$KSS Rocketed Today: A First-Hand Account from a Deep Value Degenerate

🚨 Halted for Volatility — Again?

This morning, I woke up, checked my portfolio, and had one of those what the hell is going on moments. Kohl’s ($KSS) - yeah, the mid-tier retailer you drive past on your way to Target - was up over 100% in premarket.

Trading opened at $10.70 and within minutes we were halted for volatility. Again. At its intraday high, KSS touched $21.39. That’s a 100% move before the NYSE even had time to sip its coffee.

Final close $14.34, up nearly 38% on the day.

What just happened? Welcome to meme stock season - and this time, Kohl’s was the chosen one.

Why Kohl’s? Why Now?

Let’s get this straight: Kohl’s didn’t drop earnings, announce a new CEO, or say they're launching an AI-powered beauty line. The fundamental picture hasn’t changed overnight. What’s changed is sentiment - and that’s the wildcard no DCF model can price in.

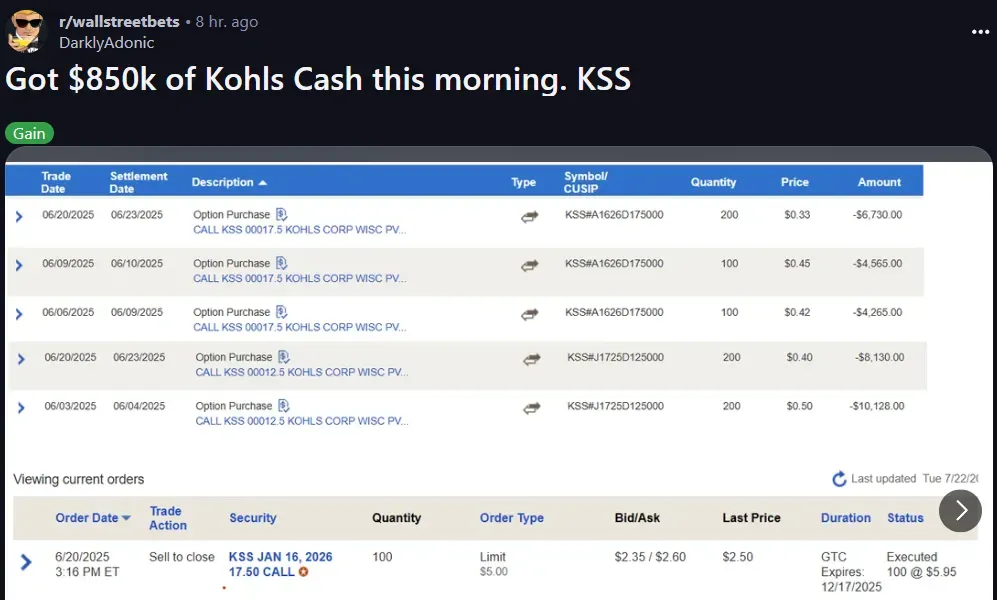

Retail traders - especially the WallStreetBets crowd - smelled blood in the water. And I get why.

Kohl’s checks every meme-stock box:

- Insane short interest: ~49% of float is sold short. That’s battleground-tier.

- Beaten down: Stock dropped from $60 post-COVID highs to $6 earlier this year.

- Corporate drama: CEO ousted in May over an undisclosed vendor relationship. Sketchy? Yes. Bullish? Also yes.

- Value hidden in plain sight: Real estate holdings worth $5B–$10B, clean balance sheet with no major debt until 2029, and somehow still doing $16B in annual revenue despite retail Armageddon.

Throw in a few threads on Reddit, sprinkle in some Opendoor energy (which doubled last week before dumping), and boom - the fuse is lit.

This Wasn’t Supposed to Happen (But I’m Not Complaining)

Here’s the kicker: I didn’t buy KSS expecting fireworks. I got in around $8.50 because, fundamentally, it was a deep value play:

- Book value north of $3B

- P/EBITDA under 1x

- Operating cash flow of $563M

- No real bankruptcy risk

- Institutional ownership near 98%

It was mispriced and forgotten. But like all great trades, value needs a catalyst - and in this case, the catalyst was a full-blown short squeeze fueled by nothing more than vibes, Reddit momentum, and short sellers overplaying their hand.

The Short Squeeze Isn’t Dead

This isn’t 2021. GameStop and AMC aren’t flying every day. But if you think the short squeeze era is over, you’re sleeping. What happened with KSS is a reminder: when retail traders rally behind a heavily shorted name with even a hint of turnaround potential, things can escalate fast.

And this wasn’t a low-float microcap. This is a multi-billion-dollar retailer with real assets, real stores, and real upside - not a SPAC zombie.

Final Thoughts: Respect the Squeeze

I didn’t expect a 100%+ intraday move. I was here for the fundamentals, and instead walked into one of the wildest trades of the year. Did I sell the top? Of course not. But I bagged a ridiculous gain in a trade that was originally about patience, not adrenaline.

If there’s one lesson here, it’s this: never ignore a good short squeeze - especially when the fundamentals are quietly improving and the bears are way too comfortable.

So yeah, $KSS was my deep value lottery ticket… and today, it paid off.

What about you - did you catch the Kohl’s rocket?

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.