Why I'm Bullish on Figma's IPO - Even With a Sky-High Valuation

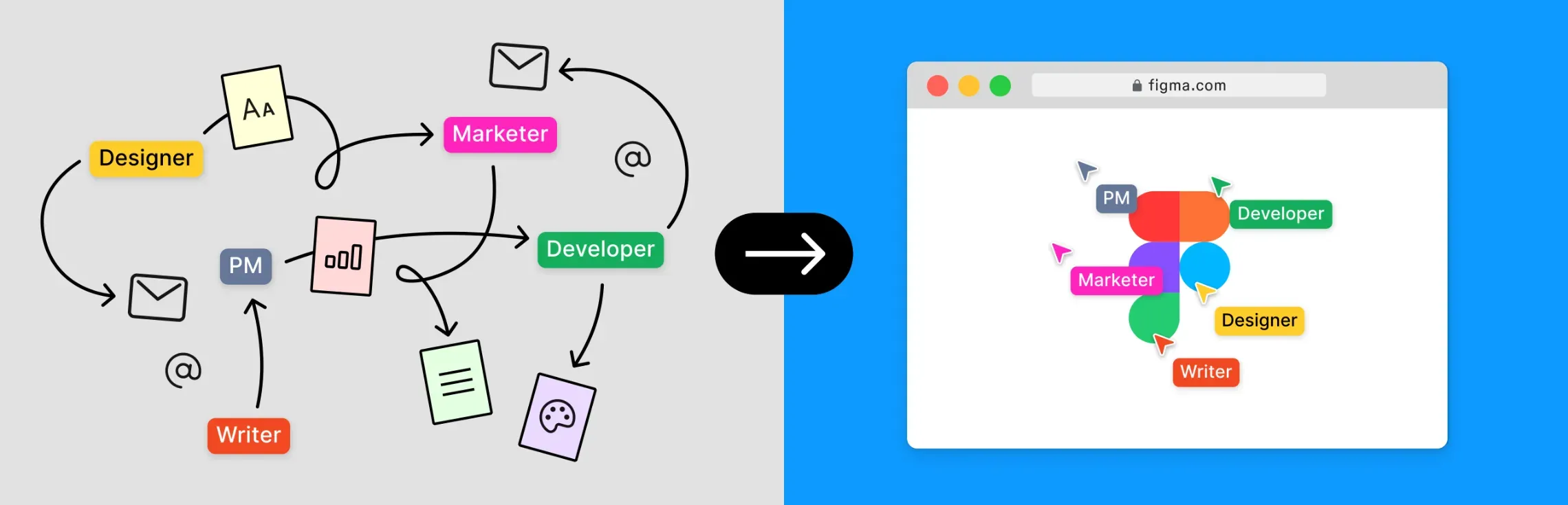

What Figma Really Is - And Why It’s Not Just a "Design Tool"

Figma (FIG) is finally going public the week of July 28, 2025, targeting the NYSE under the ticker FIG. The company plans to sell 36.94 million shares in the $25–$28 range, raising just under $1B, though it's worth noting that only 12.47 million shares are being issued by Figma itself. The rest? Secondary shares from insiders. Classic move.

Figma’s Product Isn’t Just "Design Software"

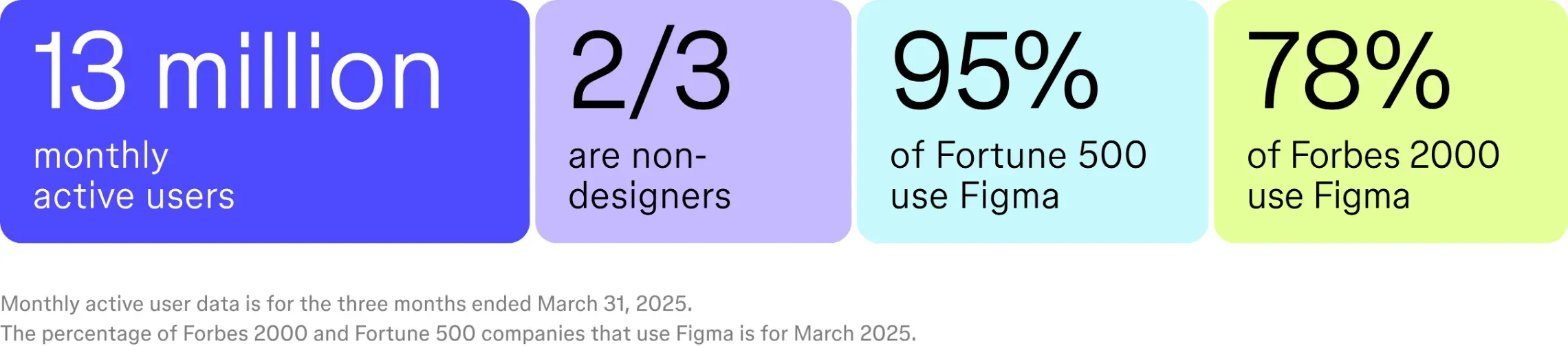

What makes me bullish isn’t just the numbers (more on that below), but the fact that Figma is way more than a design tool now. It’s evolved into a full-stack platform for cross-functional collaboration — think designers, devs, PMs, marketing, and even legal all working in the same environment. In March 2025, non-designers made up two-thirds of Figma’s 13M MAUs. That tells me they’re expanding horizontally across organizations.

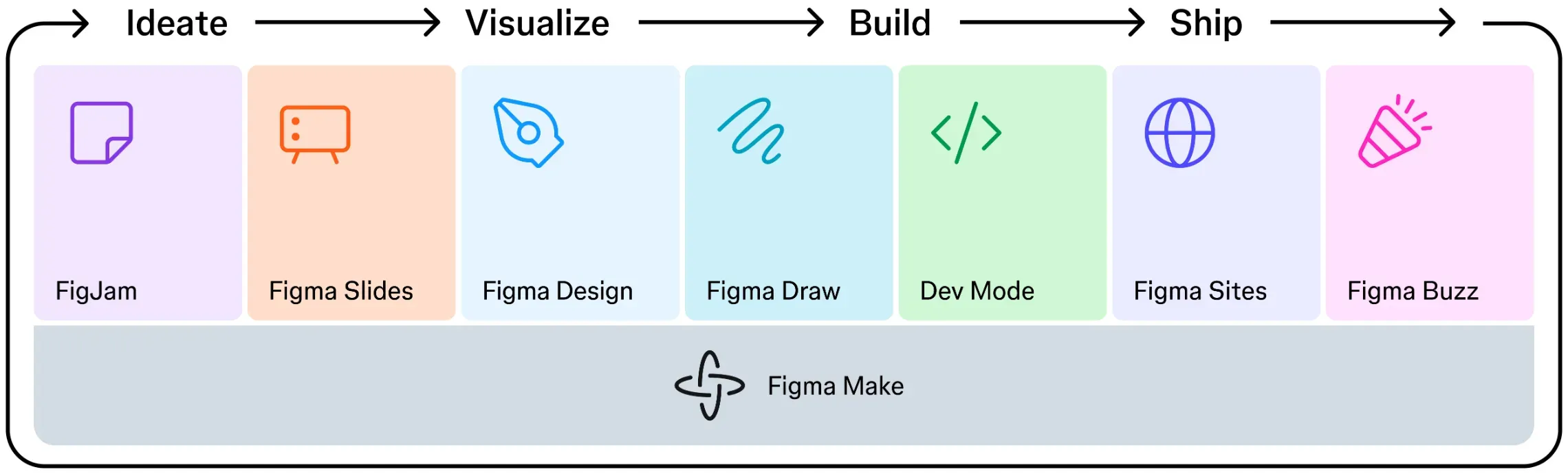

They’ve built out their suite beyond just Figma Design: FigJam, Dev Mode, Slides, Sites, Buzz, Draw, and Figma Make. It’s a modern browser-based OS for building digital products, and its AI tools are only going to make it stickier.

Traction: Fortune 500 Penetration + 132% NRR

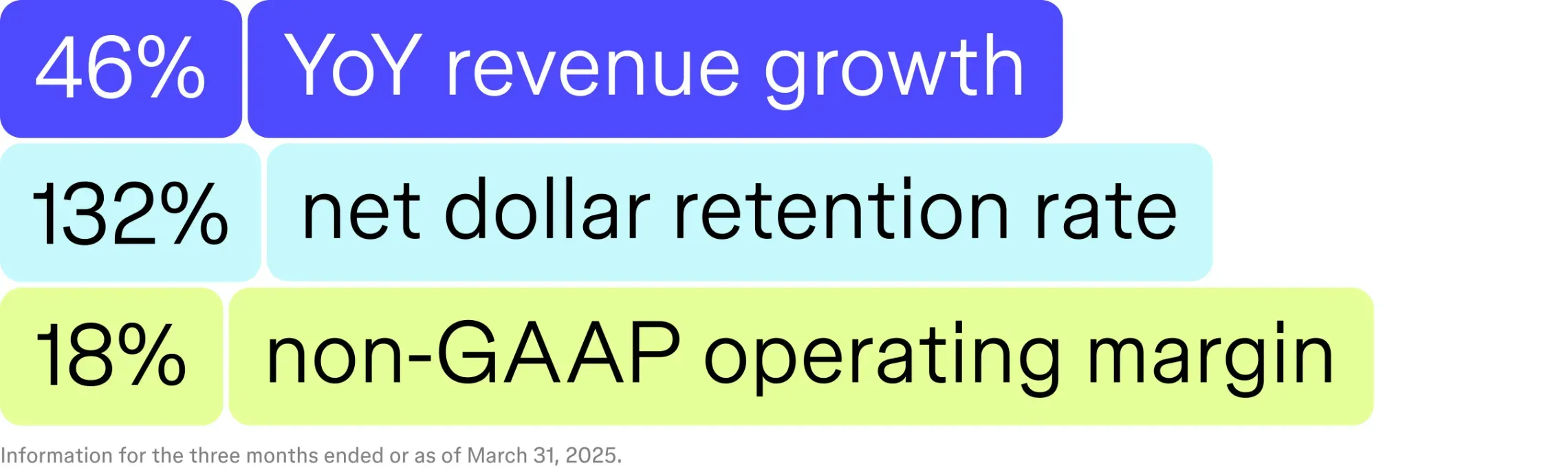

Figma’s already embedded in the enterprise. 95% of Fortune 500 and 78% of Global 2000 companies used it in March 2025. That’s not a startup trying to break into the big leagues — they’re already there. And the 132% net revenue retention rate suggests existing clients are expanding their usage rapidly.

Oh, and they pulled in $821M in LTM revenue, growing 46% year-over-year, with 91% gross margins. That’s elite SaaS territory. Even if they’re still operating at a net loss (~$674M in the last 12 months), I’m not sweating it — especially considering they burned cash to scale up ahead of the IPO.

Valuation: Expensive, But Maybe Justified

At the midpoint price of $26.50, assuming the rumored ~552M fully diluted share count, we’re talking about a $15B–$18B valuation. On a trailing revenue basis, that’s about 18–22x sales. Expensive? Yes. But if you believe Figma can continue growing north of 30% for a few more years and normalize margins toward Adobe’s 30%+ EBIT margins — this isn’t outlandish.

Let’s not forget: Adobe tried to buy them for $20B back in 2022, and that deal collapsed due to regulators. Figma walked away with a $1B breakup fee. That’s not a red flag — that’s a flex.

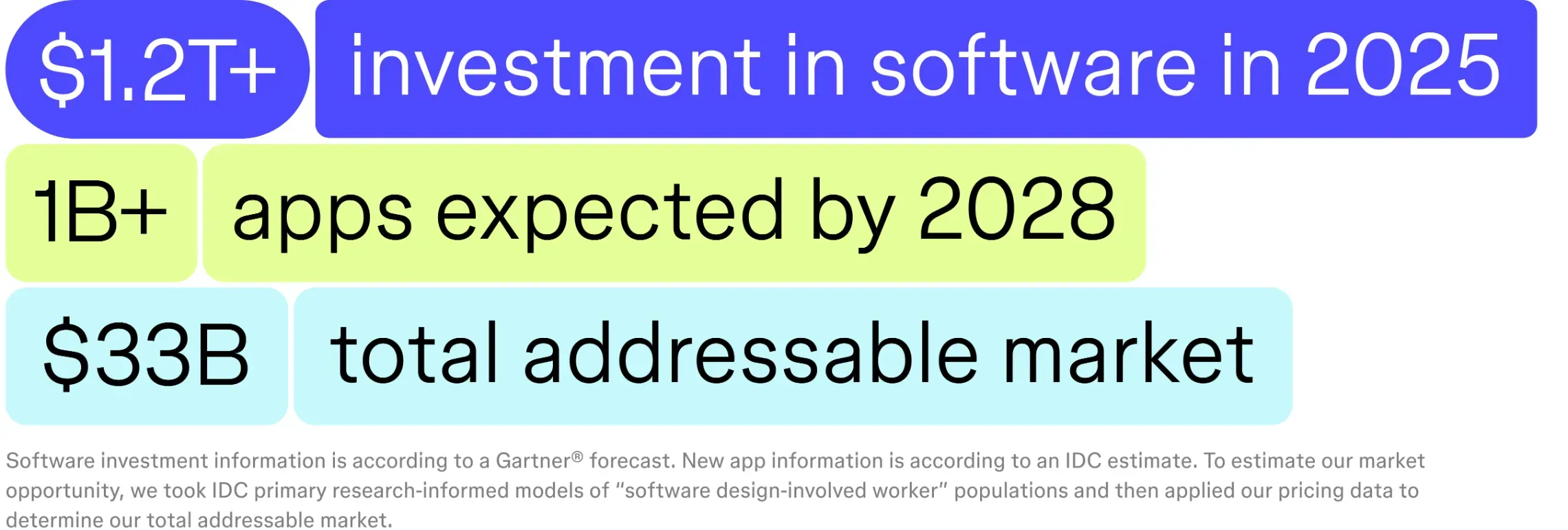

Market Dynamics: Dominant in UX, Room to Expand

Designers live in Figma. A Senior UX designer on Reddit nailed it: “There are no substitutes.” Sure, they’ve saturated the UX space, but the next wave of growth will come from up-selling enterprise clients, expanding into dev tooling, and leveraging AI to build lighter, modular tools that can eat into Adobe’s suite one product at a time.

Also, devs now make up ~30% of Figma’s users — a clear signal that Figma’s becoming a bridge between design and development.

The Risk Side

Yes, they’re not profitable.

Yes, the CEO took a weird $5M “Adobe deal collapse” bonus.

Yes, there are jokes flying about lawsuits from “Ligma.”

But none of this breaks the thesis. What matters is product adoption, customer lock-in, and category dominance — and Figma has all three.

Also, I wouldn’t ignore the looming AI threat. Tools like Galileo and Uizard are doing some wild things in design automation. But Figma’s response has been to build AI into the platform directly, rather than fight it. Smart move.

Will I Buy?

Honestly? Yes — but I’ll be watching the opening pop. If this thing opens at $40+, I’ll let it cool off. But if it prices around fair value or pulls back after the IPO hype fades, I’m in.

Figma isn’t just another SaaS name — it’s the operating system for product teams. And if they keep executing, I’d be surprised if they aren’t a $40B+ company in five years.