Wolfspeed (WOLF) surged >3000%! But why it's a gamble in every sense?

Silicon carbide dream vs harsh reality of bankruptcy

I’ve been watching Wolfspeed closely after its Chapter 11 filing and the strange bounce the stock saw in recent weeks. The story is tricky: on one hand, you’ve got a company with game-changing tech; on the other, you’ve got a balance sheet that has already collapsed under the weight of it.

Price surged over 3000%!

The chart shows a sharp, one-off speculative spike. Price briefly jumped to $32.82 on a single large candle accompanied by a major volume surge, then pulled back to around $28.30. Short-term, volatility is extreme - up double digits one day, flat the next - which is classic post-bankruptcy noise. There isn’t really a strong support to lean on, but the reorg news did create a floor for speculators to play off.

Short-term, volatility is extreme - up double digits one day, flat the next - which is classic post-bankruptcy noise. There isn’t really a strong support to lean on, but the reorg news did create a floor for speculators to play off.

Deep losses but debt wiped out in major restructuring

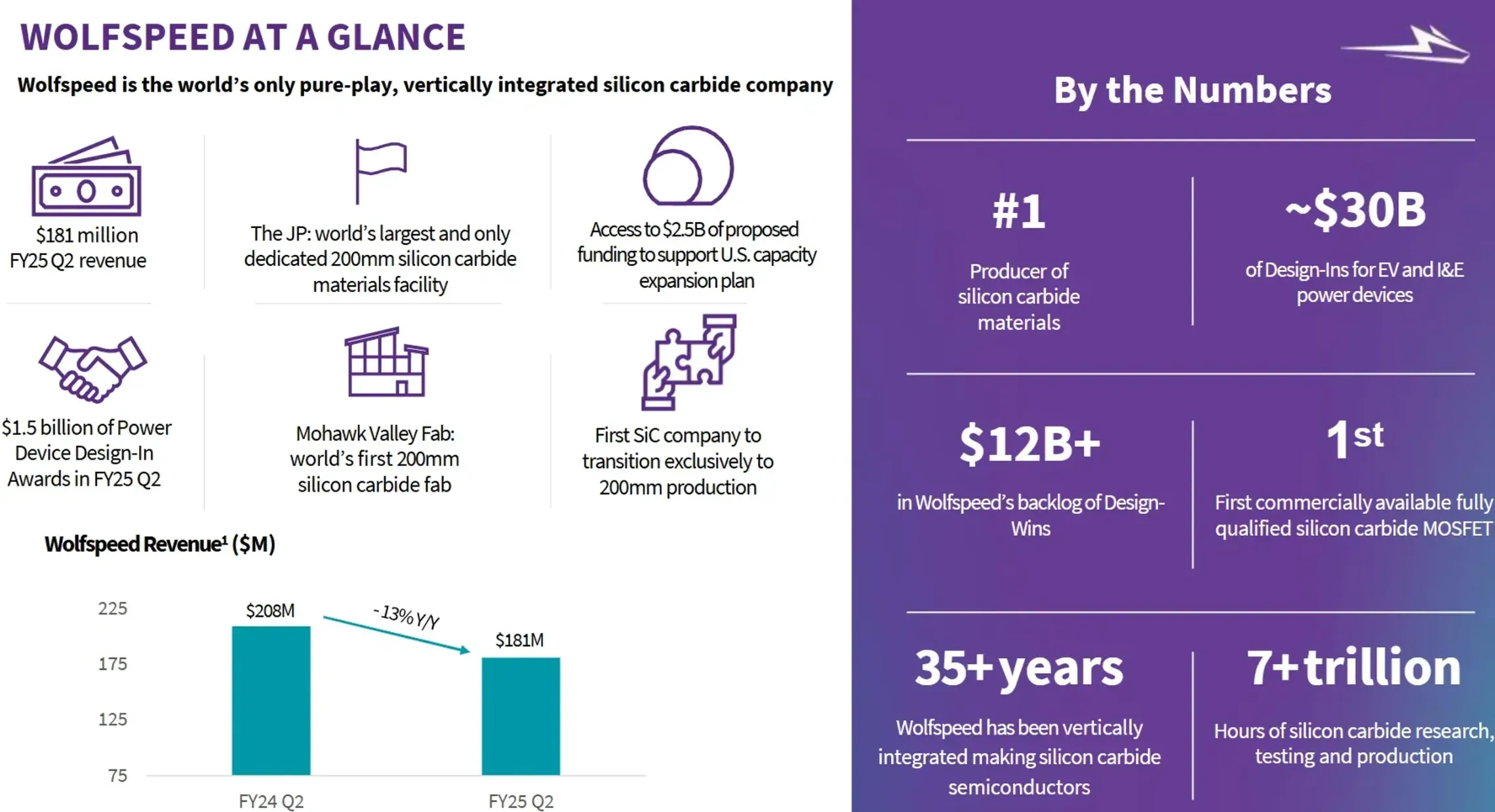

On fundamentals, the picture is grim. Revenue was only $758M last fiscal year, profitability remains negative, and the company is buried in debt. That said, the restructuring wipes out roughly 70% of the $6.5B debt load and hands equity to creditors.

Current shareholders are left with scraps - 3% to 5% of the new equity - but in theory, the company emerges leaner. The big bet is that Wolfspeed finally hits scale in silicon carbide just as EVs, renewables, and high-voltage applications demand it.

Industry & Macro Outlook

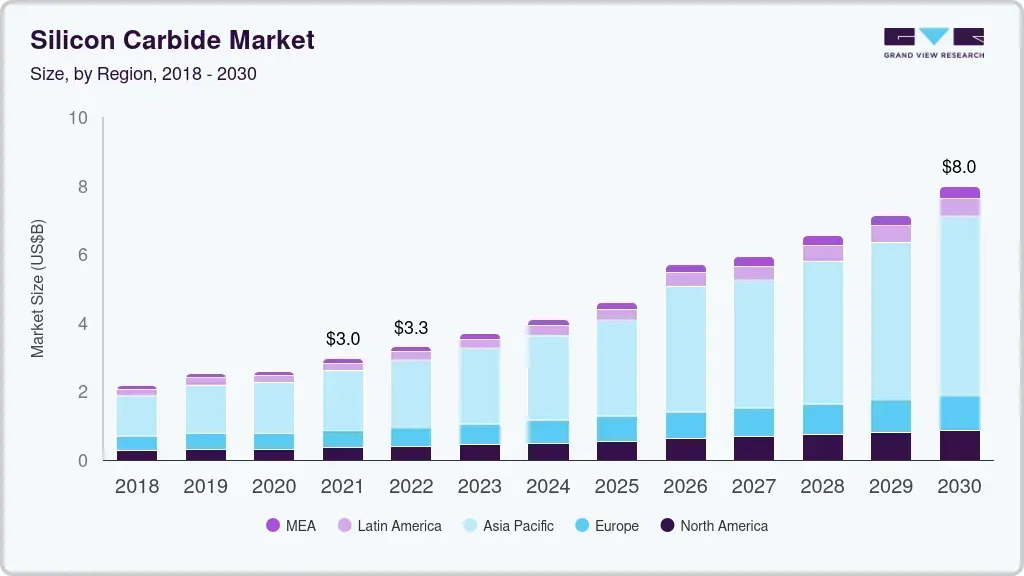

The macro story helps a little. Silicon carbide is expected to grow at a 30%+ annualized pace through 2034.

If Wolfspeed survives, the market tailwinds are real. The problem is execution and competition - rivals like STMicroelectronics and Coherent are in the game, and Wolfspeed has to spend heavily to stay relevant. Bankruptcy may clear the books, but it doesn’t solve the fact that the tech is still expensive and adoption is slower than bulls hoped.

My conclusion

Neutral leaning bearish. Yes, there’s a lottery-ticket upside if Wolfspeed nails the timing on silicon carbide adoption, but the odds are low. I’d rather watch the restructuring unfold and see proof of demand than try to front-run a turnaround. For most traders, this is more speculation than investment.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.