S&P 500 next Week

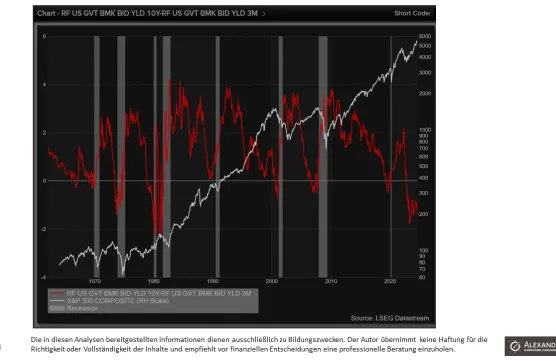

Quoting yourself is rather difficult, but since I base my own investments on these market assessments, it is sometimes necessary to remind yourself of your strategies and to have the red line in your strategy in such turbulent times. So here is my approach so far: I formulated these two options in the first week of August: Option 1: The correction is complete and the 5,500 point mark is overtraded at the end of the week and the daily volume also goes with the rise. On this basis, I will then select and invest in the leading sectors and stocks of this movement. Option 2: In my view, the best option for the sustainability of the trend. After rising to the 4,400-4,500 point region, the downward movement develops a second, stronger downward leg to the 4,800 to 4,900 point region. In this region, I will then select the sectors and stocks that have held up relatively well and then invest the first positions. The stocks that recover dynamically after a sell-off are also interesting. That was my approach last week: After a strong week, it looks very much like option 1, because on the one hand the downtrend was overtraded and on the other hand the volume was also decent, although not stronger than in the sell-off the week before last. In addition, a positive divergence can be seen in the market breadth (A/D line), which has marked a new all-time high, while the S&P500 has not yet managed to do so. In the current week, the positive signs for option 1 continue and of course it is a pity that I did not take the direct “V-recovery” through my risk management, but I would do it again at any time, because according to Warren Buffet: Rule No. 1: Never lose money, rule No. 2 don't forget rule No. 1. The risk management mode is currently in the background and the search for opportunities is in the foreground. Why? After the strong Friday, the S&P500 is close to its all-time high and, as described in my primary scenario, can overshoot this to 5,770. After that, I expect a setback to the 5,420 region or a volatile sideways pause. I would also make an index investment during this setback; if the market continues directly until the end of 2024, I will successively collect individual stocks with attractive chart constellations, as I did this week, and will be fully invested by the end of September 2024. Is a deeper correction “still possible”? Yes, it is, but the probability has fallen sharply for the following reasons: We will enter the “normal” positive stock market cycle from October. The already seasonally strong last quarter will be strengthened by the significant presidential cycle (see also chart). The market breadth of the S&P500, Dow Jones and Nasdaq100 have all developed a positive divergence in price performance versus market breadth. This means that although prices are still below the all-time high, the market breadth (roughly speaking the number of rising stocks) has formed a new high. This also shows that this rise is much broader basis than the rise at the beginning of 2024, which was primarily based on “Big Tec”. The V-recovery is a strong signal and has triggered the “Follow Through Days” indicator, here you can find the definition https://mobile.traderfox.com/blog/aktien-magazin/v-formige-erholung-der-us-indizes-zwei-follow-through-days-nach-william-oneil-was-gilt-es-nun-zu-beachten/p-125276/ Now the question with the interest rate cuts, what do they trigger? Simply put, a statistic from Goldman Sachs says that if no recession follows the first interest rate cut, we will see rising prices. If we go into a recession after the interest rate cut, the average share performance is strongly negative. For the second quarter of 2025 onwards, things do not look so rosy at the moment, as the interest rate differential between 10-year U.S. government bonds and the three-month interest rate is still negative, but an end to the divergence has always been followed by a recession. Not directly, but with a gap of 3-6 months. The only option would be, as in Corona after this signal, to “wash away” the recession again by printing money. Not likely, but also an option. The U.S. remains my investment focus, especially after the continued high relative strength against the DAX. The strongest stocks were in real estate and commodities in the U.S.A.. Currently, the sector clock in the U.S. (see chart) is moving very tightly and therefore I am currently only selecting according to individual stock settings and the stock “only” has to be relatively strong in its sector. Today I will describe “only the precious metal” in more detail and merely add my DAX scenario here, as this also remains unchanged and for me the music is currently playing in the U.S. and this is also my clear investment focus.