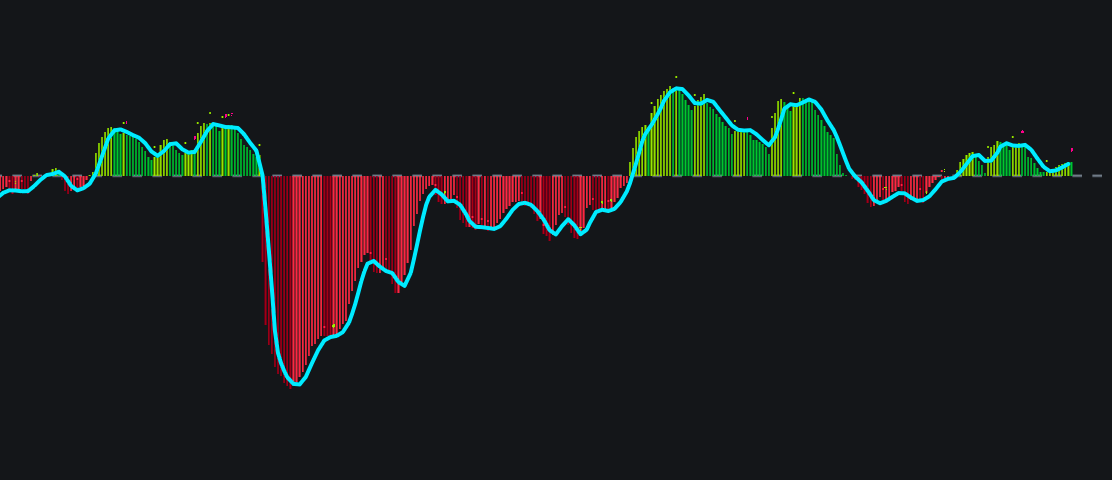

MTC Divergence Pro (free for Subscriber)

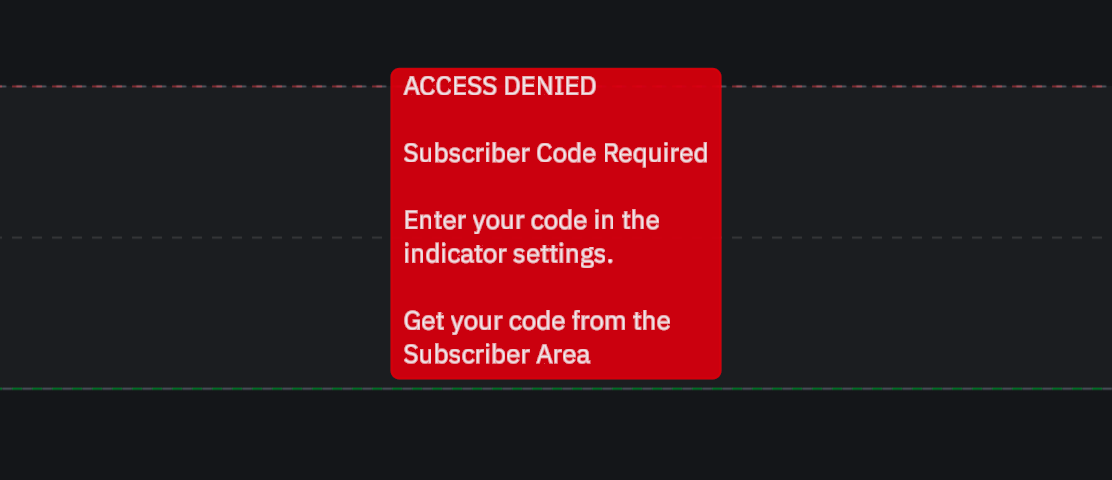

This is the free Version for Mustermann Subscriber! You can find the access code in the subscriber area. Please enter this in the settings menu.

This is the free Version for Mustermann Subscriber! You can find the access code in the subscriber area. Please enter this in the settings menu.