 months ago.

Catalysts nobody’s talking about

Prediction Markets are the sleeper hit. Over 12 billion event contracts traded in 2025, and Robinhood established a joint venture (Rothera) with Susquehanna to deepen this business. “Other transaction revenue” went from $36M to $147M quarter-over-quarter largely on the back of this product. If prediction markets continue scaling, this could become a $500M+ annual revenue stream by late 2026.

Robinhood Cortex - their AI-powered investing assistant - is rolling out with custom indicators and scanners. Short selling launched in November and has already seen billions in notional volume. Banking is starting to roll out. The product cadence is relentless.

International expansion via Bitstamp (institutional crypto) and the Asia-Pacific push through Singapore adds optionality that’s not priced in at current levels. Trump accounts for millions of children? That’s a potential massive user funnel that hasn’t even been factored in yet.

Technical setup

Fibonacci levels are drawn from the swing low at $71.16 to the swing high at $151.16 (the Sep/Oct top):

Current price ~$85.64 is sitting in the red/pink demand zone between the 0 fib ($71.16) and the 0.236 ($90.07). This is the deepest retracement zone before a full round-trip to the swing low. The stock has essentially given back the entire move from June through October.

The 100 SMA at $87.33 has now rolled over and is declining - it was support through the entire rally and is now acting as overhead resistance. Price is trading below it, which confirms the bearish trend structurally. Any bounce attempt needs to reclaim this moving average first.

The descending channel is clearly visible from the October highs. The lower trendline appears to be pointing toward the $71-75 zone in the coming weeks if the downtrend persists. The upper channel boundary currently sits around $100-105.

RSI is deeply oversold - reading around 29-30 on the 14-period, well below the 30 oversold threshold. The RSI SMA (yellow line) at ~34.70 is also depressed. This is the most oversold HOOD has been since the early 2025 consolidation. Historically, RSI readings this low on HOOD have preceded at least a short-term bounce, though oversold can stay oversold in a strong downtrend.

The earnings sell-the-news pattern is well-established — 4 of the last 5 earnings reactions were negative with an average -4.27% move. This latest -7% reaction is worse than average but consistent with the pattern. Historically, these post-earnings dips have been buyable.

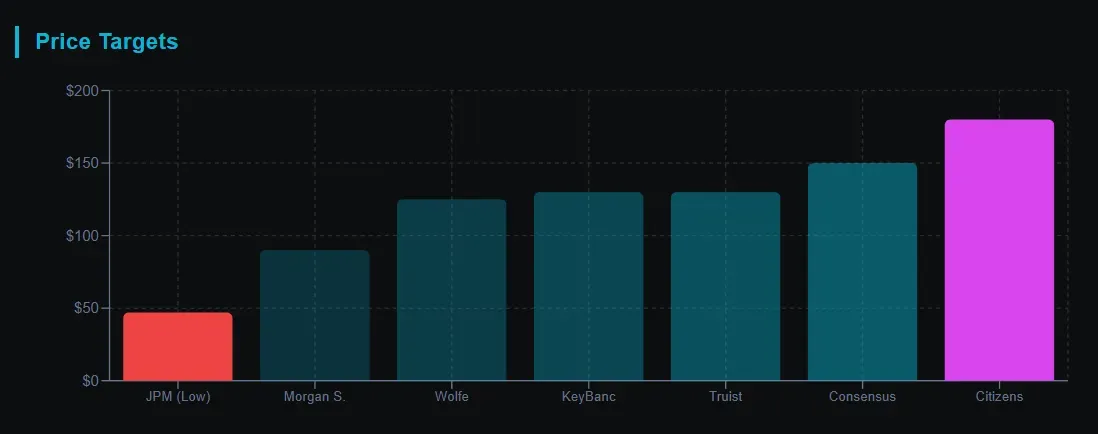

What the Street says

Despite the selloff, the analyst consensus remains Strong Buy with 19 Buy ratings, 4 Holds, and 2 Sells out of 25 analysts covering the stock. The consensus price target sits around $122-$150 depending on the source, implying 50-90% upside from current levels.

Highest target: $180 (Citizens — Devin Ryan)

Lowest target: $47 (JPMorgan — May 2025)

Recent updates: Truist $130, KeyBanc $130, Wolfe $125 (upgrade to Outperform)

The gap between the stock price and analyst targets has rarely been this wide. Either the analysts are wildly wrong, or the market is offering a significant discount based on temporary crypto headwinds.

Bottom line

Robinhood in 2026 is not Robinhood in 2021. The business has diversified dramatically, Gold subscribers are compounding, platform assets keep growing, and the product roadmap is stacked. Yes, crypto is getting crushed. Yes, the stock is in a downtrend. But the fundamental business is executing at a level that doesn’t match the price action.

The market is pricing HOOD like crypto is going to zero and staying there. If crypto even stabilizes — not recovers, just stabilizes - this stock has significant upside from current levels. And if you believe in a crypto recovery at any point in the next 12-18 months, HOOD at $79 could look like an absolute steal in hindsight.

Not financial advice. Do your own research. But I’m watching this one very closely.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.