Why Did Windtree Therapeutics (WINT) Fail?

And Should We Be Afraid the Same Could Happen to MSTR, Metaplanet, and Others

If you are new to the concept of a Crypto Treasury, I recommend starting by reading this article.

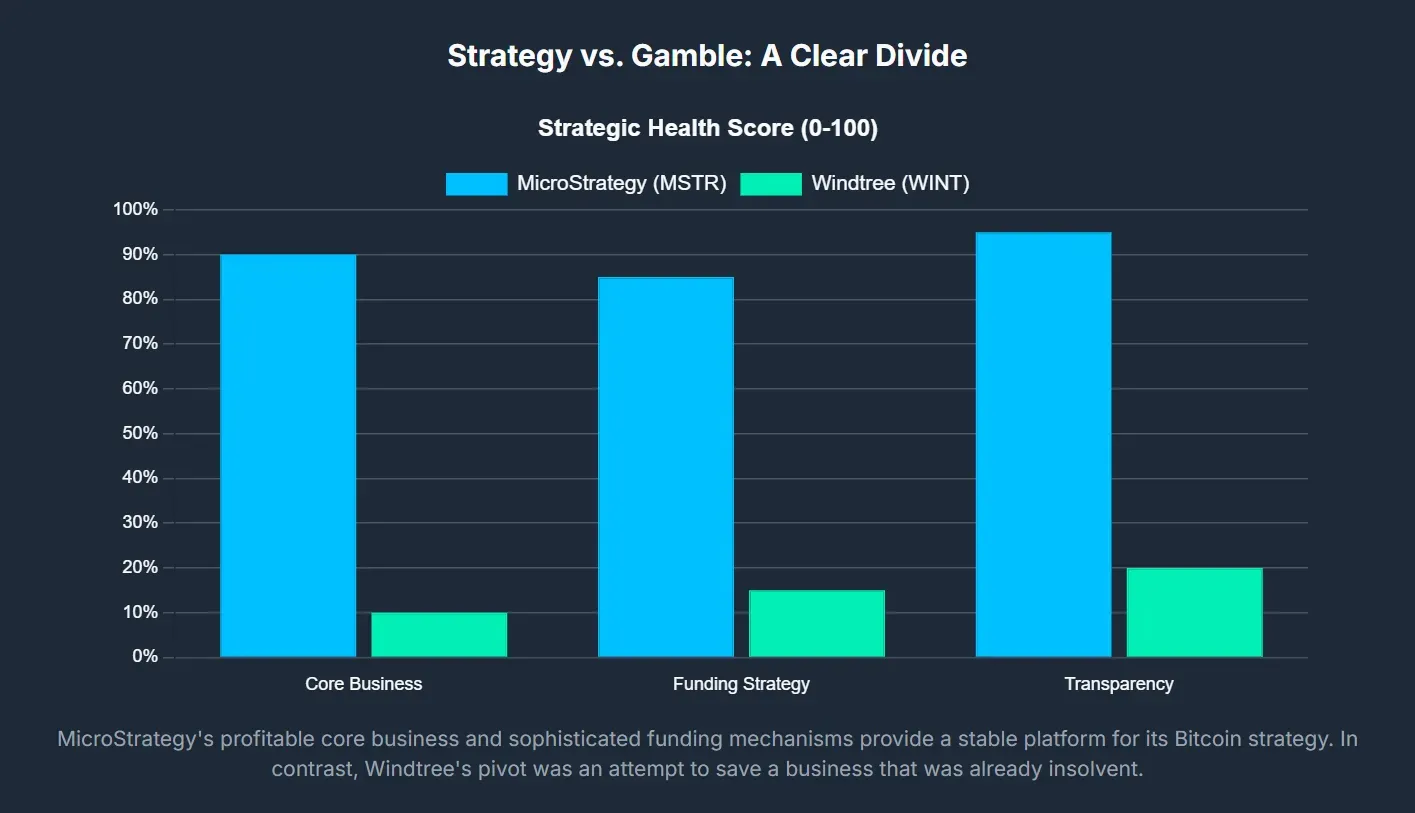

I've been in the game for a while, and if there's one thing I've learned, it's that hype kills. We've seen it with tech, with EVs, and now with crypto treasuries. For me, MicroStrategy set the gold standard. They had a plan, they executed it, and they were transparent about it.

Then you get a company like Windtree Therapeutics (WINT).

They were a struggling biotech company trying to use a crypto pivot to save themselves. That's a red flag. What happened next was a lesson for anyone who thinks a splashy crypto announcement can fix a broken business.

The Ticking Clock: Why Windtree Was Already a Bad Bet

To understand Windtree's failure, you have to look at the company before it went all-in on BNB. It was a biotech company on life support. The stock was in freefall, down over 99% in the year before its crypto announcement, with its price averaging $36.21 and hitting a 52-week low of $0.36 by mid-2025. The company was a walking dead man with a market cap of only $6 million and zero revenue. They were a long shot from the start.

In August 2025, Windtree even had to stop a clinical trial for their main drug candidate, istaroxime, citing "limited resources".

This happened a month after they announced a new crypto strategy. So, while the company was literally giving up on its core business because it couldn't afford to run it, it was simultaneously pitching a massive, multi-million dollar crypto play. It's a clear contradiction that showed their desperation.

The company's history was also full of shady financial moves, like constantly diluting shares and issuing and then redeeming preferred stock. This wasn't a company built for growth; it was built to survive by preying on the financial markets.

The Hail Mary: A Last-Ditch Effort That Failed

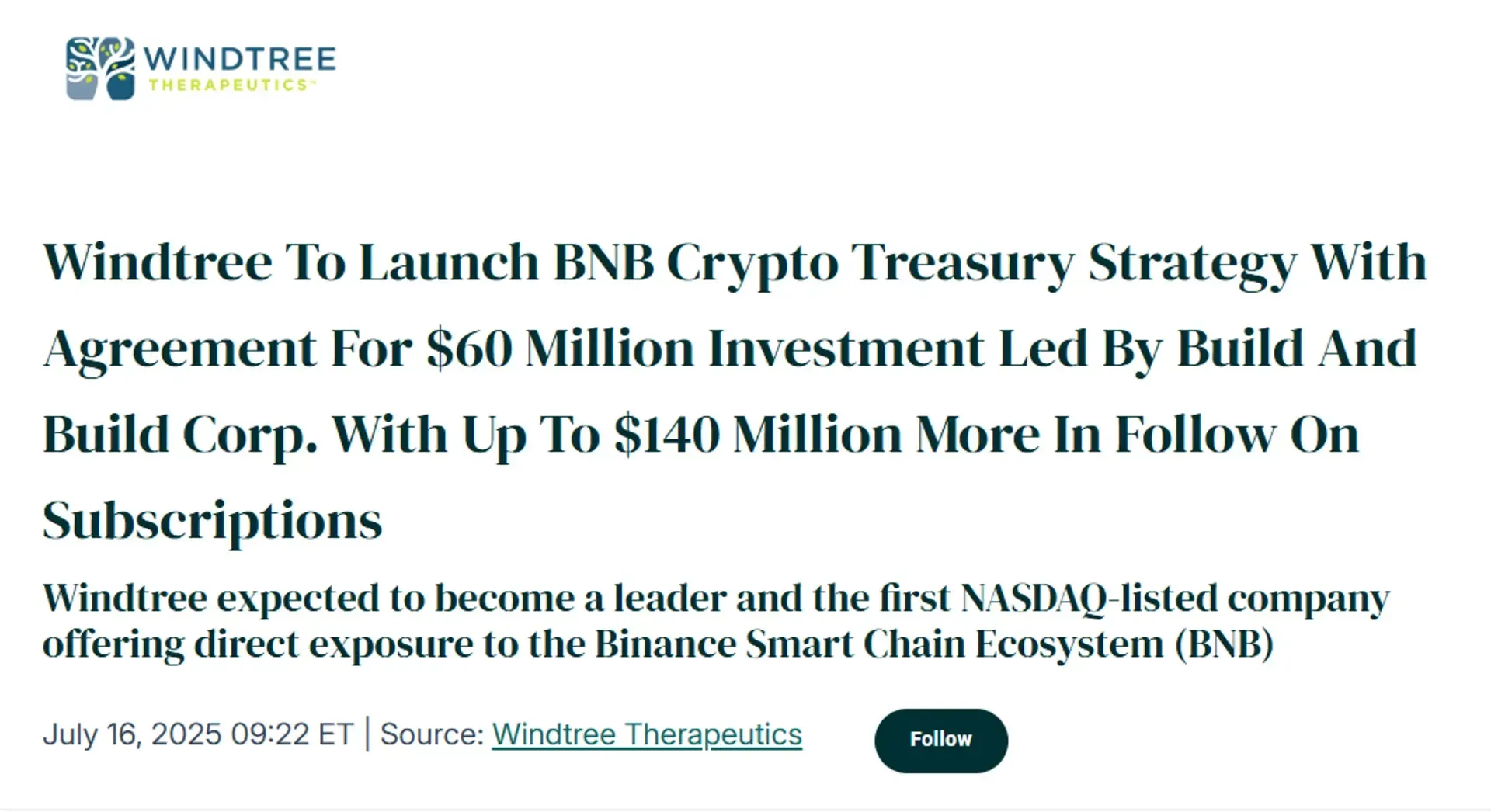

In July 2025, Windtree made its move, announcing a plan to create a BNB treasury. They signed an agreement to raise up to $200 million, with 99% of the funds meant to buy BNB. They marketed themselves as the first Nasdaq-listed company to give investors direct exposure to the BNB token.

The stock had a temporary speculative pump, but it didn't last. About a month later, Nasdaq sent them a delisting notice because their stock had been trading below $1 for 30 straight days. This wasn't a surprise. It was the predictable end for a company that had been failing for a long time.

When the delisting news broke, the stock tanked 76% in a single day, even as the price of BNB was hitting a new all-time high. The stock's value was tied to its listing on a major exchange, not the underlying crypto. When that lifeline was cut, the company's value collapsed. This wasn't a failure of the crypto treasury model; it was a failure of management and a fundamentally broken business. The move to an OTC market only sealed its fate, as OTC trading has less liquidity and transparency.

Can You Really Trust the Leaders? MSTR, Metaplanet & the New Wave

MicroStrategy (MSTR) and Metaplanet didn't just stumble into this. They created a new playbook for corporate finance. This is a key difference from companies like Windtree, and it’s why they’ve earned a spot at the top.

MicroStrategy (MSTR) and Metaplanet didn't just stumble into this. They created a new playbook for corporate finance. This is a key difference from companies like Windtree, and it’s why they’ve earned a spot at the top.

The Original: MicroStrategy's Bitcoin Playbook

Unlike Windtree, MicroStrategy was a profitable software company before it pivoted. Michael Saylor's decision to buy Bitcoin in 2020 was a proactive strategy to hedge against inflation, not a reactive one to avoid bankruptcy.

MSTR's strategy is a masterclass in using financial tools. They've used convertible bonds and at-the-market (ATM) offerings to buy billions of dollars worth of Bitcoin. This approach allows them to raise capital without the typical limitations of debt.

They are also incredibly transparent. Saylor and his team openly share their strategy, regularly disclose their purchases in SEC filings, and even created an open-source playbook for other companies to follow. That's the opposite of a Ponzi scheme.

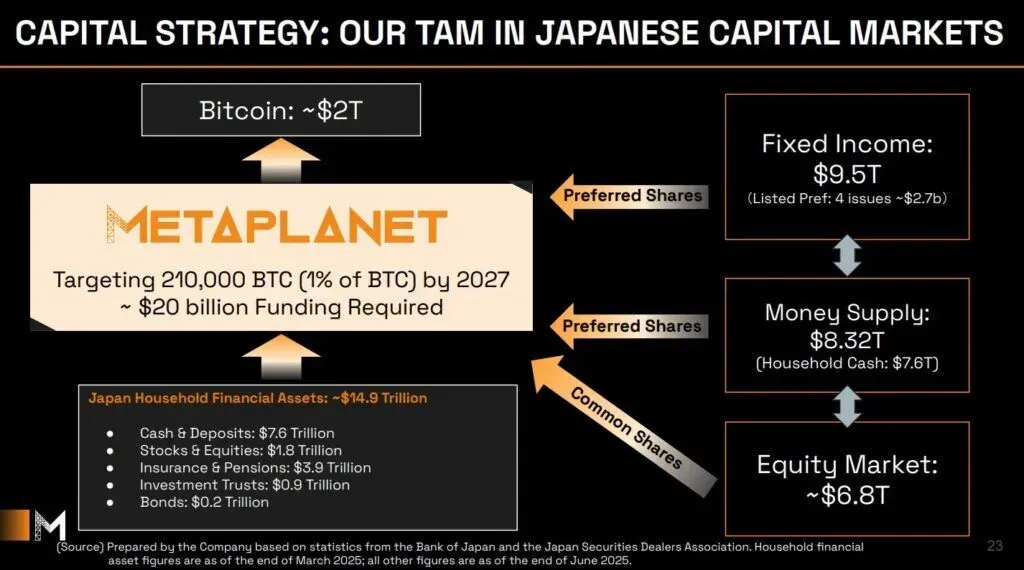

The Japanese Take: Metaplanet

Metaplanet is a similar story. The Japanese company saw an opportunity in its country's low-yield bond market and decided to use Bitcoin to give investors higher returns. They've been innovative, using Bitcoin-backed preferred shares to raise capital. This provides permanent funding without the maturity constraints of debt.

One thing that still confuses some investors is the premium on MSTR stock, where the stock price is higher than the value of its Bitcoin holdings and its software business combined. This isn't just a random markup; it's a reflection of the market's expectation that the company will keep buying more Bitcoin. This premium acts like a "crypto reactor" that gives the company a continuous source of capital to acquire more Bitcoin.

Ethereum Treasury Companies

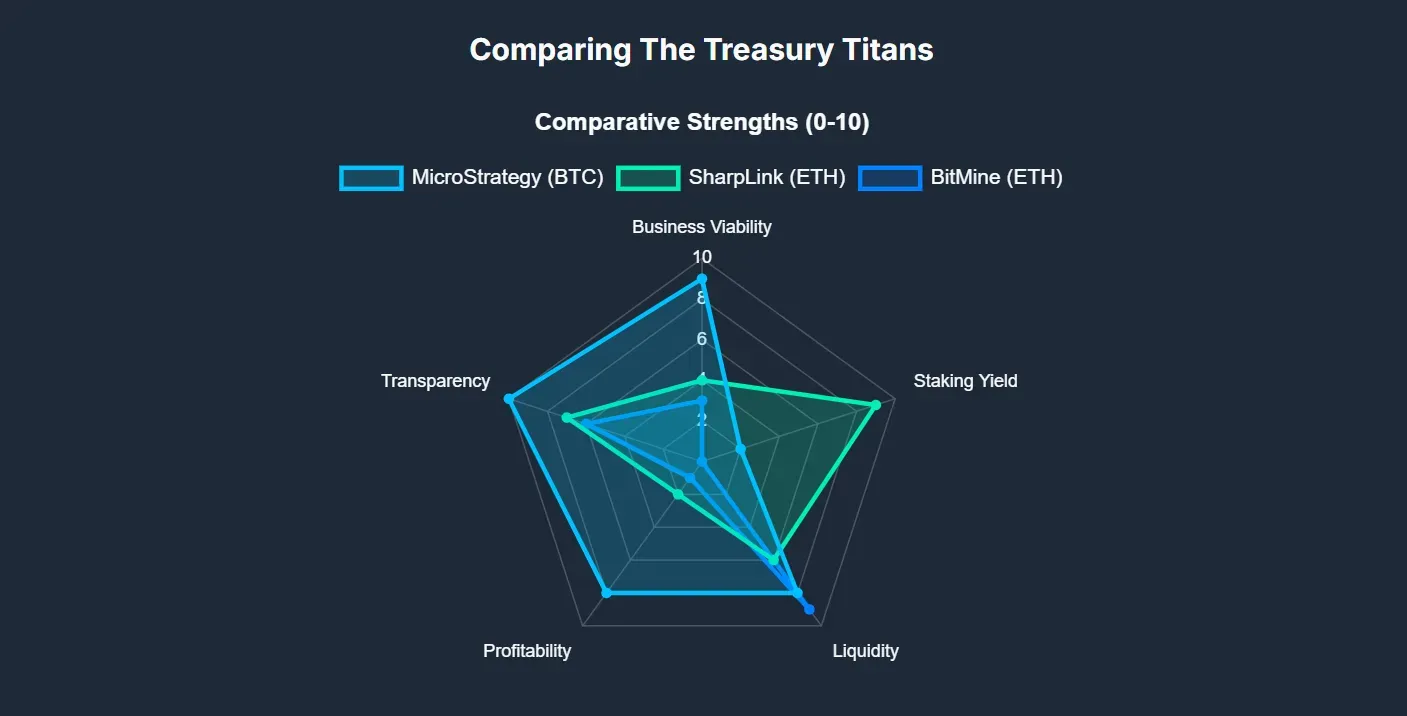

While MSTR and Metaplanet were building their Bitcoin treasuries, a new class of companies is now following a similar playbook with Ethereum. The two most prominent are BitMine Immersion (BMNR) and SharpLink Gaming (SBET).

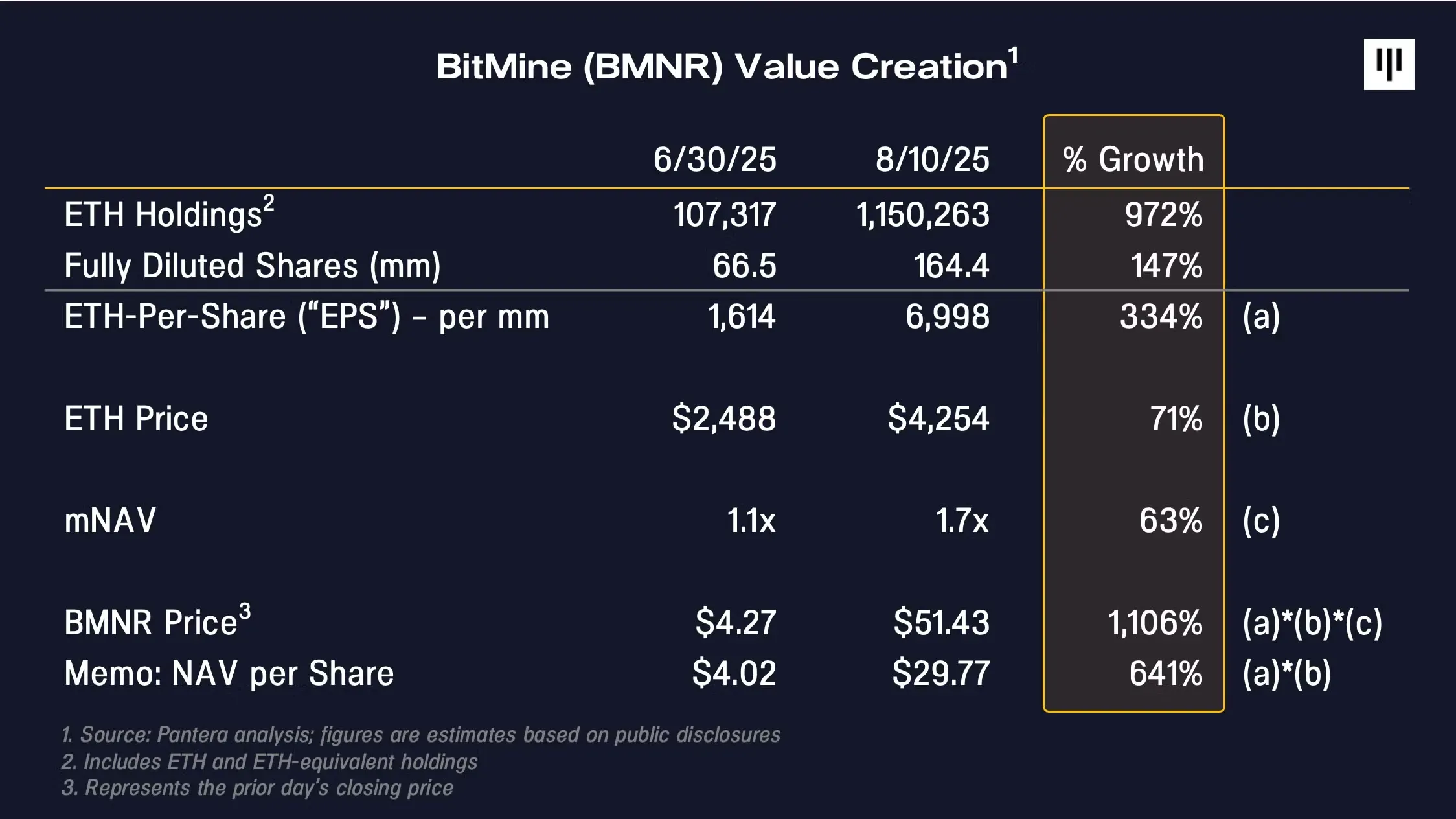

BitMine Immersion (BMNR): BMNR has demonstrated superior growth and reliability through a cohesive, multi-faceted strategy. BMNR operates on a dual-engine model that combines efficient Bitcoin mining with an aggressive Ethereum treasury strategy. At the core of its operations is proprietary immersion cooling technology, which boosts hashrate by up to 30% and cuts electricity use by 40%, creating a more cost-effective and sustainable business. BMNR's high-conviction vision, known as "The Alchemy of 5%," aims to acquire 5% of all circulating Ethereum, a goal that has attracted a "premier group" of institutional investors, including ARK Invest and Bill Miller III.

The company's execution of this strategy has been exceptionally fast, with its chairman highlighting its "velocity of raising crypto NAV per share". This has resulted in explosive market capitalization growth, with a surge of over 1,155% in a single month , and its stock becoming one of the top 10 most liquid in the US.

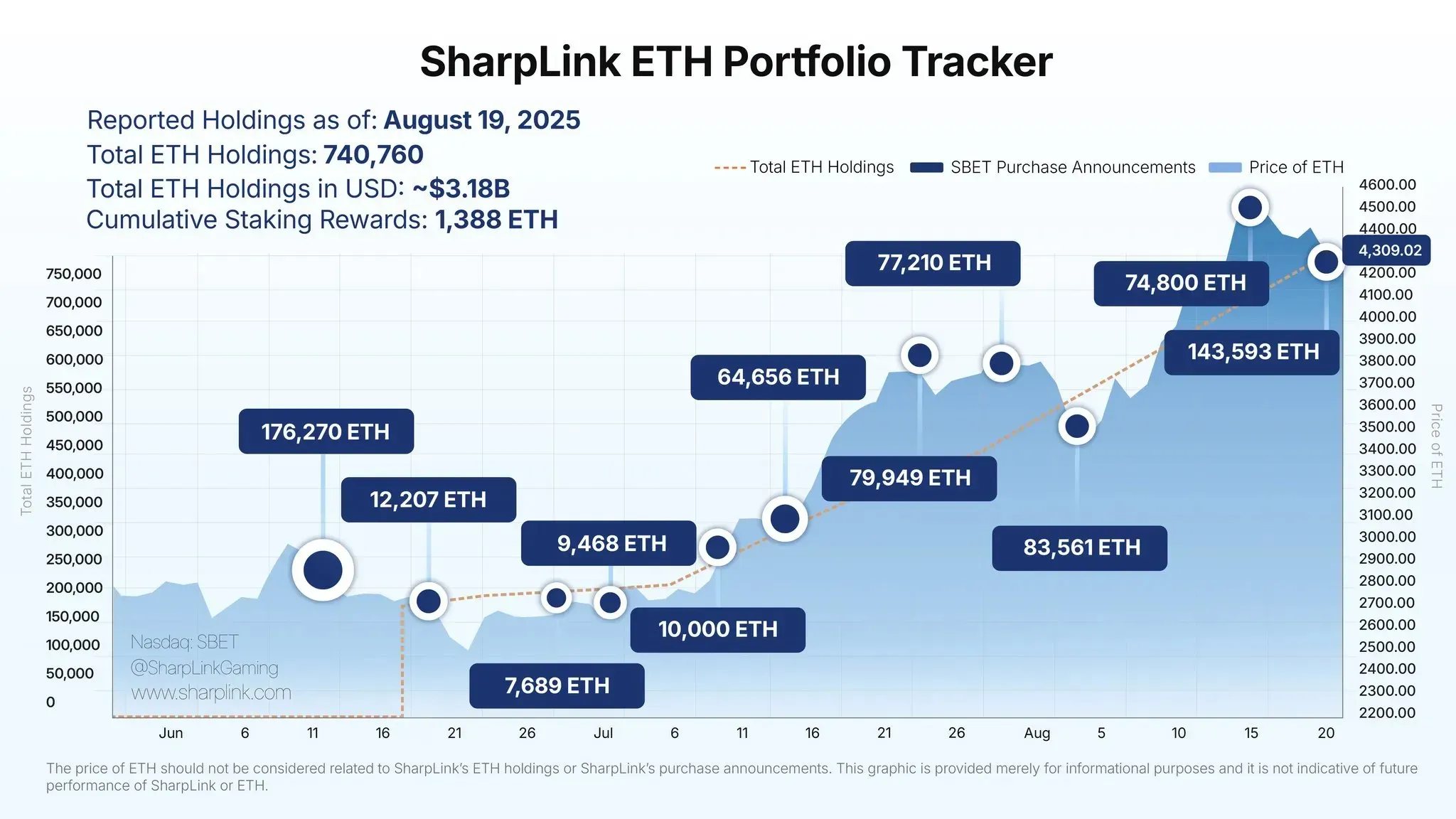

SharpLink Gaming (SBET): SBET shifted from a gaming company to an Ethereum treasury. They've partnered with ConsenSys and have Ethereum co-founder Joseph Lubin as their chairman.

A key advantage of their strategy is staking their ETH holdings to generate yield, a feature that isn't available to investors who use a US spot Ethereum ETF. But their financial reports show some risks, including an $87.8 million non-cash impairment loss on their staked ETH and a massive quarterly net loss.

Separating the Signal from the Noise

The success of MSTR has led to a lot of copycats. Some, like BMNR and SBET, are creating their own version of the playbook. Others, like Windtree, are simply trying to capitalize on a trend. Here are a few more risky examples I've seen:

- KindlyMD (NAKA): A primary healthcare company that merged with a "Bitcoin-native holding company".

- Empery Digital (EMPD): An old electric vehicle company that pivoted to a "global Bitcoin aggregator".

- Microcloud Hologram (HOLO): A holographic technology company that announced a $200 million investment in Bitcoin.

When you're looking at a company like this, here's my quick checklist:

- Is the core business viable? A crypto pivot should be a strategic decision by a healthy company, not a last-ditch effort to save a dying one.

- Is management credible? Do they have a clear long-term plan, or are they just cashing in on hype? Trusting the management is a huge part of investing in this space.

- What's their funding strategy? Do they have a smart, sustainable plan like MSTR's convertible bonds, or are they just diluting shares?

- Are they transparent? They share their strategy and regularly file with the SEC, or do they just make loud announcements to pump the stock?

- What crypto are they holding? Is it a major, liquid asset like Bitcoin or Ethereum, or something more niche?

The Ultimate Question: Stock vs. Coin?

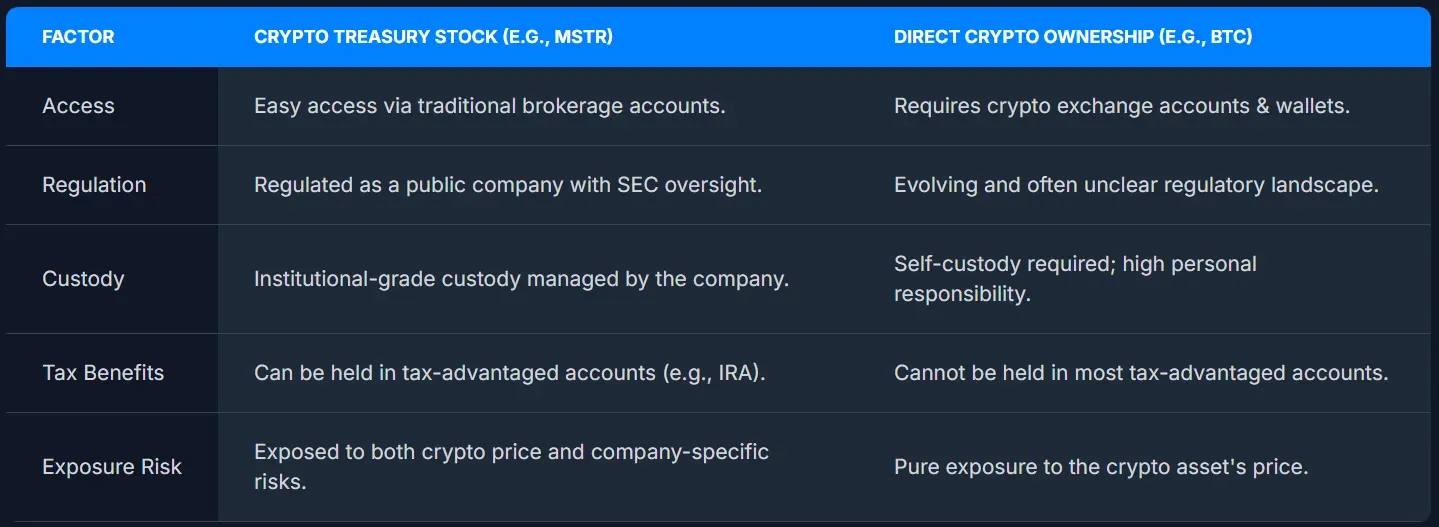

The choice between buying a crypto treasury stock and buying the crypto itself is a personal one. Both have pros and cons.

- Buying the crypto directly gives you the most direct exposure. You have access to 24/7 trading and a global market. But it also means dealing with extreme volatility, security risks (like managing your own private keys), and a lack of the same regulatory protection as traditional markets.

- Buying a crypto treasury stock gives you indirect exposure that is leveraged to the price of the underlying asset. You get the regulatory protections that come with a publicly traded company, including SEC reporting and institutional-grade custody. It's also a great option for people who just want to use a regular brokerage account and don't want to deal with the complexities of opening a crypto exchange account or managing a crypto wallet. Plus, these stocks can be held in tax-advantaged accounts like an IRA. The downside is you're exposed to company-specific risks (like bad management or a flawed business model). The stock is also subject to wider price swings due to the premium it might trade at.

For a long-term investor, it makes sense to have both. I hold my core crypto assets directly for the pure, unadulterated exposure. But I also own carefully vetted crypto treasury stocks. I see them as well-managed, complex financial products that provide unique benefits like institutional-level custody and tax efficiency that you can't get by holding the coin yourself.

My Final Take

Windtree was a scam in plain sight. Its failure wasn't a surprise to anyone paying attention. The market is getting smarter and is learning to differentiate between a truly innovative strategic play (MSTR, Metaplanet) and an opportunistic cash grab. As this space matures, I'm confident that the well-run, transparent players will succeed, and the desperate ones will go bust. My advice is simple: do your homework, look for fundamental strength, and don't confuse a sinking ship with a vessel built for the future.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.