Tesla (TSLA): Best quarter this year, but the tape says "Show me"

Why I’m watching: Big beat on revenue, miss on profit, and a tax-credit hangover ahead

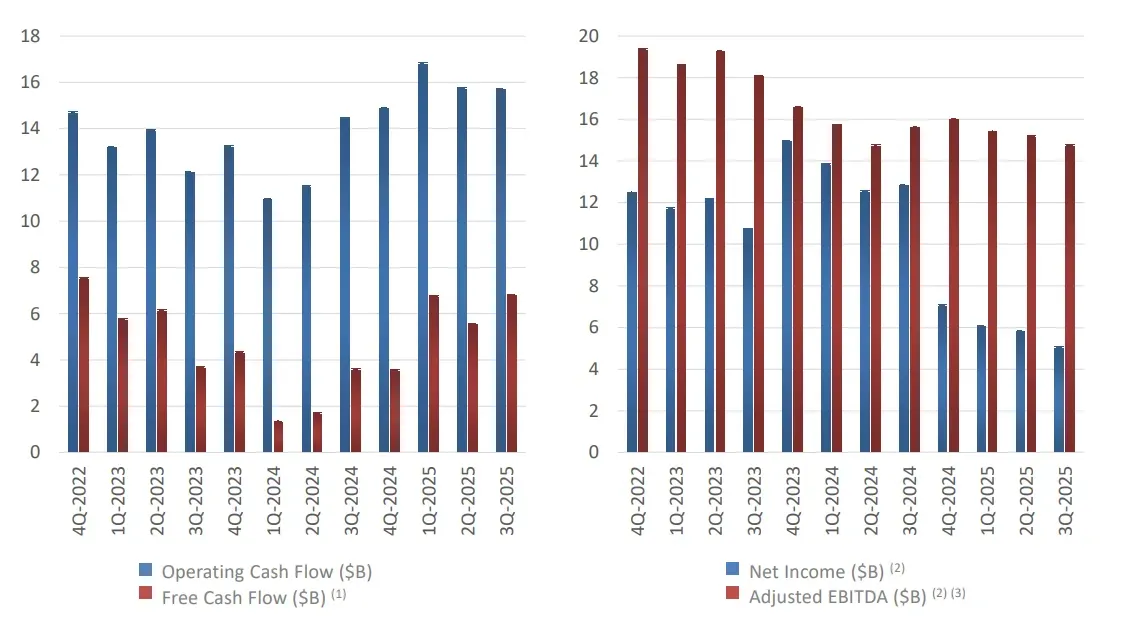

I’m looking at Tesla today because the Q3 print was the strongest top line of the year - $28.1B (+12% YoY) - yet the stock still slipped after hours. EPS missed (about $0.50 vs. ~$0.54 est), net income fell to $1.37B, and adjusted profit was down 29% YoY. Deliveries hit a record ~497k as buyers rushed to lock in the $7,500 credit before the Oct 1 expiry - great for the quarter, but likely a pull-forward that drags on Q4 demand.

Technicals (my read): price faded from a $438.97 close to ~$431 after hours.

I’m treating $415–$425 (round number + recent congestion) as first support; lose that and the April rebound gap starts to matter. On the upside, $450–$455 looks like near-term supply. Momentum has cooled - a classic “good news, bad reaction” setup that often resolves with a retest of support before trend resumes. Until we see buyers defend $420 with volume, I’m not chasing.

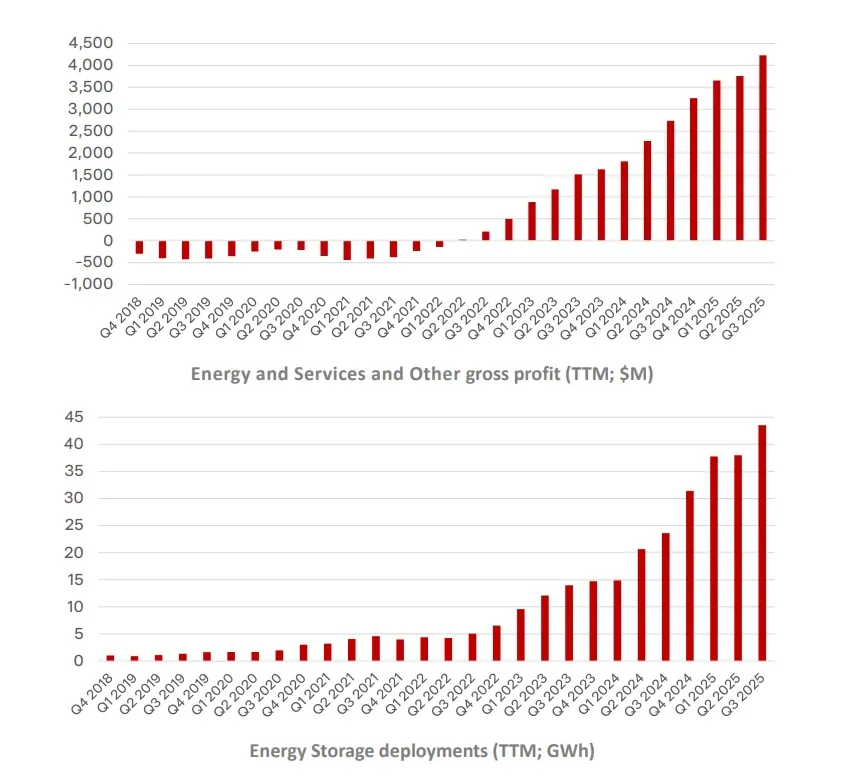

Fundamentals: revenue was solid, but the mix isn’t as pretty. Automotive grew ~6%, energy/storage stayed a bright spot (+43% to $3.42B), services +24.6%.

Regulatory credits were still $417M, but that’s down $322M YoY and likely to shrink further after policy changes - removing a cushion that helped past profitability.

Cash sits at ~$41.6B, which buys time, but gross/operating leverage didn’t show up this quarter.

Add in US demand risk post-credit and stiffer China/EU competition (BYD pressure), and the near-term auto story stays execution-heavy.

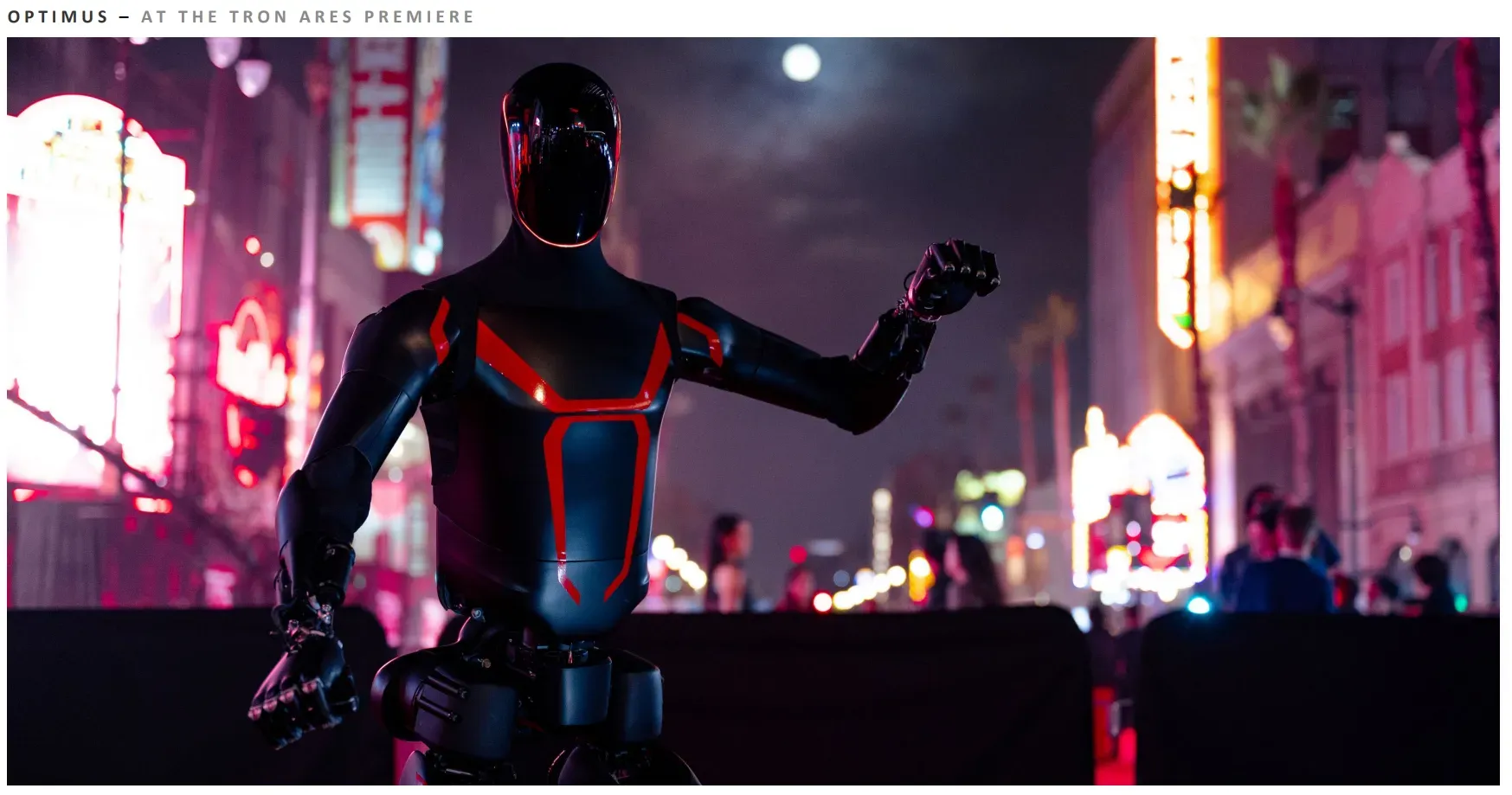

Narrative & catalysts: the equity is increasingly about autonomy and robotics optionality. Robotaxi service is live in limited geos; Cybercab/Tesla Semi “volume production” targeted for 2026; Optimus lines being installed, with initial units for internal use.

The street will parse the call for timelines, capex cadence, and regulatory path. Also hanging over the stock: the upcoming Nov 6 vote on a new CEO pay package (Musk signaling he wants 25% voting power) - governance overhang meets long-dated AI upside.

Conclusion: neutral (near-term), with a tactical bearish lean into $420 support. Record sales and energy strength couldn’t offset the earnings miss, credit pull-forward, and shrinking regulatory tailwind - hence the “show me” tape. I’ll reconsider if (a) $420 holds with strong demand, (b) margin math improves without relying on credits, or (c) management gives credible, dated milestones for robotaxi/Optimus that translate into unit economics. Until then, it’s a traders’ range, not a momentum breakout.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.