Walmart's (WMT ) Q3 shows why this is the only retail stock that matters

My take on Walmart's monster Q3: Why I'm loading up on this inflation fighter

Just finished digging through Walmart's Q3 earnings and, this is exactly the kind of setup I've been waiting for. The retail giant just crushed expectations and I'm seeing a technical breakout forming that's too good to ignore.

The numbers that caught my attention

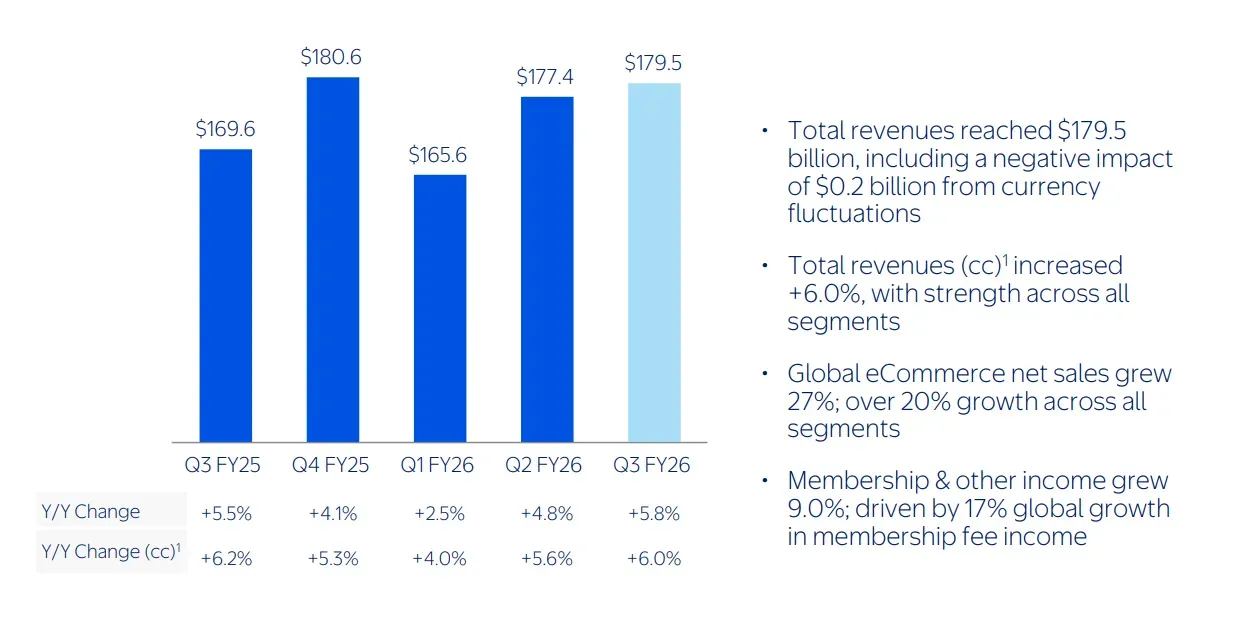

Walmart delivered $0.62 EPS versus the Street's $0.60 - not a massive beat, but here's what's interesting: revenue hit $179.5B, smashing the $177.6B consensus with 6% year-over-year growth. Same-store sales in the US jumped 4.5% against 4% expectations. But the real story? Online sales exploded 27% globally.

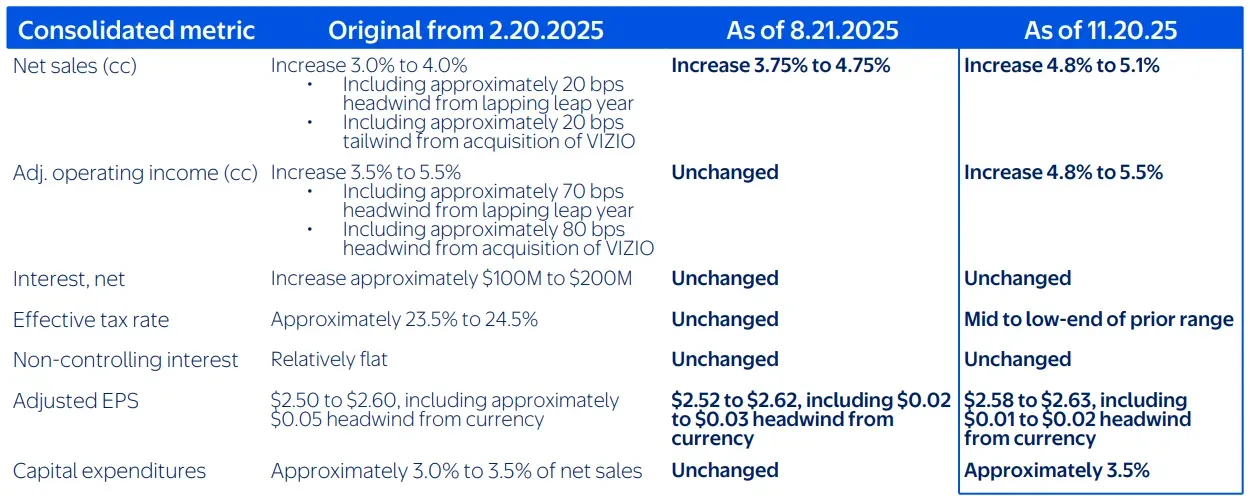

I'm looking at a company that raised full-year guidance to $2.58-$2.63 EPS (up from $2.52-$2.62) and revenue growth to 4.8%-5.1%. When a mega-cap raises guidance in this environment, you pay attention.

Technical setup screaming buy

The stock initially popped 6% to $106+ on the earnings beat - classic momentum move that shows institutional interest. We're now sitting around $105.80, and here's what I'm watching:

- Immediate support at $103 (previous resistance turned support)

- Key resistance at $107 (52-week high territory)

- RSI cooled off from overbought levels after the initial surge

- Volume spike on earnings day confirms institutional accumulation

If we break above $107 with volume, I'm expecting a measured move to $112-115.

Why Walmart is crushing the competition

This is where it gets really interesting. Target's been stagnant for four years while Walmart's eating their lunch. Dollar General? Getting destroyed as low-income shoppers migrate to Walmart. The secret weapon? Walmart's massive grocery business (60% of US sales) creates that sticky customer relationship.

What really has me excited: high-income households are flooding in. CEO Doug McMillon specifically called out strength "across income cohorts and especially with higher income households." When wealthy consumers start shopping at Walmart for value, that's not a temporary trend - it's a secular shift.

The catalysts nobody's talking about

Three things could send this stock parabolic:

- CEO transition in February - John Furner taking over from McMillon. New leadership often unleashes value, especially when the incoming CEO already runs the successful US operations.

- Nasdaq listing switch December 9th - Moving from NYSE to Nasdaq signals tech transformation. This isn't your grandpa's Walmart anymore.

- OpenAI partnership - They're integrating AI for grocery restocking through ChatGPT. The productivity gains from AI could be massive for margins.

Market context and timing

We're heading into the holiday season with Walmart already raising guidance. Consumer spending patterns show a K-shaped recovery - high earners spending strong, low-income struggling. Walmart uniquely positioned to capture both segments.

Fed Chair Powell acknowledged this bifurcated economy in October. While McDonald's reported double-digit traffic declines from low-income consumers, Walmart's seeing growth across all income levels. That's resilience.

My trading strategy

I'm bullish with a 6-month target of $115.

Here's how I'm playing it:

Entry zones:

- Aggressive: Current levels around $105-106

- Conservative: Wait for pullback to $103-104

Position sizing:

- Initial position: 40% allocation now

- Add 30% on any dip to $103

- Final 30% on breakout above $107

Risk management:

- Stop loss: $99 (below 200-day moving average)

- Take partial profits: 25% at $110, 25% at $113

- Let the rest ride with trailing stop

Options play:

- Buying March 2026 $110 calls on any weakness

- Selling $95 puts for income if we get a broader market pullback

Bottom line

Walmart's proving it's not just a recession play - it's THE play for this weird economic environment. Growing market share, crushing online sales, attracting wealthy shoppers, raising guidance - this is what momentum looks like in retail.

The risk/reward here is compelling. Downside seems limited with that dividend yield and defensive characteristics. Upside could surprise if they execute on the tech transformation and maintain these growth rates.

I'm not waiting for a perfect entry. Sometimes you just need to recognize when a company's hitting an inflection point. Walmart's there right now.

Position: Long WMT shares, adding on dips, targeting $115 by May 2026

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.