Undervalued efficiency play: FDX margins expand, $250–$300 in sight

I’ve been closely following FedEx (FDX) for years now, and the Q1 FY2026 earnings report once again affirmed my thesis: this is a company that can defy market skepticism when it focuses on operational discipline.

FDX beat expectations across the board, reporting a strong top-line of $22.24 billion vs the $21.66 billion consensus (+2.7%), and EPS of $3.83, 6.7% above estimates. Net income grew 3.8% YoY to $820 million, and management reaffirmed a full-year earnings guidance that, while slightly below Wall Street consensus, still reflects solid profitability despite macro headwinds.

Operational efficiency continues to be the company’s strongest lever. The ongoing DRIVE transformation - aimed at cutting $4 billion in structural costs - is already bearing fruit, visible in operating margin expansion and improving unit economics. While international softness (specifically from tariff policy changes) adds external risk, FedEx’s leaner cost base and pivot toward higher-margin shipping protect against major downside.

Sentiment from market participants confirms a cautious optimism. While the broader investor community appreciates the beat and strategic execution, there's some withholding due to macro uncertainty, tariff pressure, and inevitable scrutiny as UPS faces its own profit warnings.

Earnings Highlights

- Revenue: $22.24 billion (vs consensus $21.66B), +4.0% YoY, +2.7% surprise

- EPS (Adjusted): $3.83 (vs consensus $3.59), +6.4% YoY, +6.7% surprise

- Net Income: $820 million, +3.8% YoY, margin: 3.7%

- Operating Income: $1.29 billion, operating margin: 5.8%

- Free Cash Flow: Not disclosed this quarter

Guidance Q2 FY2026:

- Revenue: $22.5–$22.7 billion

- EPS: $3.40–$4.00

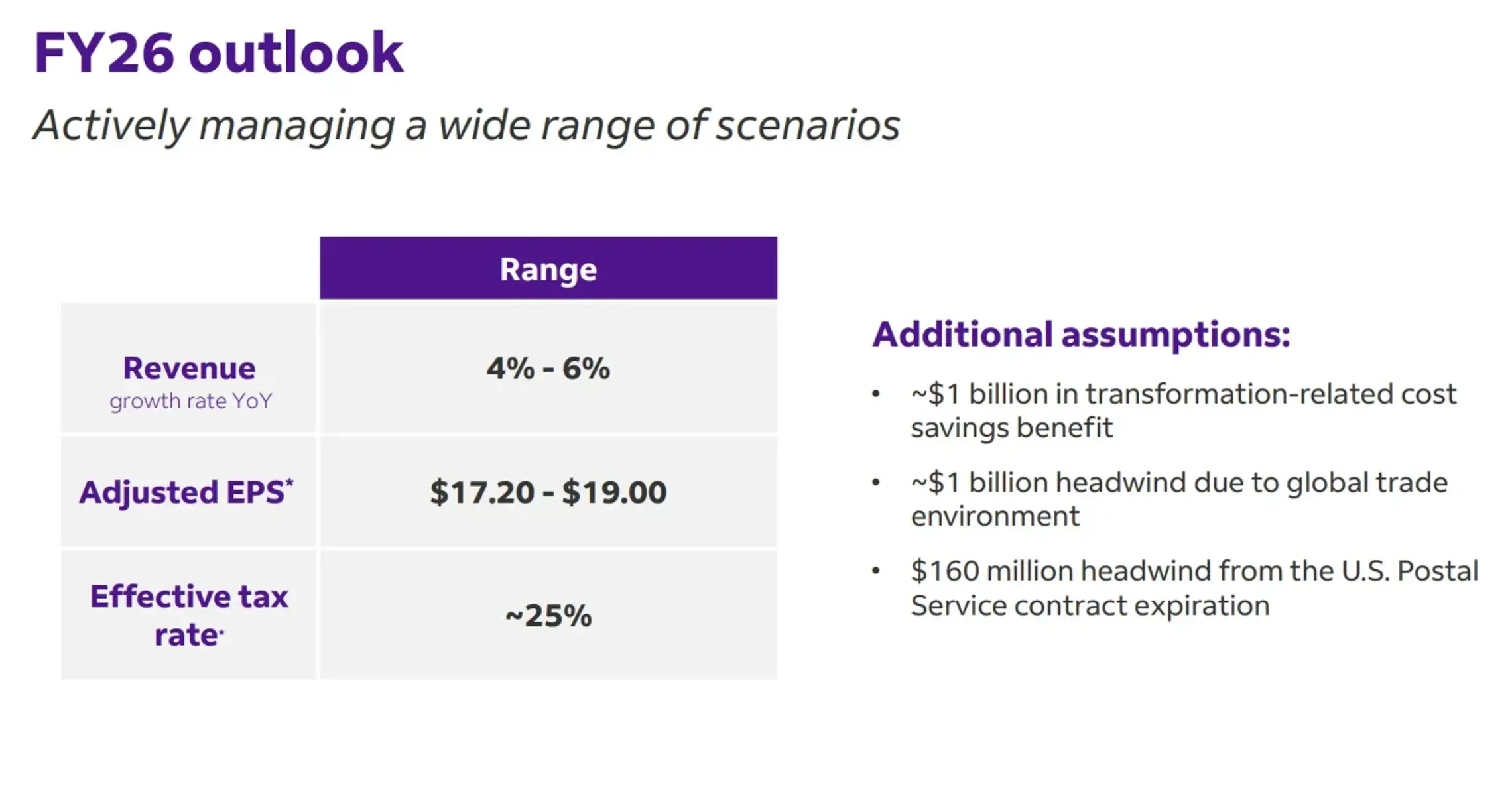

Guidance Full FY2026:

- Revenue: $87.9–$90.0 billion

- EPS: $17.20–$19.00 (Street consensus: ~$18.21)

Financial Analysis

FedEx’s revenue beat this quarter was driven mainly by increased pricing and modest growth in average daily volumes. The standout here is the resilience of its domestic business and the early cost savings from its DRIVE initiative, which has begun streamlining operations, closing redundant facilities, and leveraging AI-driven logistics.

While some corners of the business still face pressure - particularly international exports, which declined 3% due to low-value tariff changes - the overall margin profile improved. Last quarter's 5.2% operating margin rose to 5.8%, and EPS grew faster than net income thanks to FedEx’s ongoing share buybacks and favorable tax positioning.

Strategically, the guiding light remains the impending freight segment spinoff, expected by June 2026. This will slim the company's balance sheet and offer optionality to shareholders. However, the slightly conservative full-year EPS guidance suggests they are factoring in ongoing macro volatility, including fuel costs, trade policy shifts, and competitive tension with players like UPS and Amazon Logistics.

Still, from a valuation standpoint, the stock trades at just around 10x FY26 EPS on the lower range of guidance — a significant discount to its 5-year historical average of 13x. That opens room for multiple expansion, especially as margins normalize post-restructure.

Technical Analysis Summary

Technically, things are aligning nicely for a potential breakout. FedEx has been consolidating in a narrowing range between $225 and $230, forming what I interpret as an ascending triangle - a bullish continuation pattern. The RSI is neutral around 50–55, MACD is flattening near the signal line, and volume is increasing at support levels, reinforcing accumulation.

Strong horizontal support sits at $224, which coincides with both the 50-day moving average and long-term trend support from 2019. From a risk/reward view, I consider this area compelling — support below around $220 and resistance above $240-$250 zone. A confirmed breakout above $230–$232 would validate a medium-term bullish thesis, potentially pushing price toward $250 in the coming quarter.

Price targets I'll be watching:

- Initial: $240 (minor resistance)

- Secondary: $250

- Long-Term: $295–$300 (historical high volume node and top channel line)

Downside is relatively contained unless price breaches $220 with conviction, which would invalidate this setup and suggest reversion to $210 or lower.

Sentiment Check

In broader investing circles, I've noticed a notable divide in sentiment. While many retail and institutional traders are impressed by FedEx’s cost-cutting discipline and turnaround story, there’s a current of caution driven by macro risks and peer underperformance, especially after UPS’s earnings miss.

Traders with short-term biases have expressed doubt in momentum sustaining amid concerns about global trade softness. Some view the DRIVE program as priced in, and tariffs - particularly the removal of U.S. exemptions on low-value imports - have brought the international logistics outlook under skepticism.

That said, option flow and institutional signals I’ve seen support bullish accumulation over the last quarter. Hedge fund additions and sustained buying post-earnings signal growing confidence in the transformation story. Some community members argue that FedEx is undervalued and that the market has underpriced future cash flow enhancements from automation and AI investments. Others, more skeptical, are choosing to "wait and watch" - citing recession fears and the broader weakening in the transportation index.

My Verdict

I'm holding a bullish bias on FedEx at these levels. The fundamental beat, coupled with positive technical signals and a structural cost tailwind, gives this setup a favorable skew over the next 6–12 months. I would classify FDX as a Buy with an initial price target of $240, and a medium-term range of $250–$270 assuming breakout confirmation above current resistance.

Key levels to watch:

- $230–$232: breakout trigger

- $225: nearest stop level

- $220: trend invalidation point

That said, I’m keeping one eye on macro signals — particularly tariff policy shifts and fuel price trends — and will revisit position sizing if UPS continues to struggle, as competitor sentiment can spill over.

In this market, being selective matters. FedEx has done a lot of the hard work internally — now it just needs a little help from the economy.

Let me know if you're trading this too. Always open to seeing how others are approaching FDX.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.