SoFi Earnings: This Isn’t Just Growth, It’s Acceleration

SoFi (SOFI) just delivered a quarter that, in my view, can only be called a decisive leap forward. When a company posts record metrics across the board and raises full-year guidance at the same time - that deserves attention.

SoFi (SOFI) just delivered a quarter that, in my view, can only be called a decisive leap forward. When a company posts record metrics across the board and raises full-year guidance at the same time - that deserves attention.

However, following this initial rally, SoFi's stock took a hit later in after-hours trading due to the announcement of a $1.5 billion public stock offering, which raised concerns about dilution. This caused the stock price to drop about 6% after-hours.

Profitable for Seven Straight Quarters

SoFi turned in $0.08 GAAP EPS, beating analyst expectations of $0.06. That’s seven consecutive profitable quarters. A fintech scaling at this pace while staying profitable is rare, and the market is starting to notice.

Guidance Raised Well Above Wall Street

Full-year EPS guidance raised to $0.31 vs Wall Street’s $0.25. Net income forecast also moved up to $370M, and adjusted EBITDA is now expected at $960M with a 28% margin. That’s not “survival mode” - that’s execution with confidence.

Explosive Growth Across the Board

- Adjusted Net Revenue: +44% YoY to $858M (record)

- Adjusted EBITDA: +81% YoY to $249M (record)

- Fee-based Revenue: +72% YoY to $378M (record)

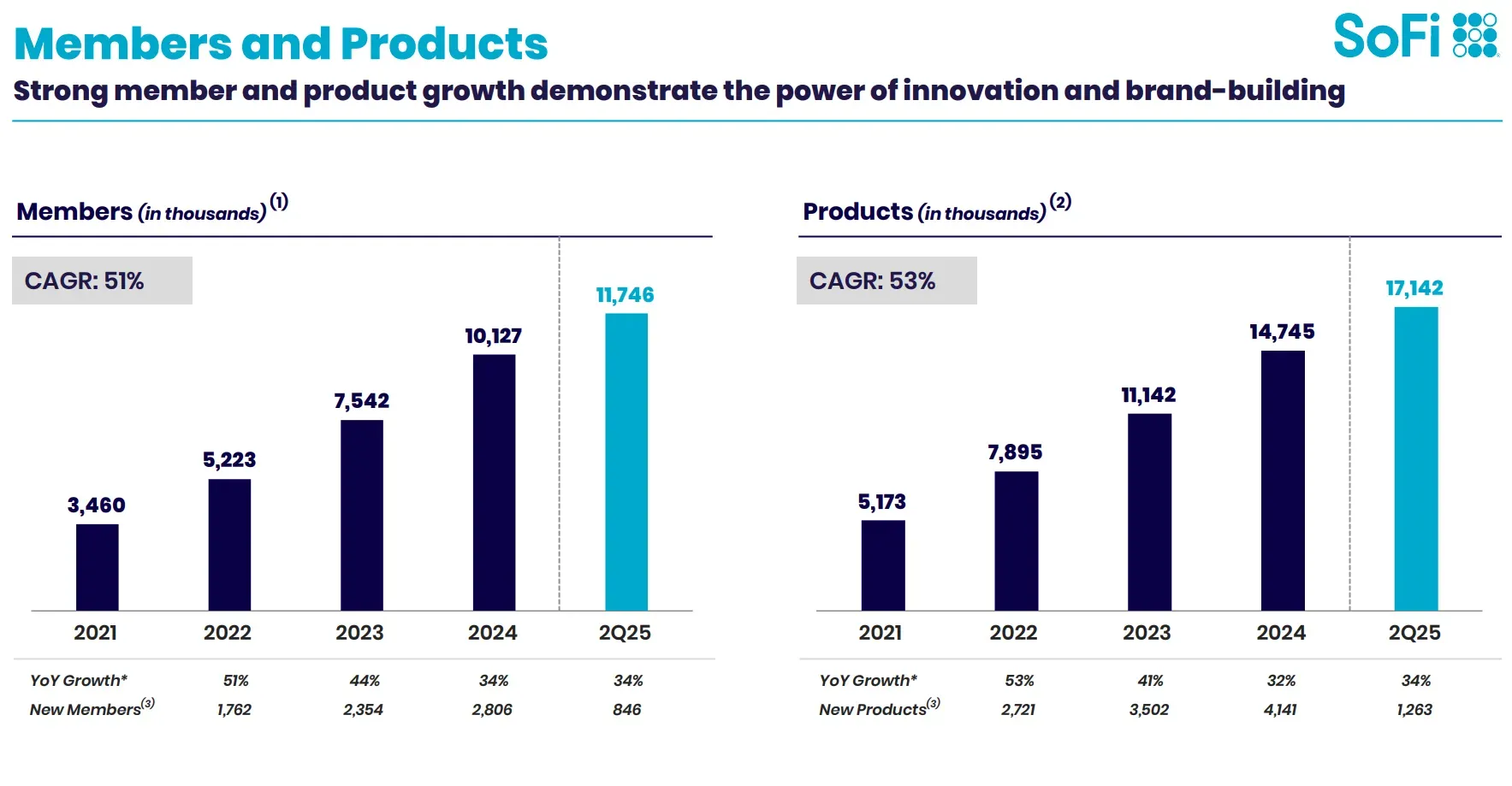

- Members: +34% YoY to 11.7M (record)

- Products: +34% YoY to 17.1M (record)

Even more interesting - noninterest income jumped from $37M to $169M in one year, now making up almost half of total revenue. That reduces reliance on lending and strengthens the “tech platform” narrative investors want to see.

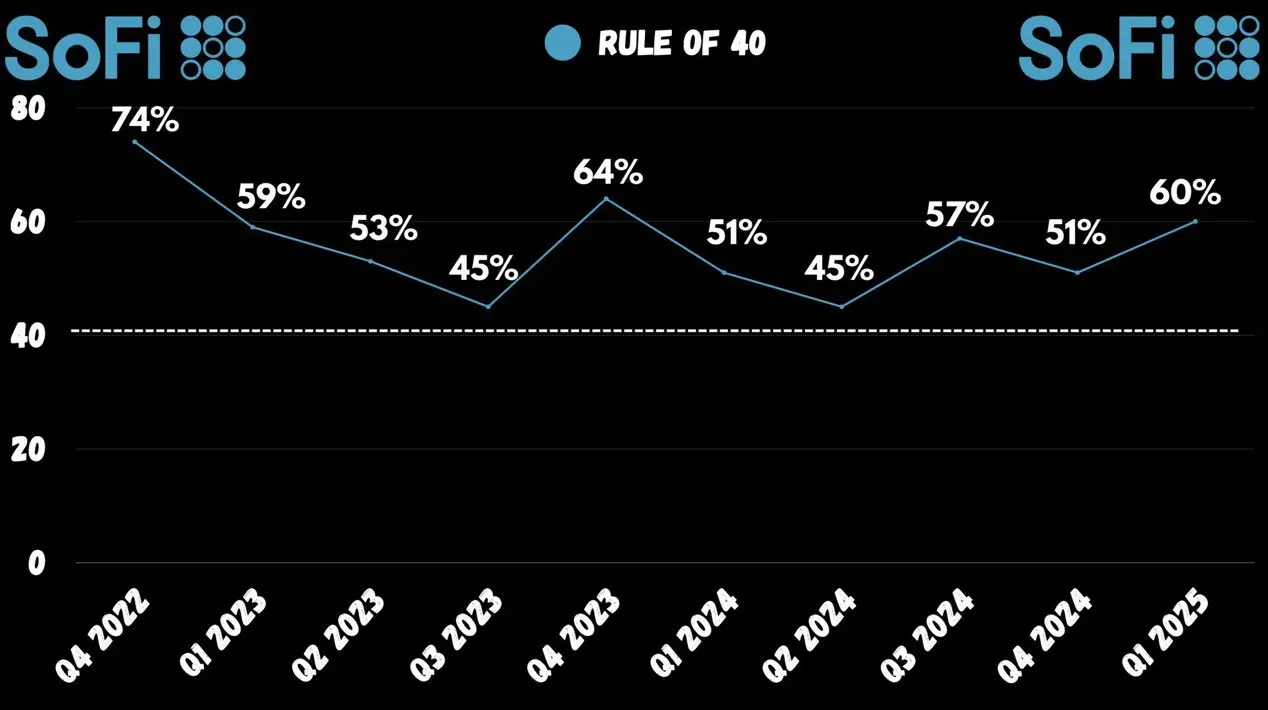

Beating the “Rule of 40” Every Quarter

SoFi has beaten the Rule of 40 for 13 consecutive quarters. This quarter it posted a score of 70 - well above the benchmark. That’s elite SaaS-level performance, not typical fintech choppiness.

CEO’s Tone: Opportunity Overload

Anthony Noto summed it up best:

Our biggest challenge beyond 2025, quite frankly, is what not to do. There are more opportunities on the table for us than ever before, it feels like we are just getting started

That’s not defensive - it’s offensive. SoFi is scaling aggressively, but with discipline.

This isn’t a “hype stock” move. SoFi just demonstrated that it’s a profitable, fast-scaling fintech with a growing fee-based business that’s less rate-sensitive. The raised guidance shows management isn’t afraid to commit.

I think the market will need to re-rate SoFi if this execution continues. For me, this quarter wasn’t about survival - it was about showing that SoFi is evolving from a niche fintech lender into a true diversified financial platform.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.