Uber (UBER) Analysis: Post-Earnings Deep Dive

I've been tracking Uber's price action closely leading up to their Q2 2025 earnings, and the market's reaction was... interesting, to say the least. The numbers were solid, and while we saw the typical post-earnings volatility with an initial sell-off, the stock actually bounced back strong in the following session. Classic earnings whipsaw - weak hands got shaken out, then the smart money stepped in.

Here's my take: Uber delivered a fundamentally strong quarter that's being overshadowed by controversy around their massive $20 billion buyback program. The technical setup is screaming bullish signals, and institutional money is flowing into calls, but retail sentiment is all over the place.

My $98 price target stands firm, and I'm viewing this as one of the better risk/reward plays in the large-cap tech-adjacent space right now.

The Numbers Don't Lie

Let me break down what actually happened in Q2:

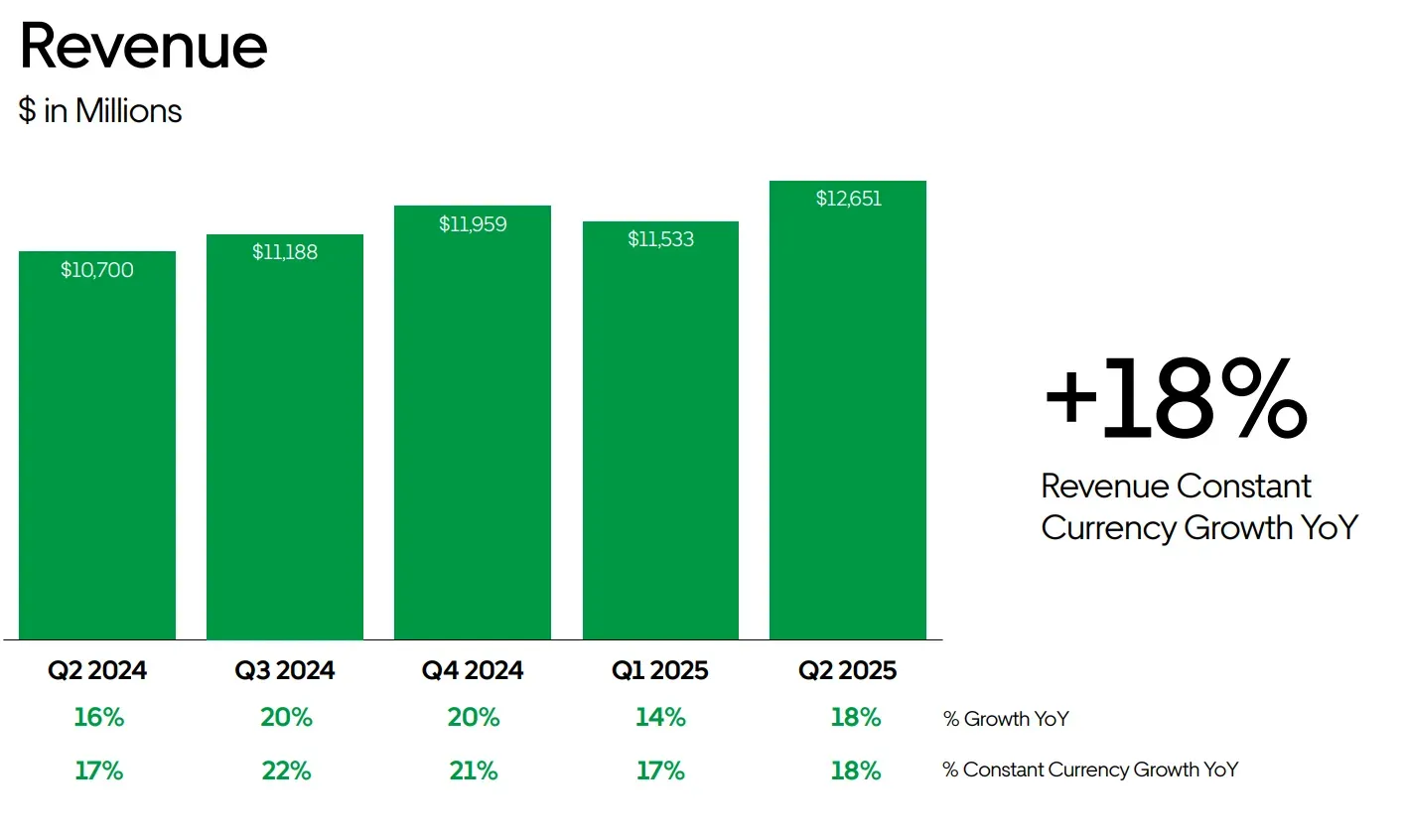

- Revenue: $12.65 billion (+18.2% YoY) - beat expectations of $11.45 billion

- EPS: $0.63 - right in line with consensus

- Net Income: $1.4 billion vs $394 million last year (that's huge)

- Gross Bookings: $46.8 billion (+17% YoY)

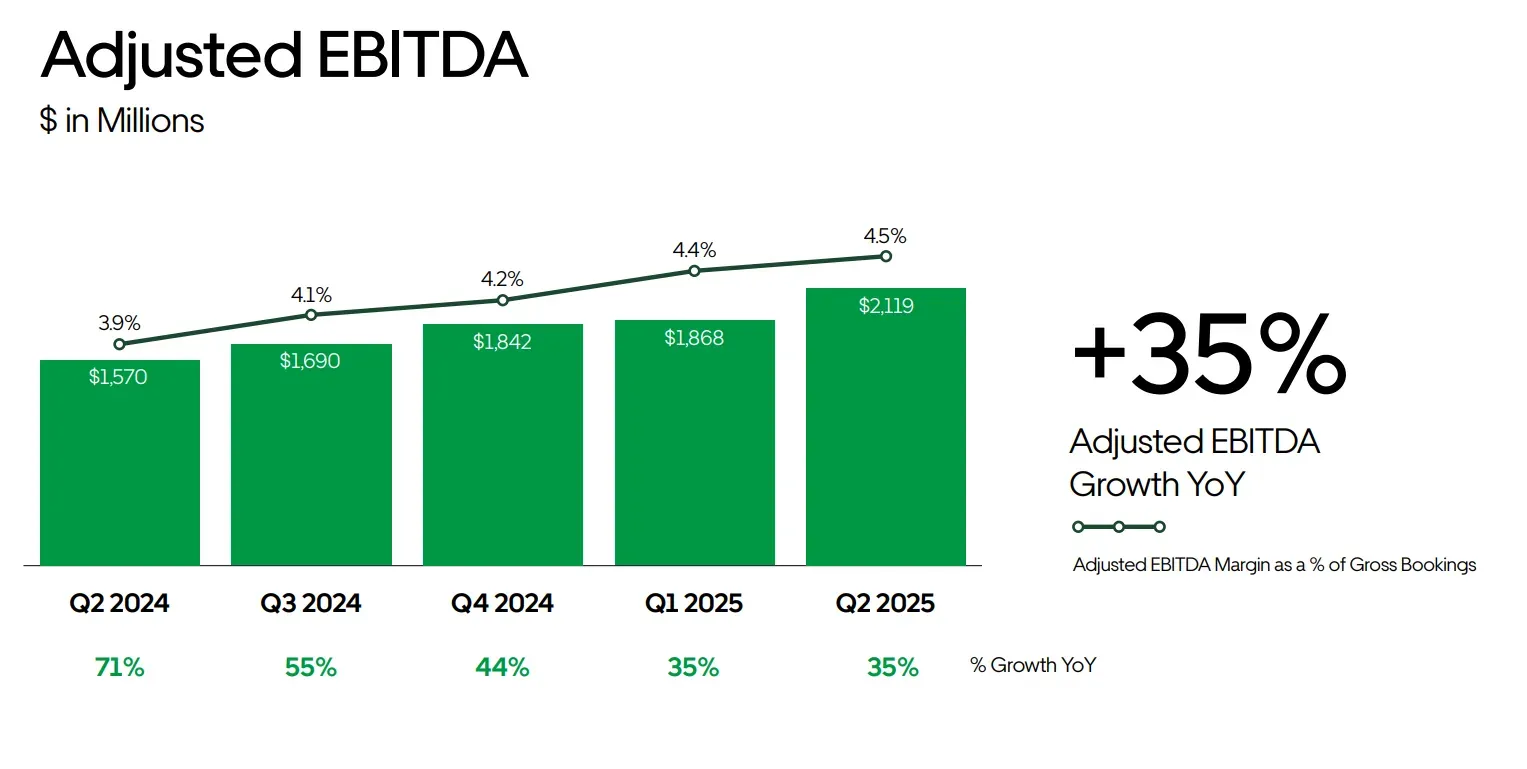

- Adjusted EBITDA: $2.1 billion - a record high, up 35% YoY

- Free Cash Flow: $2.5 billion vs $716 million in Q2 2024

- 2025 Guidance: Gross bookings forecast between $48.25 billion and $49.75 billion

- The Big One: $20 billion share repurchase program announced

My Financial Take

Look, I'm not gonna sugarcoat it - these are solid numbers. Revenue growth of 18% in this macro environment? That's impressive. The EBITDA margins are expanding, showing real operating leverage finally kicking in. And nearly $2.5 billion in free cash flow means Uber isn't that cash-burning startup anymore.

But that $20 billion buyback... man, that's where things get spicy. We're talking about repurchasing over 20% of the company's market cap at current levels. From a pure financial standpoint, it makes sense - they've got the cash flow, low debt, and minimal capex needs.

The problem? Optics. While management is buying back shares, drivers are still fighting for better pay. It's creating this weird tension that's making some investors uncomfortable, and I get it.

Technical Picture Looking Solid

I've been watching the charts, and here's what I'm seeing:

The stock was hanging around $90 in late July, holding that $87.75 support like a champ. Then we got this beautiful breakout that pushed us up to $98 in early August - that's a clean 14% move. We've pulled back a bit since then, but $98 is now our key resistance level.

Key Levels I'm Watching:

- Resistance: $98.00 (double top, psychological level)

- Support: $87.50-$89.00 (volume cluster zone)

- RSI Daily: Around 43 - consolidating but not oversold

- RSI Weekly: 57+ and climbing - bullish on the bigger timeframe

The options flow is telling too. I'm seeing a 3.2x call/put ratio, which suggests the smart money is positioning bullish. That $98 call expiring August 8th is getting a lot of attention from traders.

If we break below $87.50 with volume, I'd probably step aside short-term. But longer-term, I'm eyeing that $100 breakout level.

My Trading Plan

Position: BUY (High Conviction)

I'm staying bullish on Uber despite the noise. The fundamentals are improving, margins are expanding, and they're returning cash to shareholders aggressively. The market just hasn't caught up yet.

Short-term strategy: Looking for bullish call spreads targeting $98-$100. If we hold above $91 for the next couple sessions, I'm adding September calls or shares.

Long-term play: Any pullback below $90 is a gift for long-term holders, especially with the company buying back stock at these levels.

Key Triggers:

- Break above $98 with volume = momentum entry

- Drop below $87 = reassess the bullish thesis

- Daily RSI above 45 = higher probability setup

The technical setup supports higher prices, institutional money is flowing in, and the valuation isn't crazy stretched. I'm staying long and looking to add on any weakness.

Just remember - in this market, even good earnings don't guarantee immediate upside. But when the fundamentals and technicals align like this, patience usually pays off.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.